Getting a Cary Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Cary is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents.

Cary Home Insurance Coverage: The Basics

If you’re like most homeowners in Cary, your home is your most valuable asset, and you should protect it as such. It’s important to understand that when you create your home insurance policy, it should meet your individual needs. Insurance companies offer different levels of coverage, endorsements, and protections with varying conditions and limitations that enable policies to be customized. With that in mind, the most common types of coverage you will see on a homeowners insurance policy include:

- Dwelling coverage for the structure of your home.

- Other structures coverage for structures not attached to your home, like detached garages, sheds, and fences.

- Personal property coverage for replacing and repairing furniture, electronics, clothing, etc.

- Loss of use coverage for additional living expenses if you need to stay somewhere else while your home is being repaired.

- Personal liability coverage for legal bills if someone gets injured on your property or you cause damage and get sued.

- Medical payment coverage helps cover medical expenses for nonhousehold members injured on your property.

How Much is Home Insurance in Cary, North Carolina?

Cary home insurance costs an average of $1,371 per year for TGS Insurance customers. This average is factored with policies with a 2% wind and hail coverage deductible and an average home value of $377,447. The cost of your home insurance premium will vary based on a few different things. This can be your credit, where you live, how much your house is worth, and the age of your home. Our instant home quote tool shops for you to find the best rates with just your address. After your instant quote, connect with one of our agents to further customize your coverage!

Average Cary Home Insurance Cost By Dwelling Coverage Limits

Dwelling coverage is the component of home insurance that protects the physical structure of your home from covered perils. It is designed to cover the cost of repairing or rebuilding your home if it is damaged or destroyed by a covered event. The amount of dwelling coverage you need will depend on the cost of rebuilding your home. Your home insurance policy typically provides coverage up to a specified dollar amount, known as the policy limit. It’s important to ensure that your dwelling coverage limit is high enough to cover the cost of rebuilding your home in the event of a total loss. Dwelling coverage limits can have a significant impact on home insurance premiums. In general, the higher the dwelling coverage limit, the higher the premium since the insurance company will take on more risk.

In Cary, North Carolina, if you need $200,000-$299,999 in dwelling coverage, you’ll pay an average of $1,091 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000-$499,999 in dwelling coverage will pay an average of $1,604 in Cary, North Carolina.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $786.69

