Comparison Shop Home Insurance in Beaumont, TX from Multiple Carriers in Minutes!

Over 56% of homeowners don’t shop their home insurance policy around and therefore are missing out on substantial savings. At TGS Insurance, we automatically shop over 35+ A-rated (or better) home insurance carriers in Beaumont, TX so homeowners always get the best policy at a great rate!

How Much is Home Insurance in Beaumont, TX?

On average, TGS Insurance customers in Beaumont pay about $2,348 per year for their homeowners insurance policy. Your exact premium may vary based on factors like your home’s size, age, construction type, and coverage limits. Living in Beaumont also comes with unique risks, including hurricanes, heavy rainfall, and flooding, all of which can influence insurance costs. At TGS Insurance, we shop multiple top-rated carriers to help Beaumont homeowners secure the right coverage at the best possible price. Finding out how much you can be saving is as easy as providing your address above for an instant quote– really!

Comparing the Average Cost of Homeowners Insurance in Beaumont, TX By Home Value

Your homeowners insurance coverage limits determine the maximum your policy will pay in the event of a loss, and they have a major impact on your premium. Higher limits mean more financial protection, but they also increase your insurer’s risk, which typically leads to higher costs. In Beaumont—where risks like hurricanes and severe storms can cause widespread damage—it’s especially important to set limits high enough to fully rebuild your home if the unexpected happens.

| Dwelling Coverage Limits | Average Annual Premium (incl. Wind Coverage) |

|---|---|

| $100,000 - $200,000 | $1,707 |

| $200,000 - $300,000 | $2,218 |

| $300,000 - $400,000 | $2,854 |

| $400,000 - $500,000 | $3,762 |

| $500,000 - $600,000 | $4,554 |

| $600,000 - $700,000 | $5,162 |

What Does Home Insurance Cover in Beaumont?

A standard homeowners insurance policy in Beaumont typically includes:

-

Dwelling Coverage – Protects the structure of your home against covered risks like fire, wind, hail, theft, and vandalism.

-

Personal Property Coverage – Covers belongings such as furniture, clothing, and electronics if they’re damaged or stolen.

-

Liability Protection – Provides financial protection if someone is injured on your property or if you accidentally cause damage to another person’s property.

-

Loss of Use Coverage – Helps pay for temporary living expenses, like hotel stays or meals, if your home becomes uninhabitable after a covered event.

Every home and homeowner in Beaumont is unique, which is why TGS Insurance works with you to customize a policy that balances affordability with complete protection.

Common Risks for Beaumont Homeowners

Beaumont homeowners face a mix of risks, from severe thunderstorms and hurricanes to theft and accidental damage. A standard homeowners policy usually protects against common perils such as fire, wind, hail, theft, and vandalism—but there are important gaps that every Beaumont homeowner should be aware of.

Popular Endorsements to Consider in Beaumont:

-

Flood Insurance – Standard homeowners insurance does not cover flood damage. Given Beaumont’s proximity to the Gulf and history of heavy rainfall, a separate flood policy is essential.

-

Windstorm/Hail Coverage – High winds and hail can cause significant roof and structural damage. In many coastal regions, this protection may require a separate endorsement.

-

Water Backup Coverage – Protects your home against damage from backed-up drains, sewers, or sump pump failures.

-

Extended Replacement Cost – Adds an extra layer of protection if rebuilding costs rise after a major storm.

-

Scheduled Personal Property – Provides higher coverage limits for valuables such as jewelry, antiques, or collectibles.

At TGS Insurance, we help Beaumont homeowners close these coverage gaps by tailoring policies that go beyond the basics, ensuring your home is protected from the risks most likely to affect our region.

