Finding Affordable Apex Home Insurance Made Simple

At TGS Insurance Agency, we leverage our relationships with several top-rated carriers to find you the best coverage and prices. Our online quoting tool makes getting a home insurance quote easier and faster than ever- all we need is your address! Our agents are ready to review your quote to assure you are getting the coverage you need and not overpaying for coverage you don’t.

We shop, and you save time and money; it really is that easy.

What is Covered in Apex Home Insurance?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Apex, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. But not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

How Much Does Apex Home Insurance Cost?

On average, a TGS customer in Apex would pay $1,253 per year for home insurance. Home insurance rates vary based on several factors, including your home’s age, value, and location, as well as your credit score and desired coverage levels. This average is based on policies with an average home value of $375,746 and includes windstorm and hail coverage with a 2% deductible. TGS Insurance Agency offers customizable options to all our customers so you can find the right policy and pay what you want. Get started with a free instant home insurance quote by providing your address above.

Home Insurance in Apex Cost by Dwelling Coverage Limit

Dwelling coverage limits are one of the key factors that insurers consider when setting premiums. You’ll generally pay a higher premium if you choose a high dwelling coverage limit. However, it’s important to ensure adequate coverage to protect your home during a loss. If you have a mortgage on your home, your lender may require you to have a certain amount of dwelling coverage to protect your investment.

In Apex, North Carolina, a policy with $200,000-$299,999 in dwelling coverage costs an average of $1,074 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000-$499,999 in dwelling coverage will pay an average of $1,365 in Apex, North Carolina.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $777.47 |

| $200,000.00 - $299,999.00 | $1,073.87 |

| $300,000.00 - $399,999.00 | $1,215.41 |

| $400,000.00 - $499,999.00 | $1,364.99 |

| $500,000.00 - $599,999.00 | $1,545.80 |

| $600,000.00 - $699,999.00 | $1,649.26 |

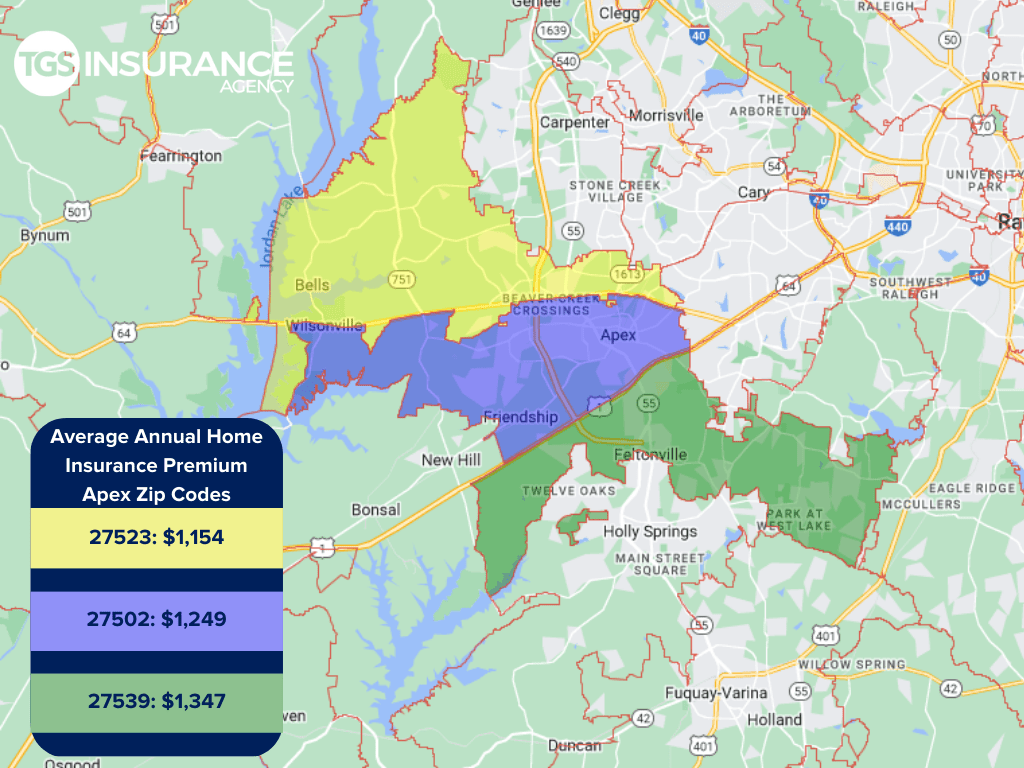

Does My ZIP Code Affect Home Insurance Premiums in Apex?

