Comparison Shop Dallas Home Insurance from 35+ Carriers in Seconds

Dallas, Texas, is known for many things, such as the Texas State Fair, the Dallas Cowboys football team (and their cheerleaders), the home of numerous telecommunications hubs, the Ewing family of the 1970 sitcom of the same name, and so much more! Dallas is also home to very unpredictable and often severe weather; each year, the city of Dallas faces several natural disasters such as drought, earthquakes, floods, tornadoes, freezes, tropical storms, and violent windstorms spun up from severe thunderstorms. With so many known risks, the 1.3 million people who also call the city home must be diligent in protecting their homes with sufficient Dallas home insurance coverage.

How Much Does Dallas Home Insurance Cost?

The average homeowners insurance policy in Dallas, Texas, costs an average of $1,667 per year. This average is based on policies with an average home value of $311,418, $300,000 liability coverage, a 1% AOP deductible, and includes windstorm and hail coverage written with a 2% deductible. Our agents know that every homeowner’s needs are different, and that’s why we work with you to build the right policy with customized coverage options at the best rates on the market. On average, we have saved our customers throughout Texas $870 a year when they switch to us. Seeing how much you could be saving is quick and free- enter your address above for your instant quote!

Comparing Dallas Home Insurance Quotes by Dwelling Coverage Limits

One of the biggest mistakes a homeowner can make is not carrying enough dwelling coverage on their home insurance policy. Dwelling coverage refers to the amount it would cost to completely rebuild your home from the ground up to its current value. The dwelling coverage level you select is one of the most significant factors insurance carriers use when determining your home insurance premium. So, for example, if you choose $100,000-$200,000 in dwelling coverage, your home insurance policy in Dallas will cost an average of $1,177. However, if you needed $400,000-$500,000 in dwelling coverage, your home insurance premium would then increase to an average of $2,149. The more dwelling coverage you want, the higher the home insurance premium.

| Dwelling Coverage Limit | Average Annual Premium |

|---|---|

| $100,000 - $200,000 | $1,176.68 |

| $200,000 - $300,000 | $1,392.22 |

| $300,000 - $400,000 | $1,806.88 |

| $400,000 - $500,000 | $2,148.78 |

| $500,000 - $600,000 | $2,485.97 |

| $600,000 - $700,000 | $2,718.96 |

| $700,000 - $800,000 | $3,630.62 |

| $800,000 - $900,000 | $4,039.58 |

| $900,000 - $1,000,000 | $4,408.61 |

| > $1,000,000 | $4,549.10 |

Remember that dwelling coverage limits are not the only factor influencing your premium! Other factors insurers often consider include:

- Location

- Age of home

- Credit history

- Claims history

- Marital status

- Breeds of pets

- Attractive nuisances (swimming pools, trampolines, swing sets, etc.)

- And more!

What Does Dallas Home Insurance Cover?

Dallas homeowners insurance gives you peace-of-mind and financial protection from weather-related and catastrophic events for your home and your possessions. Your home insurance policy typically covers your home, detached structures, and personal belongings including furniture, electronics, jewelry (to a specified limit), clothing, etc. You will also receive financial assistance should your home become unlivable or if someone is injured while on your property.

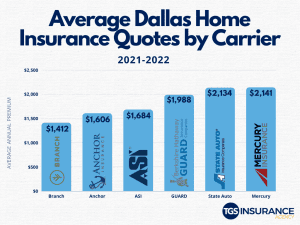

Cheapest Home Insurance Companies in Dallas

Choosing your home insurance provider is about more than just price, but the cost is undoubtedly an essential factor. Because each carrier sets its own rates, based on its own analysis, often times the same coverage will vary in price among carriers.

Below is a comparison of Dallas homeowners insurance rates for our cheapest home insurance carriers using the following coverage limits:

- $300,000 dwelling coverage

- $300,000 liability coverage

- 1% AOP deductible

While these carriers have been the cheapest for the most customers, they are only six of the companies we represent. Home insurance rates differ considerably due to several constituents, based on you, your home, and your location, among many other things. Which carrier is able to provide you with the cheapest rate is completely dependent on what you need. Below are some examples of where the cheapest carrier has changed from the above order:

- If you own a larger home, ASI typically has the most competitive rates for 5,000 square feet or larger homes.

- Owners of homes newer than five years have found Anchor Insurance the most competitive carrier.

The only way to find the cheapest home insurance rate in Dallas that provides you with the coverage you need is to comparison shop. By comparison shopping your policy, you can see what the market has to offer and select the policy that works best for your coverage needs and budget. Don’t have time to spend shopping for insurance? Let us do it for you! As a carrier-agnostic insurance agency, we don’t work for one insurance company; we work for you! When you input your address, we will search our bank of trusted carriers and find you the best policy possible to fit your needs within seconds.

Zip Codes in Dallas, TX We Cover:

| 75201 | 75222 | 75242 | 75267 | 75336 | 75374 |

| 75202 | 75223 | 75243 | 75270 | 75339 | 75376 |

| 75203 | 75224 | 75244 | 75275 | 75342 | 75378 |

| 75204 | 75225 | 75245 | 75277 | 75346 | 75379 |

| 75205 | 75226 | 75246 | 75283 | 75350 | 75380 |

| 75206 | 75227 | 75247 | 75284 | 75353 | 75381 |

| 75207 | 75228 | 75248 | 75285 | 75354 | 75382 |

| 75208 | 75229 | 75249 | 75286 | 75355 | 75386 |

| 75209 | 75230 | 75250 | 75287 | 75356 | 75387 |

| 75210 | 75231 | 75251 | 75294 | 75357 | 75388 |

| 75211 | 75232 | 75252 | 75295 | 75359 | 75389 |

| 75212 | 75233 | 75253 | 75301 | 75360 | 75390 |

| 75214 | 75234 | 75258 | 75303 | 75363 | 75391 |

| 75215 | 75235 | 75260 | 75310 | 75364 | 75392 |

| 75216 | 75236 | 75261 | 75312 | 75367 | 75393 |

| 75217 | 75237 | 75262 | 75313 | 75368 | 75394 |

| 75218 | 75238 | 75263 | 75315 | 75370 | 75395 |

| 75219 | 75239 | 75264 | 75320 | 75371 | 75396 |

| 75220 | 75240 | 75265 | 75323 | 75372 | 75397 |

| 75221 | 75241 | 75266 | 75326 | 75373 | 75398 |

Don’t see your zip code listed? Don’t worry, as long as it’s in Texas, we’ve got you covered!

Disclaimer

Every home is unique. Insurance premium costs are impacted by several factors; therefore, we recommend obtaining an individualized quote to find your rates.

Our data is representative of quality, publicly sourced, and internal data, but should not be deciphered as bindable.