Getting a Black Mountain Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Black Mountain is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents

Black Mountain Home Insurance Coverage

The beauty of home insurance is that it can be tailored to fit you and your situation. Typically, a standard home insurance policy covers the following:

- Coverage for your home and other structures on your property, like detached garages

- Coverage for your belongings inside your home, like clothes and furniture

- Liability coverage for guests that may be injured on your property

- It covers additional living expenses if you need temporary lodging while your home is being repaired

What is the Average Cost of Home Insurance in Black Mountain?

In Black Mountain, the average cost of home insurance for TGS Insurance customers is $857 per year. While the cost of your policy will depend on several factors, such as the value and age of your home, your location, and your credit score, our agents can help you find the coverage you need at a price you can afford. We’ll work with you to customize your coverage and ensure you’re not sacrificing anything important to save money.

Average Homeowners Insurance Cost by Coverage Level in Black Mountain

The cost to replace your home is essential to determine the dwelling coverage you need on your home insurance policy; this limit directly impacts your home insurance premium. On top of affecting your average annual costs, having an accurate replacement cost can prevent you from being underinsured if a covered loss takes your entire house. These are the average annual home insurance costs in Black Mountain, North Carolina, based on dwelling coverage limits associated with the policy.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $618.50 |

| $200,000.00 - $299,999.00 | $858.43 |

| $300,000.00 - $399,999.00 | $1,055.61 |

| $400,000.00 - $499,999.00 | $1,218.46 |

How the Age of Your Black Mountain Home Affects Your Insurance

The age of your home can affect your insurance in many ways. Older homes are more at risk of electrical, plumbing, and heating/cooling complications. These issues increase the risk of fire and water damage in homes. Also, newer homes are more structurally sound than older homes. This could lead to more damage when natural disasters-like hurricanes- come through. All of these can result in higher insurance premiums. In contrast, newer homes may be immune to these issues, making them cheaper to insure.

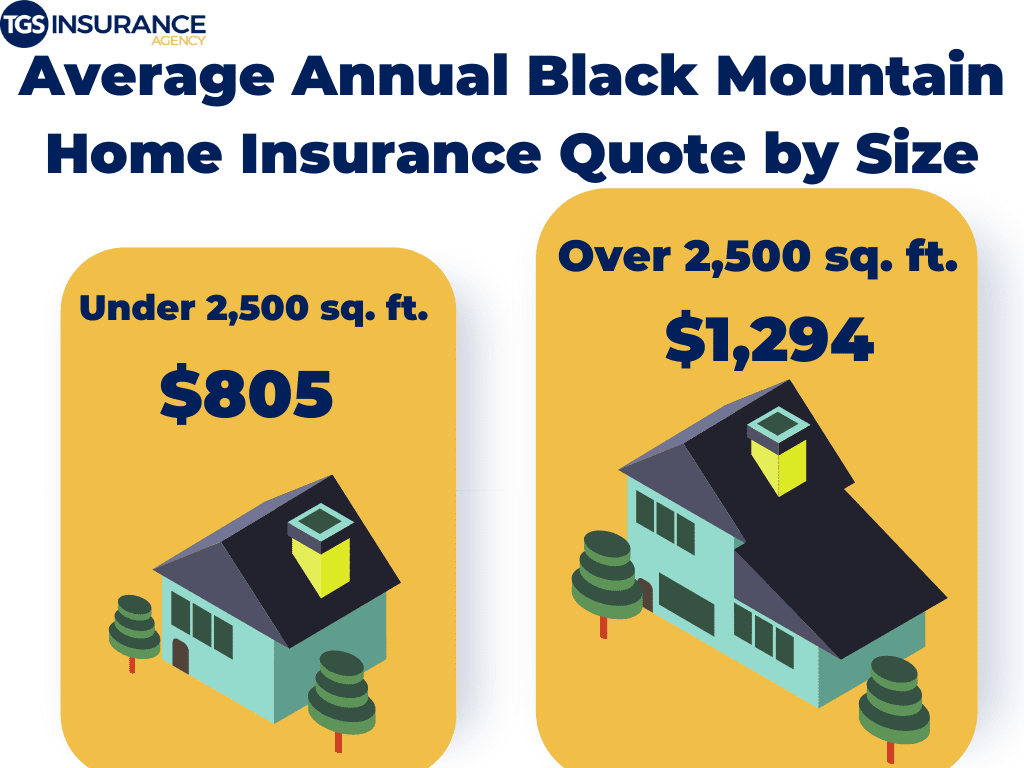

How the Size of Your Black Mountain Home Affects the Cost of Insurance

Another thing that will affect the cost of your Black Mountain home insurance is the size of your home. Insurance carriers look at the square footage of your home to determine the replacement cost. If you have a larger house, your replacement cost will be higher. Because of the higher replacement cost, your home insurance premium will be higher than that of smaller houses. Some other factors that affect your replacement cost are:

