Getting a Lenoir Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Lenoir is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents

What is Covered in Lenoir Home Insurance?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Lenoir, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. But, not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

What is the Cost of Home Insurance in Lenoir, North Carolina?

Your home insurance policy is crafted to fit your needs as a homeowner and protect your home. Furthermore, your specific policy will look different from anybody else’s since it is built to protect your home and belongings. Look at how Lenoir compares to other averages.

National Average: $1,477

North Carolina Average: $1,215

Lenoir, North Carolina Average: $850

Your home insurance premium can vary from these averages, but it is always good to compare. If your current homeowners insurance policy is much less expensive than the city average, you may not have enough coverage and be underinsured. If you pay much more than these averages, you could simply be overpaying for home insurance.

Average Lenoir Home Insurance Cost By Dwelling Coverage Limits

Dwelling coverage is the component of home insurance that protects the physical structure of your home from covered perils. It is to cover the cost of repairing or rebuilding your home if it experiences damage or destruction by a covered event. Therefore, the amount of dwelling coverage you need will depend on the cost of rebuilding your home. Your home insurance policy typically provides coverage up to a specified dollar amount, known as the policy limit. Therefore, it’s important to ensure that your dwelling coverage limit is high enough to cover the cost of rebuilding your home in the event of a total loss. Dwelling coverage limits can have a significant impact on home insurance premiums. In general, the higher the dwelling coverage limit, the higher the premium since the insurance company will take on more risk.

In Lenoir, North Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $891 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $1,325 in Lenoir, North Carolina.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $620.12

$200,000.00 - $299,999.00 $890.76

$300,000.00 - $399,999.00 $1,132.41

$400,000.00 - $499,999.00 $1,325.12

$500,000.00-$599,999.00 $1,606.25

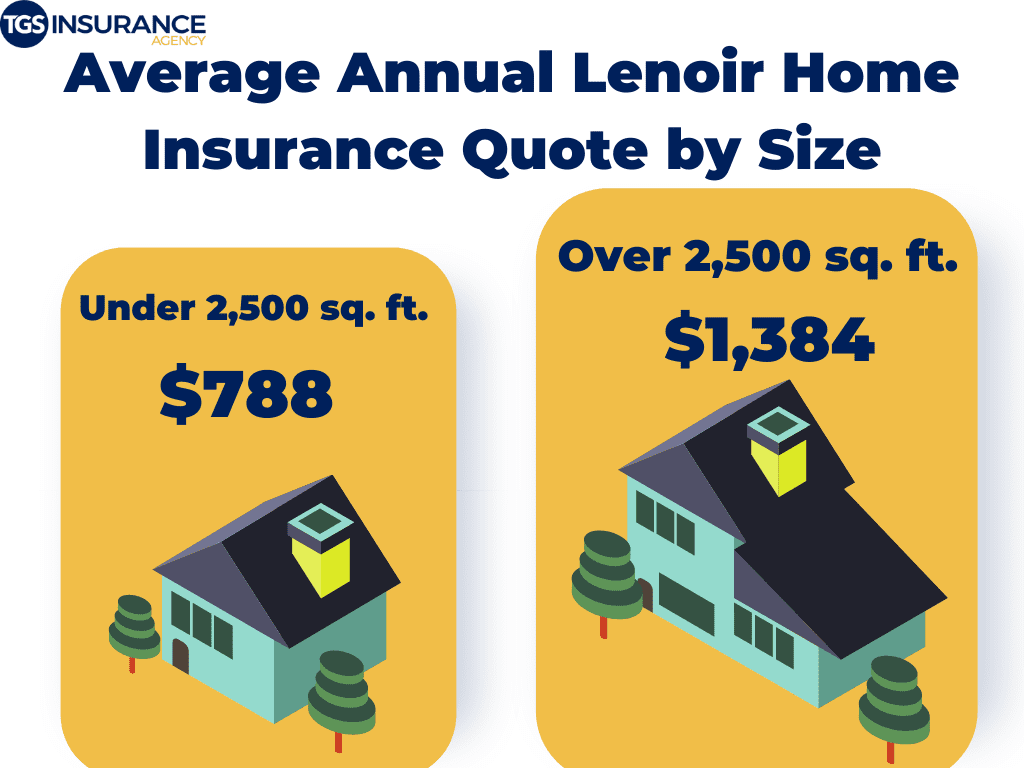

How the Size of Your Lenoir Home Affects the Cost of Insurance

Another thing that will affect the cost of your Lenoir home insurance is the size of your home. Insurance carriers look at the square footage of your home to determine the replacement cost. If you have a larger house, your replacement cost will be higher. Because of the higher replacement cost, your home insurance premium will be higher than that of smaller houses. Some other factors that affect your replacement cost are:

- Building materials used to build your home

- Features in your home like fireplaces or a jetted tub

- The age of your home

In Lenoir, houses that are over 2,500 square feet cost $1,384 per year. Houses under 2,500 square feet have an average annual premium of $788.

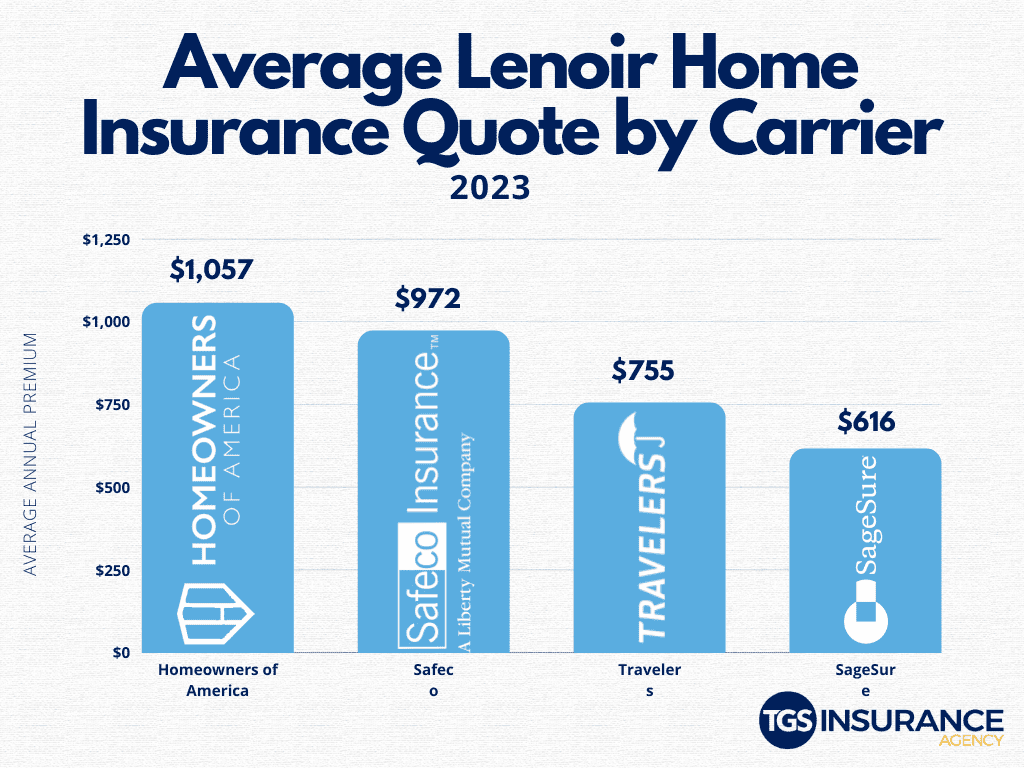

Who is the Most Popular Home Insurance Carrier in Lenoir, North Carolina?

We want you to find the perfect homeowners insurance in Lenoir, North Carolina. Knowing what the best insurance carriers in your area charge for home insurance is a great way to know if your policy is competitive. So, we pulled together some data from TGS customers in your area and found that SageSure is the most popular in Lenoir. People with SageSure pay an average of $616 annually. Another popular carrier in Lenoir is Travelers. Travelers’ rates differ slightly from SageSure, having an average cost of $755 a year. Check out our data below for Lenoir’s four most popular carriers and their average annual home insurance premiums.

Lenoir Zip Codes TGS Insurance Agency Covers

- 28645

If your zip code is not on this list, fret not! We have access to amazing rates for homeowners all across North Carolina. Simply enter your address above to start by getting a free instant quote.