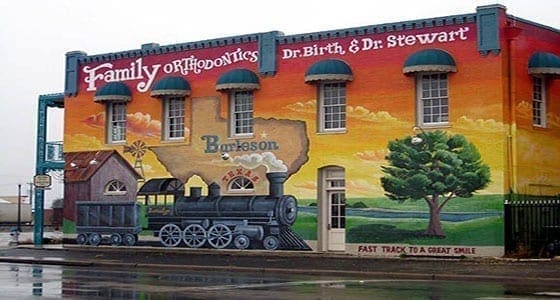

With TGS Insurance, Finding The Right Burleson Home Insurance Policy is as Easy as 1-2-3

When it Comes to Burleson Homeowners Insurance, Texas Property Owners Can Depend on TGS Insurance Agency for Personalized Coverage.

A basic homeowners insurance policy will typically cover the following:

- Your home’s structure

- Replacement costs for stolen or damaged property

- Personal possessions (a set limit)

- Living expenses in case your home is uninhabitable due to a disaster such as a fire, flood, or severe windstorm

- Liability should someone injure themselves on your property

You can purchase supplemental policies to add to your home insurance suite such as:

- Valuable Articles/Floater policies (i.e. Jewelry Insurance)

- Flood policies

- Windstorm/hail coverage

- Umbrella policies (additional liability)

- Animal Liability (liability issues due to household pets)

Burleson, TX Home Ownership Costs

In Burleson, TX, the average home insurance premium costs around $1,940 each year. This is slightly more than the national average of $2,305 per year. Texas homeowners pay the 5th highest average insurance premiums in the country.

TGS Insurance is here and ready to serve first-time buyers and homeowners looking to lower their rates throughout Burleson, TX. Our average customer saves around $870 per year!

Popular Additional Home Coverages in Burleson, TX:

Windstorm and Hail Coverage: Homeowners in Burleson face many windstorms and hail threats to their homes. The damage from extreme weather including severe thunderstorms, tropical storms, and hurricanes can be costly and extensive. TGS Insurance includes a 2% deductible automatically for any windstorm/hail damage in every homeowners insurance policy we write for our clients.

Water Backup: Drain and sewer backup can be costly, complicated, and just downright gross. Your homeowners insurance will not cover these perils nor will flood insurance, and without additional coverage, you’ll be stuck paying the bill to repair and recover. TGS Insurance can add-on protection that protects you from such events with coverage to help you pay for the damages. Your policy can cover significant costs and begins covering a minimum of $5,000 in damages for homeowners.

Mortgage Life Insurance: The death of a spouse can be devastating and beyond the emotional toll, the financial burden can add to the pain. TGS Insurance offers our clients this unique protection to pay for the remaining balance of your mortgage in the event your spouse passes. Our policyholders pay an average of $30 a month for this coverage, but rates may vary depending on your carrier.

Common Home Insurance Questions from Our Clients:

Does homeowners insurance cover water damage from rain?

Your homeowners insurance will cover water damage from rain if it is caused by a sudden, weather-related event and is not flooding. An example would be your roof becoming damaged in a storm, exposing your home, and enduring water damage. While this may be covered, a flood event would require a separate flood insurance policy.

Can you change home insurance providers at any time?

Absolutely, you can change your homeowners insurance whenever you are ready and TGS Insurance is happy to help you navigate the process. It should be noted that switching may cause you to incur fees depending on your terms and conditions. Speak with your agent to best understand your policy.

Is it a legal requirement to have home insurance in Burleson,TX?

Lenders may require home insurance as part of their terms and conditions but it is not illegal to forgo home insurance. With that said, we always advise homeowners to remain insured to avoid paying for costly damages, lost possessions, medical liability, or any of the other major perils your policy protects you from alone. A home insurance policy should always be kept in place by the homeowner.

Our Local, Independent Agents Are Ready to Help You With Your Burleson Homeowners Insurance:

TGS Insurance insures homes in Burleson, TX, and the surrounding area every day. We serve the community with pride and grade-A customer service. Our agents are a resource from beginning to end and help homeowners find the best coverage for the lowest price through one of our 35+ insurance carriers.

Footnotes

1. Census.gov