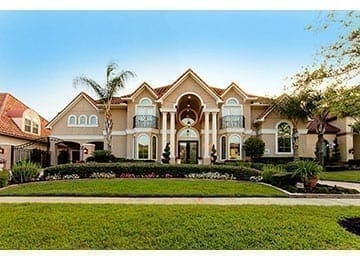

Sugar Land Homeowners Insurance Made Easy with Quick, Accurate Quotes!

Comparison Shop Home Insurance in Sugar Land, TX from Multiple Carriers in Minutes

As an independent insurance agency, we’re carrier agnostic, so we don’t work for one insurance provider; we work for you! When you input your address, your policy is immediately shopped against our bank of A-rated (or better) carriers to find you the best policy possible to fit your needs in seconds.

How Much is Home Insurance in Sugar Land, TX?

Homeowners in Sugar Land pay an average of $3,811 per year for home insurance, based on our latest data. Your rate might be higher or lower depending on factors like your home’s value, age, construction materials, and coverage selections. Sugar Land’s desirable location and proximity to the Gulf Coast bring unique considerations—such as hurricane and flood risks—that can affect premiums.

How Dwelling Coverage Limits Affect Your Premium

Dwelling coverage is one of the most important parts of your homeowners insurance—it protects the physical structure of your home against covered risks. If your house is damaged or destroyed by a covered event, this coverage helps pay for repairs or a complete rebuild. Your dwelling coverage limit is the maximum amount your policy will pay toward rebuilding costs, so it should be high enough to cover a total loss.

This limit also plays a significant role in determining your premium. The higher your dwelling coverage limit, the more risk your insurer takes on, which usually means a higher premium. The key is finding the right balance—enough coverage to fully protect your home without overpaying for insurance you don’t need.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000 - $200,000 $2,498

$200,000 - $300,000 $3,071

$300,000 - $400,000 $3,660

$400,000 - $500,000 $4,374

$500,000 - $600,000 $4,782

$600,000 - $700,000 $5,358

How Home Size Impacts Your Premium

The size of your home has a direct effect on your homeowners insurance premium. In Sugar Land, homes under 2,500 square feet average about $3,113 per year for coverage, while homes larger than 2,500 square feet average closer to $4,261. Larger homes typically cost more to insure because they require more materials and labor to repair or rebuild, and they often contain more personal property that needs protection. When setting your coverage, insurers consider not just the square footage but also the complexity of your home’s design, the number of rooms, and any custom features that could increase rebuilding costs.

What Does Home Insurance Cover in Sugar Land?

A standard homeowners insurance policy in Sugar Land typically includes:

- Dwelling Coverage – Protects the physical structure of your home from covered risks like fire, theft, vandalism, or certain storms.

- Personal Property Coverage – Helps replace or repair your belongings—such as furniture, clothing, and electronics—if they’re damaged or stolen.

- Liability Protection – Covers you if someone is injured on your property or if you accidentally cause damage to another person’s property.

- Loss of Use Coverage – Pays for additional living expenses, such as hotel stays or meals, if your home becomes uninhabitable after a covered event.

Because every home and homeowner is unique, TGS Insurance works with you to customize coverage that fits your property, lifestyle, and budget.

Additional Coverages for Your Sugar Land Home Insurance Policy

Be Ready for Texas Weather

Sugar Land homeowners know Texas weather can be unpredictable—sunny skies one day, damaging storms the next. Your homeowners insurance should be ready for anything. Most standard policies cover perils like fire, explosions, hail, windstorms, theft, and vandalism unless specifically excluded. One common misconception is that flood damage is included—it’s not. To be protected from flooding caused by hurricanes, heavy rain, or overflowing waterways, you’ll need a separate flood insurance policy. At TGS Insurance, we can help you build complete protection against all of the elements.

Hail Damage

Hail can cause thousands in repairs, and it’s not always covered in standard policies.

The TGS Difference: Hail protection comes standard with a 3% hail/windstorm deductible—customizable to your needs.

Windstorm Damage

From hurricanes to tornadoes, strong winds can bring major damage.

The TGS Difference: Every policy we write includes windstorm coverage by default, starting with a 3% deductible you can adjust.

Flood Damage

No home in Sugar Land is completely safe from flooding, whether it’s caused by heavy rain, hurricanes, or overflowing waterways. Standard homeowners insurance doesn’t cover flood damage, so a separate policy is essential to protect your home and belongings.

The TGS Difference: We make it easy to bundle flood insurance with your home policy for complete, gap-free coverage.