Comparison Shop Home Insurance in Clemmons from Multiple Carriers Instantly!

Being an independent insurance agency means we shop and compare the best Clemmons homeowners insurance options on your behalf to find you the best combination of cost and coverage. You’ll love doing business with us if you want an easier insurance experience. How do you get started? Easy! All we need is your address; you’ll get an instant quote in 15 seconds or less. After that, our agents will tailor and further customize your policy to fit your specific insurance needs. Did we mention we re-shop your policy renewal to ensure you are still getting the best deal year after year?

You’re one click away from never worrying about home insurance again!

Clemmons Home Insurance Coverage: The Basics

If you’re like most homeowners in Clemmons, your home is your most valuable asset, and you should protect it as such. It’s important to understand that when you create your home insurance policy, it should meet your individual needs. Insurance companies offer different levels of coverage, endorsements, and protections with varying conditions and limitations that enable policies to be customized. With that in mind, the most common types of coverage you will see on a homeowners insurance policy include:

- Dwelling coverage for the structure of your home.

- Other structures coverage for structures not attached to your home, like detached garages, sheds, and fences.

- Personal property coverage for replacing and repairing furniture, electronics, clothing, etc.

- Loss of use coverage for additional living expenses if you need to stay somewhere else while your home is being repaired.

- Personal liability coverage for legal bills if someone gets injured on your property or you cause damage and get sued.

- Medical payment coverage helps cover medical expenses for non-household members injured on your property.

Cost of Home Insurance in Clemmons

In Clemmons, the average home insurance costs $1,145 per year for TGS Insurance customers. The cost of your home insurance is based on several different factors, including, but not limited to:

- The value of your home.

- Where your home is.

- How old your home is.

- The number of residents in your home.

- Your credit score.

These factors set a base for your home insurance, and then you can customize your coverage. The more coverage you choose to have, the more your yearly premium will be. TGS Insurance is here to help you find the best price without sacrificing any coverage you want.

Average Homeowners Insurance Cost by Coverage Level in Clemmons

The cost to replace your home is essential to determine the dwelling coverage you need on your home insurance policy; this limit directly impacts your home insurance premium. On top of affecting your average annual costs, having an accurate replacement cost can prevent you from being underinsured if a covered loss takes your entire house. These are the average annual home insurance costs in Clemmons, North Carolina, based on dwelling coverage limits associated with the policy.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $689.96

$200,000.00 - $299,999.00 $964.36

$300,000.00 - $399,999.00 $1,165.37

$400,000.00 - $499,999.00 $1,392.88

$500,000.00-$599,999.00 $1,730.96

$600,000.00-$699,999.00 $1,927.89

How the Age of Your Clemmons Home Affects Your Insurance

The main difference between older and newer houses is that older homes pose a larger risk to insurance carriers. Older homes are more susceptible to fires and issues with plumbing and roofing. It would also be more expensive for carriers to repair older homes, so your premium will be higher. To avoid high premiums on older homes, keep up with home maintenance. If you update your home systems, your insurance carrier will not see them as a big risk.

How Different Insurance Carriers in Clemmons Differ in Price

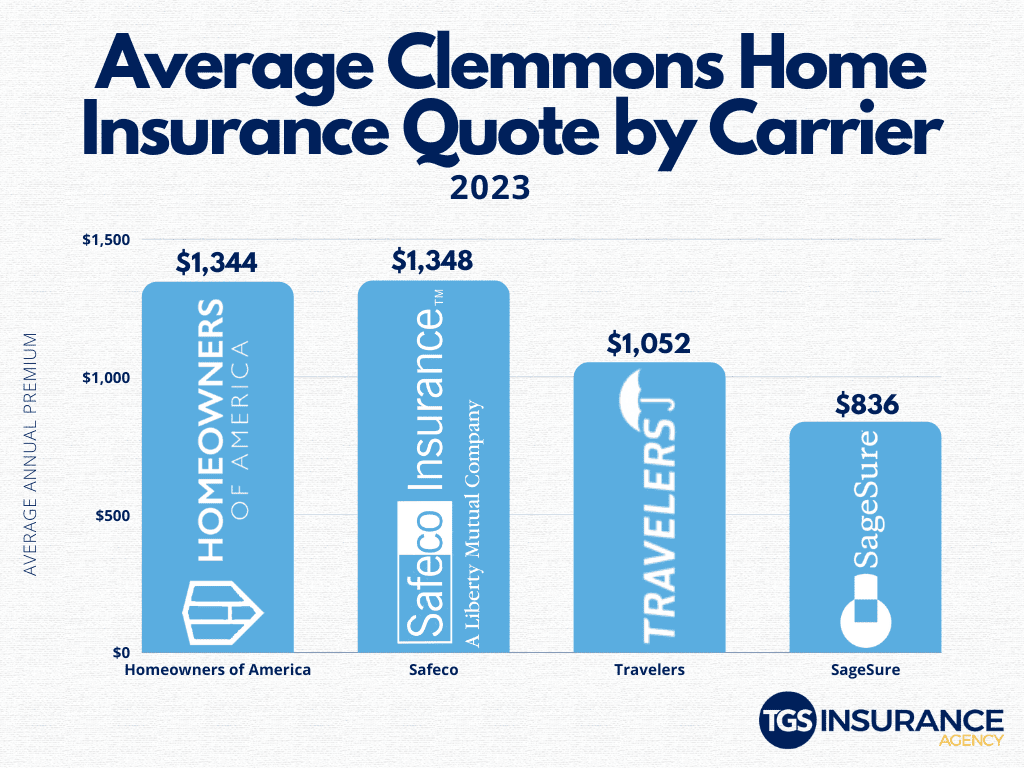

When searching for a new home insurance policy, you want to ensure it fits your needs and is within your budget. The carrier you decide to use is one of the biggest factors affecting your premium cost. Carrier rates differ because they have different ways of determining your risk to them. Say your house is a bit older- one carrier may see that as not a huge deal, but another will take that seriously and charge you more for your premium. In Clemmons, the least expensive carrier is SageSure; on average, Clemmons residents pay $836 a year. Here is a breakdown of the four most popular carriers in Clemmons and how their averages differ.

When picking which carrier is right for you, the cheapest may not always be the best. But there is no need for endless days of researching, quoting, and aggravation. At TGS, we shop around for you. You get all the prices and coverages given to you. Then you can decide which is your perfect match!

Clemmons Zip Codes We Insure

- 27012

Zip code not listed? Don’t worry! We can help homeowners throughout North Carolina save money on their home insurance. Get started with a free instant quote by providing your address above.