We Shop 35+ Carriers to Find You The Best Deal on Your Waco, Texas Home Insurance Every Time!

At TGS Insurance, we don’t believe homeowners in Waco, Texas, should have to compromise on the protection they need for a rate that doesn’t break the bank. As an independent agency, we work for YOU and not any single insurance carrier. We comparison shop every policy we issue through our bank of 35+ A-rated (or better) carriers to find our clients the best insurance policy the market has to offer. No gimmicks or tricks, just great home insurance coverage at a great rate!

What Does Home Insurance in Waco, Texas cover?

Your basic homeowners insurance policy will cover the following:

- The physical structure of your home

- Your personal belongings

- Replacement costs

- Loss-of-use coverage

- Liability

Your home insurance policy will cover all of these areas but only to a specific limit. Suppose you’re seeking additional coverage for things like art or jewelry collections or even more protection against water damages that aren’t covered in your policy. In that case, you’ll need to purchase supplemental or add-on policies to close any gaps in coverage. Popular policy add-ons in Waco, Texas, include:

- Scheduled personal property

- Valuable Articles/Floater policies (Ex. jewelry insurance)

- Umbrella insurance (Additional liability coverage)

- Animal liability

- Flood insurance (Flood damage is NOT covered under home insurance)

- Water backup coverage (Water damage due to a backed-up sewer line)

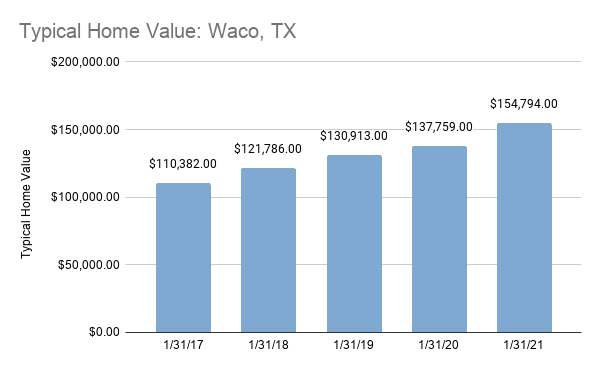

Typical Home Value in Waco, Texas and The Impact of Home Value on Home Insurance Costs

As of January 31, 2021, the typical home value, as reported by Zillow.com for Waco, TX, was $154,794. Compared to the previous year, the typical home value in Waco appreciated 12.37%; over a 5-year period, the typical home value has appreciated 40%!

Source: Zillow Home Values Index (ZHVI) Housing Data from Zillow.com

Comparing the Average Cost of Home Insurance in Waco, Texas by Dwelling Coverage

While appreciating home values is excellent for homeowners, it often means higher insurance premiums. One thing that is important to differentiate between is the overall value of the property, which includes the land, and the cost to replace the house, which is what is essential for insurance purposes. The key between being over-insured, over-paying, and having the right coverage is staying informed and shopping your policy. If you are at all feeling overwhelmed or want someone else to do the heavy-lifting, our agents are always ready to jump in.

So what does this all look like?

Let’s look at the average premium for a home in Waco, TX, with an estimated replacement cost of $150,00. For purposes of this example, we are assuming 0 claims in the past five years, a house that is 10-34 years old, and that the person seeking insurance owns the home (versus rents it) and has average credit.

Source: The overall average premium is $1,875. The table below looks at the average premiums when we sort the carriers by AM Best Ratings.

| AM Best rating | Estimated Cost / Year with Wind |

|---|---|

| A- | $1,487 |

| A+ | $1,718 |

| A++ | $1,948 |

These averages are from quotes provided by HelpInsure.com of Texas Department of Insurance and are grouped by carrier averages by AM Best Ratings.

Now, if you increase the estimated house replacement cost to $200,000 but leave all other factors the same, your overall average premium increases by $373 to $2,248. Again, the table below looks at the average premiums when we sort the carriers by AM Best Ratings.

| AM Best rating | Estimated Cost / Year with Wind |

|---|---|

| A- | $1,755 |

| A+ | $2,007 |

| A++ | $2,492 |

Source: These averages are from quotes provided by HelpInsure.com of Texas Department of Insurance and are grouped by carrier averages by AM Best Ratings.

Keep in mind that this example looks at just one factor’s role in your home insurance premium price- there are several other factors at play.

How Much is Homeowners Insurance in Waco, Texas?

The average home insurance policy premium varies from home to home, homeowner to homeowner. The average homeowner in Waco, Texas, pays about $1,875 per year for home insurance. At TGS Insurance, our average customer in Waco, Texas, pays $1,165 per year for an average savings of $710 per year! To see how much you could be saving, enter your address for a free instant quote!

Factors That Influence the Cost of Homeowners Insurance in Waco, Texas

Each insurance carrier will look at specific criteria when determining your insurance premium. While many factors may be out of your control, there are some that you can influence. Some notable carrier rating factors include, but are certainly not limited to:

- Weather (including extreme weather events such as tornadoes, hail, or hurricanes)

- The crime rates in your area

- Your claims history

- The coverages you select- this includes the deductible amounts

- Your credit score (the higher your score, the lower your premium)

- The year, construction type, and size of your home

- The age and condition of your roof

- The availability of discounts that you may qualify for, such as bundling, discounts for home security, etc.

An independent agent with TGS Insurance can help narrow down your home coverage search by running quotes with 35+ top-rated carriers at once. Comparison shopping allows our agents to find you the best price for your insurance without cutting your coverage and eliminating all the hassle.

Zip Codes in Waco, Texas That We Insure:

| 76633 | 76704 | 76711 |

| 76643 | 76705 | 76712 |

| 76657 | 76706 | 76714 |

| 76701 | 76707 | 76797 |

| 76702 | 76708 | 76798 |

| 76703 | 76710 | 76799 |

Don’t see your zip code listed? Don’t worry; as long as it’s in Texas, we’ve got you covered!