Dallas

Dallas Auto Insurance

The city of Dallas is known for many things, including the Dallas Cowboys, their cheerleaders, and being the setting for the TV drama series of the same name, to name a few. Home to 1.3 million Texans, Dallas is the 3rd largest city in Texas. As the city’s population grows, so does the congestion on the roads. The city of Dallas has seen a 34.9% increase in annual car accidents since 2010, according to the Texas Department of Transportation. Dallas auto insurance is not only legally necessary but also ethically necessary to keep yourself, your passengers, other drivers, and pedestrians safe.

Dallas Car Insurance: Understanding Your Coverages

Drivers in Dallas spend an average of 54 minutes each day and 270 minutes each work week behind the wheel of their vehicle for commuting purposes alone. With so much reliance on personal vehicles in the city, it’s crucial to make sure you have proper coverage for your car so that your are covered in the event of an accident. In Texas, you are required by law to carry liability auto insurance with 30/60/25 minimum coverage limits. Liability insurance only provides financial assistance to pay for damages or injuries to other vehicles or other drivers in an accident that you cause. If you choose to carry only liability insurance, any repairs to your own vehicle will come out of pocket for you. Carrying only liability insurance, especially at the minimum coverage limits, is a big financial risk; because of this risk, less than 0.20% of auto policies that we write in Texas for for minimum liability only. For drivers seeking coverage that provides financial protection should anything happen to their own vehicle, regardless of fault, collision and comprehensive coverages can be added. Other popular optional coverages include:

- Uninsured and underinsured motorist coverage

- Medical payments coverage

- Personal injury protection (PIP)

- Rental reimbursement coverage

- New car replacement coverage

What is the Cost of Car Insurance in Dallas?

The average cost of full coverage car insurance in Dallas is $1,143.47 per year among TGS Insurance Agency customers. It is important to note that many factors determine the price of your premium. While many people know that insurers factor in the car they drive, their own driving record, and the coverages they select, some may be surprised to hear that factors such as gender, credit history, and marital status are also considered.

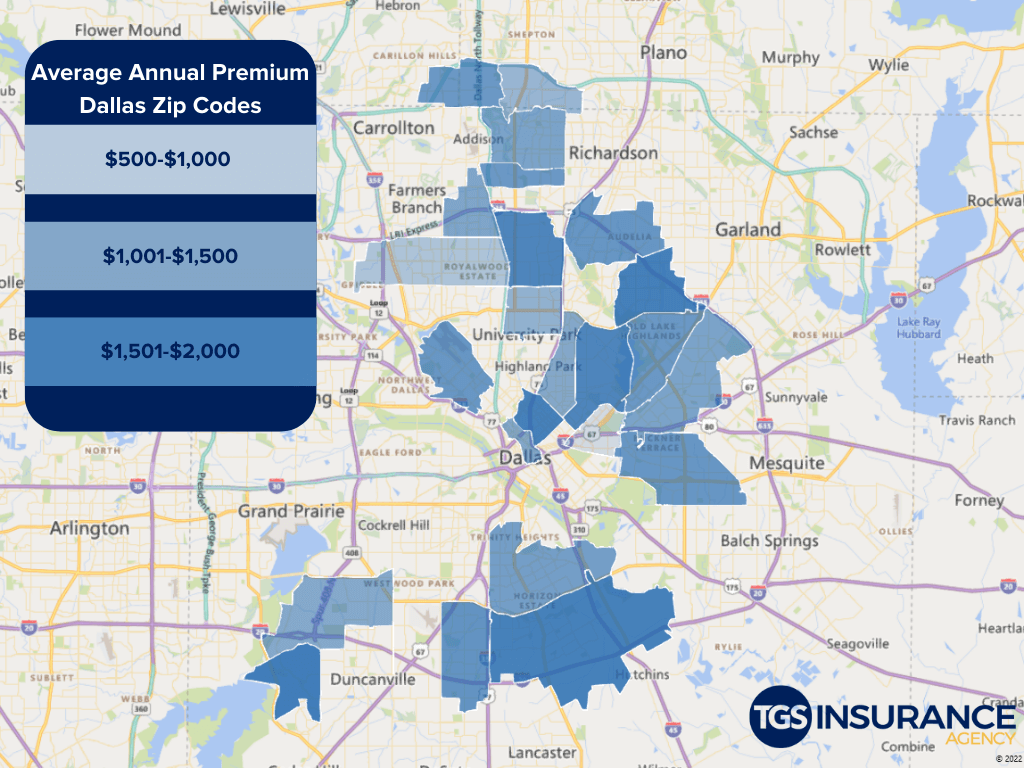

How Does Location in Dallas Affect My Car Insurance Rates?

