Comparison Shop Home Insurance in Anna,TX from Multiple Carriers in Minutes!

How Much is Home Insurance in Anna?

Homeowners in Anna, TX pay an average of around $1,658 a year on home insurance. By using TGS Insurance to shop for homeowners insurance, our customers save an average of $356 a year on their Anna home insurance with our average policy running about $1,302 per year.

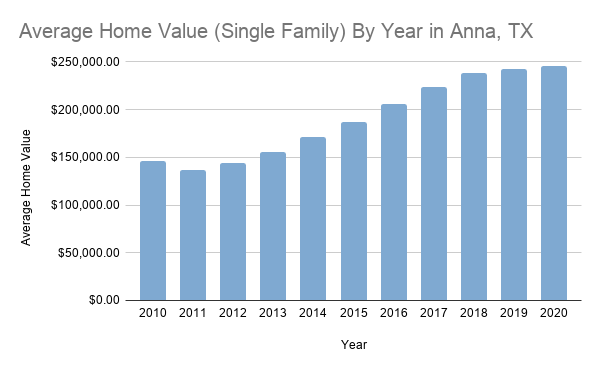

Average Home Value in Anna, TX

The average home in Anna, TX is valued at $245,278 and has risen since 2011 by over $108,000!

*This data is provided by Zillow.com. Zillow Home Value Index (ZHVI): A smoothed, seasonally adjusted measure of the typical home value and market changes across a given region and housing type. It reflects the typical value for homes in the 35th to 65th percentile range.

Comparing the Average Cost of Homeowners Insurance in Anna, TX By Dwelling Coverage Limit

| Coverage Level | Average Annual Premium |

|---|---|

| $75k Dwelling | $1,624 |

| $150k Dwelling | $2,178 |

| $200k Dwelling | $2,524 |

| $350k Dwelling | $3,572 |

*Information used from Help Insure from the Texas Department of Insurance. We applied a methodology of a homeowner with average credit, a home between 10-34 years of age, made of brick in Anna, TX.

What Does Anna Home Insurance Cover?

Homeowners in Anna, TX, have access to a range of home insurance policy options but the most popular policy is the HO3. This policy protects you, your home, and personal possessions from named perils such as accidental water/steam discharge, fire and lightning strikes, vandalism, theft, damage from aircraft and automobiles, falling objects, and even volcanic eruptions! Your policy protects you from many other perils and is there to help restore your home should it become damaged from one of these perils.

What Homeowners Insurance Add-Ons Are Available That Will Further Protect Me?

Our clients in Anna, TX, have a wide range of additional coverage options to choose from. Your home is different than even your neighbor’s and we assist our clients by tailoring their policies to their specific needs. Learn more about some of our add-ons that help protect our clients:

Flood insurance: Water damage from flood events can be devastating and the right flood insurance policy protects your home and property when recovering from these events. We shop both private and government-issued policies to help clients find the best deal on the market.

Windstorm coverage: If you’re in an area prone to severe hail and wind, homeowners should also consider windstorm/hail coverage options to stay protected from tornadoes, severe thunderstorms, tropical storms, and hurricanes. And for extra protection, we automatically write in a 2% wind/hail deductible into every policy we issue. We can easily customize coverage based on what your needs are.

Water Backup Damage: Drainage and sewer problems can be complex and expensive problems for homeowners to face. You don’t have to face them alone when you enroll with TGS Insurance. Our clients have the option to purchase Water Back-Up/Sump Discharge Coverage which provides a minimum of $5,000 in protection to help protect and restore homes damaged due to these perils.

Jewelry Insurance: The perfect coverage option for protecting expensive pieces of jewelry. Your homeowners insurance sets a limit on the amount of jewelry that is covered. With pieces that exceed that value, it is important to purchase this policy to avoid gaps in your coverage and protect your valuables.

Umbrella Policy: Homeowners with larger homes, valuable improvements, and possessions such as lavish swimming pools and luxury cars may be at risk of being sued for a higher amount than their standard homeowners insurance covers. Your umbrella liability policy protects you in the event of a lawsuit to protect everything you’ve worked for.

Advantages of Using TGS Insurance for Your Anna Home Insurance Needs:

- We provide access to more than 35 top-rated insurance carriers to our clients. What this means is that you receive more coverage options, better insurance policies, and all at a lower rate through comparison shopping done by our agents.

- From start to finish, TGS Insurance takes care of everything you need for your enrollment. Your agent can also work with your mortgage lender to make sure everything is in order and that you are covered the way you should be.

- Worrying about rate increases is a thing of the past when you enroll with TGS Insurance. We provide our clients with exceptional customer service and continue to work with them long after they have enrolled. Should your policy dictate an increase, we will shop again finding the same coverage you need for the best price on the market year after year.

Zip Codes in Anna, TX That We Insure:

- 75409

Don’t see your zip code listed? Don’t worry, as long as it’s in Texas, we’ve got you covered!