- Building materials used to build your home

- Features in your home like fireplaces or a jetted tub

- The age of your home

In Black Mountain, houses that are over 2,500 square feet cost $1,294 per year. Houses under 2,500 square feet have an average annual premium of $805.

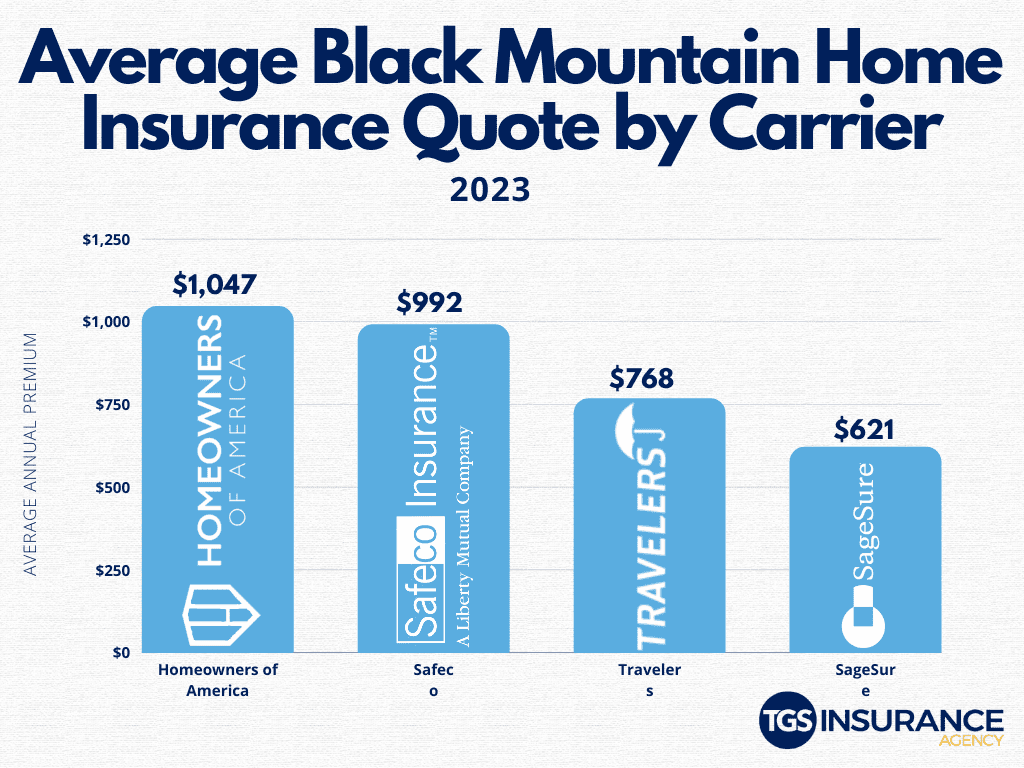

Cheapest Black Mountain Home Insurance Carrier

Homeowners in Black Mountain, North Carolina, all want the same thing- an excellent home insurance policy that doesn’t break the bank. Cost is one of the most influential things people look at when purchasing insurance, next to the amount of coverage. This is why homeowners must compare and shop their policies across multiple carriers! Insurance carriers set their rates, so your premium could vary across multiple carriers with the same coverage. Our two most affordable (and popular) insurance providers in Black Mountain, North Carolina, are SageSure and Travelers. On average, TGS Insurance customers in Black Mountain, North Carolina, pay $621 for SageSure annually and $768 for Travelers.

Zip Codes in Black Mountain TGS Insurance Covers

- 28711

Don’t see your zip code? We’ve got you covered! We make shopping for the best home insurance easy and hassle-free for all residents throughout North Carolina. Start today with a free, instant quote!