Insurance carriers look at more than your home state when pricing your premium- they can get as specific as your ZIP Code. For example, in North Carolina, when you are closer to the coast, you may experience higher annual premiums because of your risks of perils like flooding and hurricanes. In Apex, the ZIP code 27523 is the area with the lowest premium of $1,154 for TGS customers. The ZIP code with the highest premium is 27539, costing TGS customers an average of $1,347 a year.

How the Age of Your Apex Home Affects Your Insurance

The age of your home can affect your insurance in many ways. Older homes are more at risk of electrical, plumbing, and heating/cooling complications. These issues increase the risk of fire and water damage in homes. Also, older homes can be less structurally sound than newer homes. This could lead to more damage when natural disasters-like hurricanes- come through. All of these can result in higher insurance premiums. In contrast, newer homes may be immune to these issues, making them cheaper to insure.

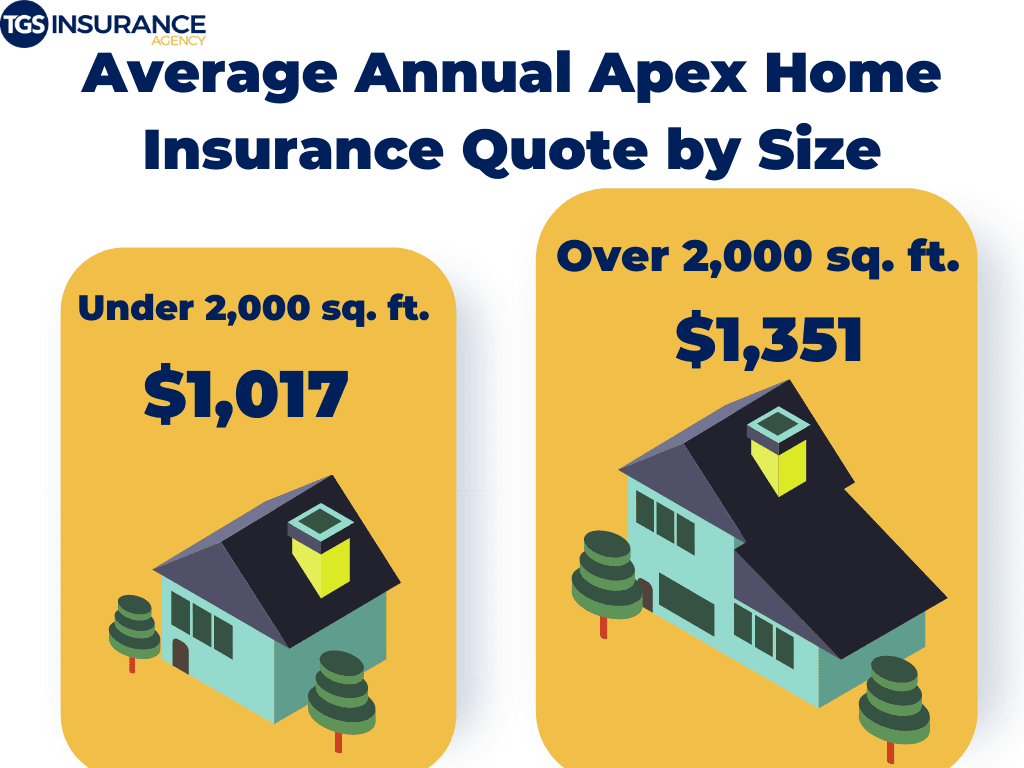

How Apex Home Insurance is Affected By the Size of Your Home

When it comes to determining the cost of your home insurance, there’s a lot that goes into it. Carriers will look at your home’s age, location, and size- among other things. The size of your home is a factor because it affects your replacement cost.