$200,000.00 - $299,999.00 $1,091.65

$300,000.00 - $399,999.00 $1,310.75

$400,000.00 - $499,999.00 $1,604.16

$500,000.00 - $599,999.00 $1,820.60

$600,000.00 - $699,999.00 $2,112.24

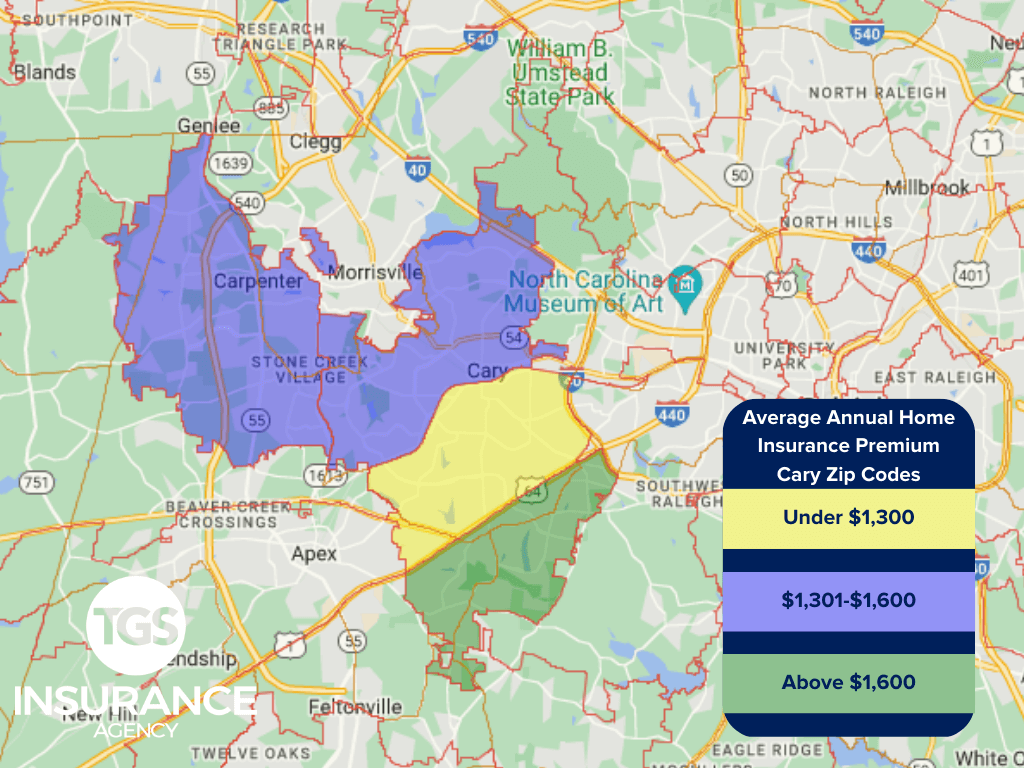

Does My ZIP Code Affect Home Insurance Premiums in Cary?

Insurance carriers look at more than your home state when pricing your premium- they can get as specific as your ZIP Code. For example, in North Carolina, when you are closer to the coast, you may experience higher annual premiums because of your risks of perils like flooding and hurricanes. In Cary, the ZIP code 27511 is the area with the lowest premium of $1,240 for TGS customers. The ZIP code with the highest premium is 27518, costing TGS customers an average of $1,609 a year.

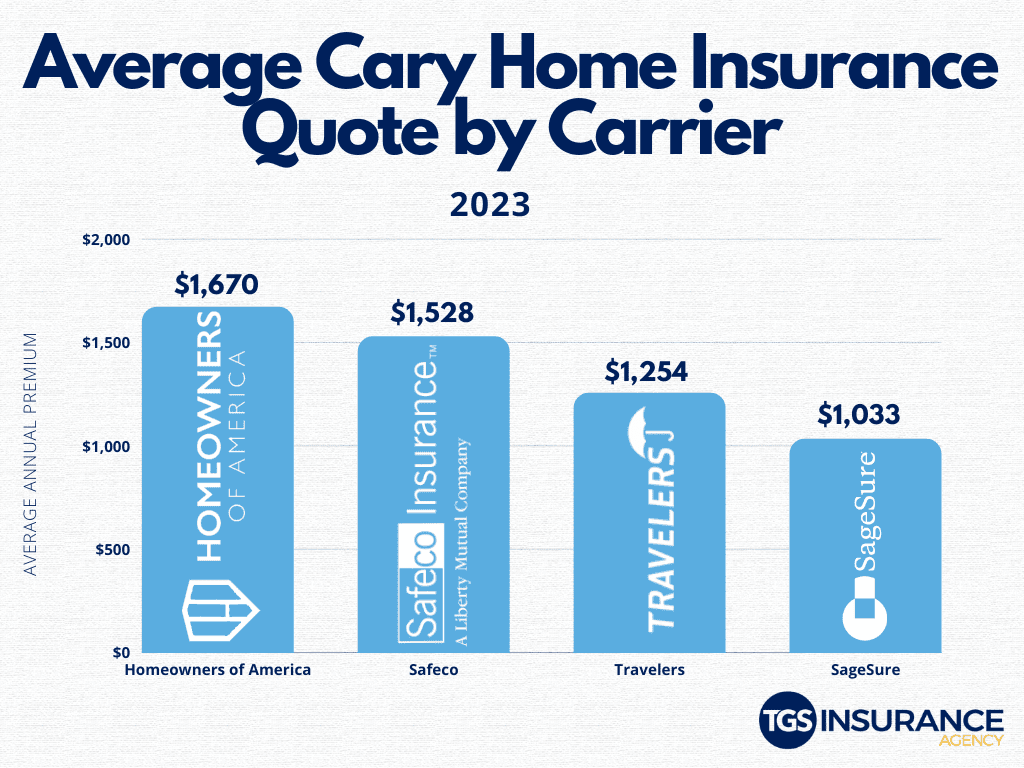

Who is the Most Popular Home Insurance Carrier in Cary, North Carolina?

We want you to find the perfect homeowners insurance in Cary, North Carolina. Knowing what the best insurance carriers in your area charge for home insurance is a great way to know if your policy is competitive. We pulled together some data from TGS customers in your area and found that Travelers is the most popular in Cary. People with Travelers pay an average of $1,254 annually. Another popular carrier in Cary is Safeco. Safeco’s rates differ a bit from Travelers, having an average cost of $1,528 a year. Check out our data below for the some of the most popular carriers in Cary and their average annual home insurance premiums.

Cary Zip Codes TGS Insurance Agency Insures

- 27511

- 27513

- 27518

- 27519

Don’t worry if you don’t see your zip code above! We can find incredible rates for homeowners throughout North Carolina. Enter your address above for a free instant home insurance quote.