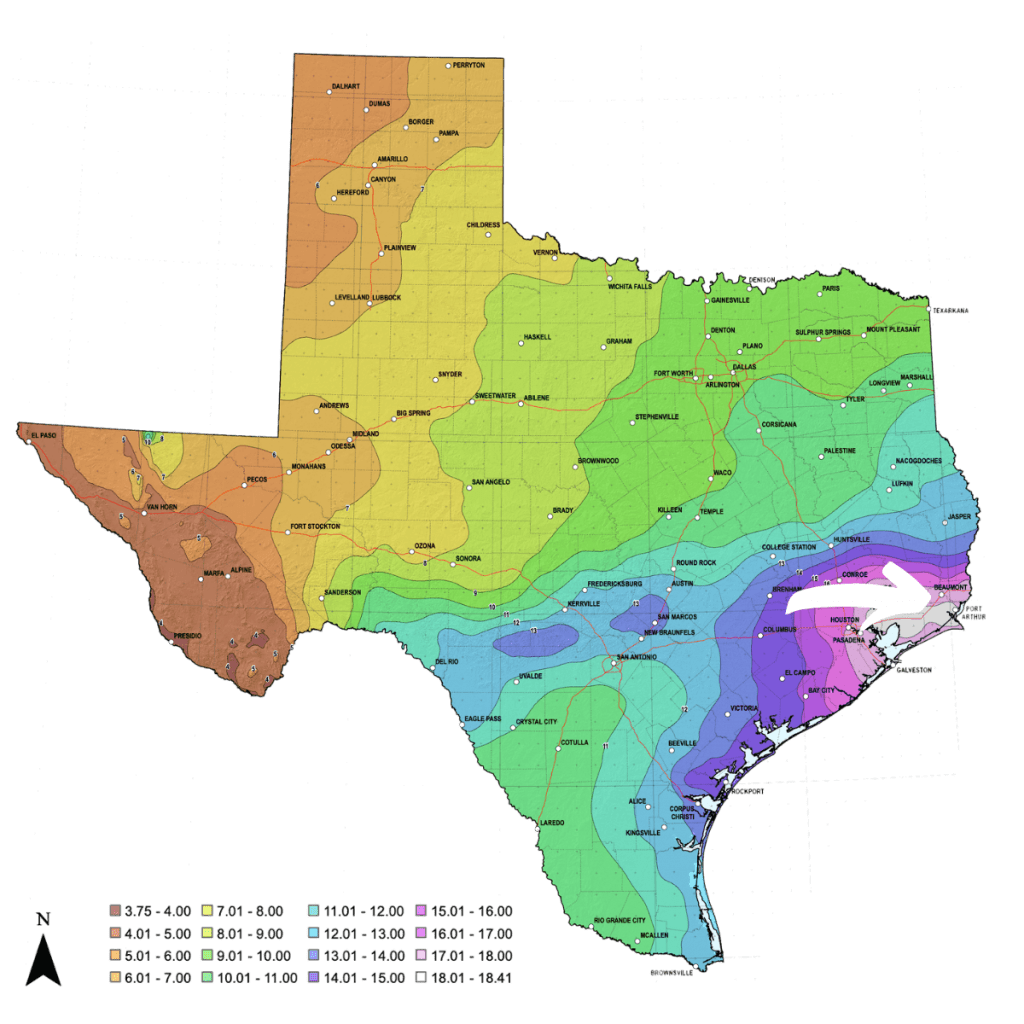

Are Floodplains Changing in Beaumont?

Beaumont, TX gets an average of about 60 inches of rain per year, with the US average at 38 inches of rain per year. During Hurricane Harvey Beaumont, TX recorded a whopping 104 inches. In 2019, the Beaumont-Port Arthur area recorded 85.49 inches so it should be no surprise that new precipitation maps released by the NOAA have increased the threshold for Beaumont by 4 inches! Based on this new data, there is potential that floodplain maps could require updates to the 100-year floodplain which would likely expand the number of homes with increased home insurance rates from being in a flood plain.

Regardless of what FEMA decides to do with this new data after further analysis, its important to remember that over 20% of flood insurance claims from Harvey came from those living outside of a flood zone. Beaumont is prone to natural weather disasters such as tropical storms and hurricanes, so it’s always a safe bet that regardless of whether you live outside of a flood zone, you should always consider a flood insurance policy.

Bundle and Save Even More on Your Beaumont, TX Homeowners Insurance!

Bundling your homeowners insurance with your auto insurance policy is an easy way to rack up additional savings on your insurance policies. When you purchase two policies from the same carrier, customers can save anywhere from 5% to 25% per year on their premiums!

At TGS Insurance, we make it easy to bundle your home and auto policies in Beaumont, TX. We work closely with 55+ highly-rated insurance providers to ensure you get the best bundling options with the most coverage at the best price!

Zip Codes in Beaumont, TX That We Insure:

| 77701 | 77702 | 77703 | 77704 | 77705 |

| 77706 | 77707 | 77708 | 77709 | 77710 |

| 77713 | 77720 | 77725 | 77726 |

Don’t see your zip code listed? Don’t worry, as long as it’s in Texas, we’ve got you covered!