If you have a house with higher square footage, your home will be more expensive to rebuild if it is damaged by a total covered loss. If you think about it, a larger house requires more building materials, time, and manpower to rebuild from the ground up. It goes the other way for smaller homes. If you have less house to rebuild, your home insurance premium will be lower.

Looking at the numbers, houses in Apex, North Carolina, that are over 2,000 square feet average at about $1,351 per year to insure. At the same time, houses that are under 2,000 square feet cost an average of $1,017 to insure a year.

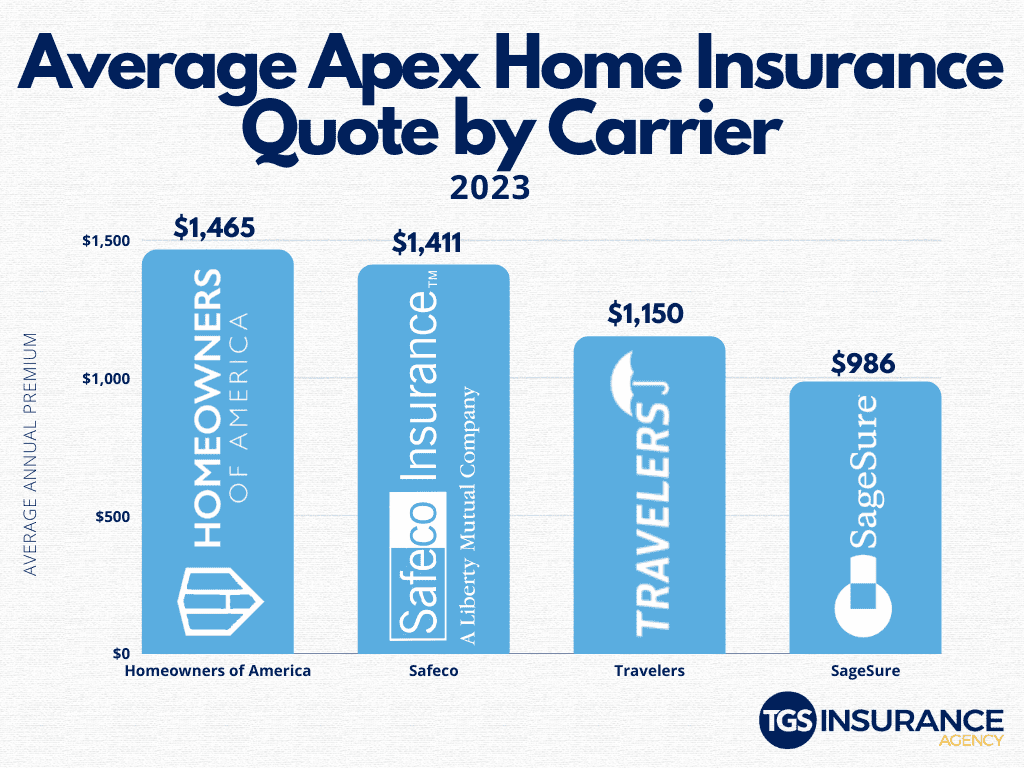

Best Apex Home Insurance Carriers

Knowing who will give you a competitive premium in your area is a big part of choosing your home insurance. Among TGS customers, the most popular carrier in Apex is SageSure. The average annual premium with SageSure is $986. Other popular carriers are Travelers and Safeco. Choosing a carrier is more than just the price; however, here at TGS Insurance Agency, we know that price is one of the more important factors. Check out the table below to see the average price for Apex based on the insurance provider.

Apex Zip Codes TGS Insurance Agency Insures

- 27502

- 27523

- 27539

Don’t worry if you don’t see your zip code above! We can find incredible rates for homeowners throughout North Carolina. Enter your address above for a free instant home insurance quote.