Location is an essential factor in determining your auto insurance rates in Dallas. If your neighborhood has a higher rate of theft than the neighborhood a few blocks down, your rates could be higher. If there is a higher than the average number of uninsured motorists in your area, your rates could also be higher. If auto insurance companies identify anything in your area that might make your vehicle riskier to insure, you will see that reflected in your premium. To avoid this, you can park your car in a garage or covered area versus the street, which can help reduce your premium. Because carriers get so granular with risk evaluations, rates can vary greatly- even within the same city. Below is a breakdown of the average premium for auto insurance around Dallas:

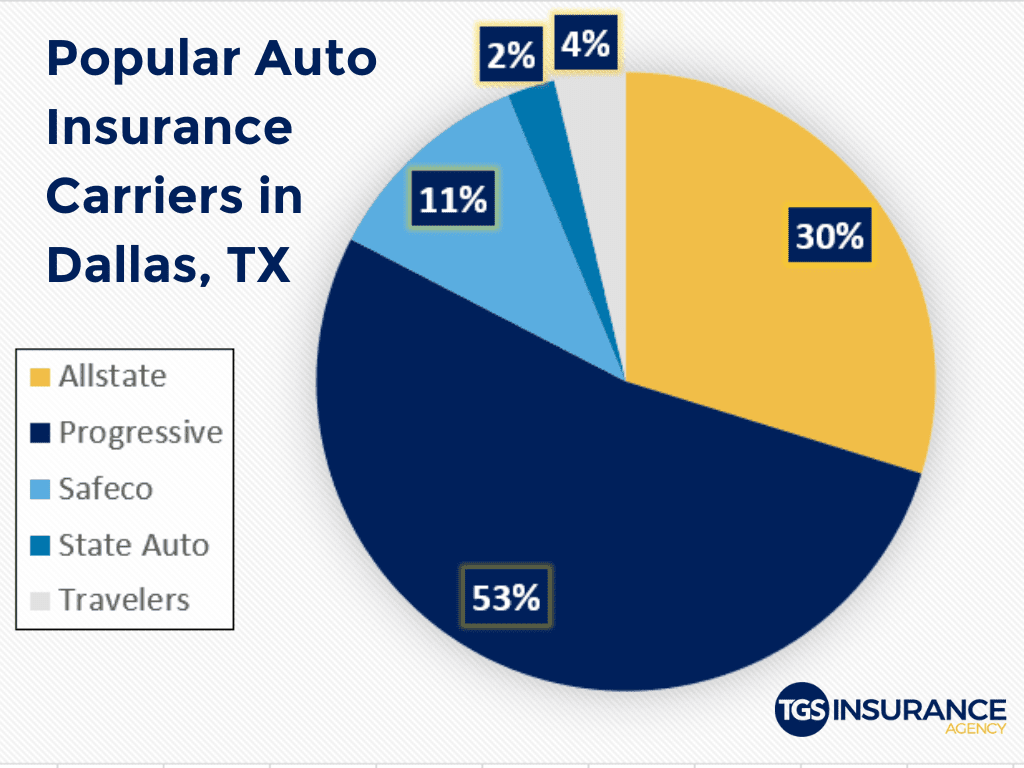

Best Dallas Auto Insurance Companies

Choosing your car insurance provider is about more than just the price, even though we know the cost is certainly a factor. Because each provider is in charge of setting their own rates, the same coverage can vary in costs between carriers. The most popular carrier in Dallas is Progressive. TGS Insurance customers in Dallas pay an average of $1,043.93 per year when insured by Progressive. Looking at the numbers, an overwhelming number of people in your area have chosen Progressive over our next most popular carrier, Allstate. The average premium for Allstate is $1,257.86 for TGS Insurance customers. Here is a breakdown of the different carriers used in Dallas.

Finding Affordable Dallas Auto Insurance Is Easier Than You Think.

Looking for car insurance can be tedious, boring, and overwhelming… you name it, we’ve heard it. And we agree! That’s why TGS Insurance Agency is dedicated to doing the heavy lifting for you, instantly comparing auto insurance quotes from 35+ A-rated (or better) carriers to find you the best possible price in your area without compromising coverage. We can provide you an initial quote within seconds with just your name and address. From there, if you would like to customize your policy, any of our dedicated independent agents are ready to work for you to create a policy that covers everything you need. We shop. You Save. Yes, it really is that easy.

Disclaimer

Every driver is unique. Insurance premium costs are impacted by several factors; therefore, we recommend obtaining an individualized quote to find your rates. Our data is representative of quality, publicly sourced, and internal data, but should not be deciphered as bindable.

Looking for Another City?

Cypress Auto InsuranceFort Worth Auto Insurance

Houston Auto Insurance

Humble Auto Insurance

Katy Auto Insurance

Missouri City Auto Insurance

Pearland Auto Insurance

Spring Auto Insurance

Sugar Land Auto Insurance

Tomball Auto Insurance

More Cities