Finding Affordable Davidson Home Insurance Made Simple

At TGS Insurance Agency, we leverage our relationships with several top-rated carriers to find you the best coverage and prices. Our online quoting tool makes getting a home insurance quote easier and faster than ever- all we need is your address! Our agents are ready to review your quote to assure you are getting the coverage you need and not overpaying for coverage you don’t.

We shop, and you save time and money; it really is that easy.

What Does Davidson Home Insurance Cover?

Most home insurance policies include some level of the following types of coverage.

Coverage A covers damages to your home

Coverage B covers damages to additional structures on your property such as detached garages, sheds, or fences

Coverage C covers damage to personal property such as furniture, electronics, and clothes

Coverage D covers additional living expenses if your home becomes uninhabitable due to a covered loss

Coverage E covers personal liability including coverage for claims arising from accidents on your property

Coverage F covers medical expenses for injuries occurring on your property for those outside of your household

When it comes to home insurance in Davidson, there’s no shortage of options. A standard policy typically covers a variety of losses, including damage caused by weather, theft, and accidents. But not all policies are created equal. That’s why it’s important to work with a knowledgeable agent who can help you navigate the complexities of home insurance and tailor your coverage to fit your needs. Whether you need more protection for your personal belongings or additional liability coverage, we’ve got you covered.

How Much Does Davidson Home Insurance Cost?

On average, a TGS customer in Davidson would pay $1,246 per year for home insurance. Home insurance rates vary based on several factors, including your home’s age, value, and location, as well as your credit score and desired coverage levels. This average is based on policies with an average home value of $388,014 and includes windstorm and hail coverage with a 2% deductible. TGS Insurance Agency offers customizable options to all our customers so you can find the right policy and pay what you want. Get started with a free instant home insurance quote by providing your address above.

Average Davidson Home Insurance Cost By Coverage Level

Dwelling coverage is a fundamental element of home insurance that protects the physical structure of your home against covered hazards. The intention is to cover the expenses of repairing or rebuilding your home if it is damaged or destroyed due to a covered event. The amount of dwelling coverage needed depends on the cost of rebuilding your home. Your home insurance covers the policy limit- which is coverage for up to a specified dollar amount. It is critical to ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding your home in case of a complete loss. Dwelling coverage limits can significantly impact home insurance premiums, with higher limits resulting in higher premiums since the insurance company is assuming more risk.

In Davidson, North Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $1,001 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $1,354 in Davidson, North Carolina.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $699.80 |

| $200,000.00 - $299,999.00 | $1,001.47 |

| $300,000.00 - $399,999.00 | $1,192.55 |

| $400,000.00 - $499,999.00 | $1,353.53 |

| $500,000.00-$599,999.00 | $1,561.96 |

How the Age of Your Davidson Home Affects Your Insurance

The main difference between older and newer houses is that older homes pose a larger risk to insurance carriers. Older homes are more susceptible to fires and issues with plumbing and roofing. It would also be more expensive for carriers to repair older homes, so your premium will be higher. To avoid high premiums on older homes, keep up with home maintenance. If you update your home systems, your insurance carrier will not see them as a big risk.

How Different Insurance Carriers in Davidson Differ in Price

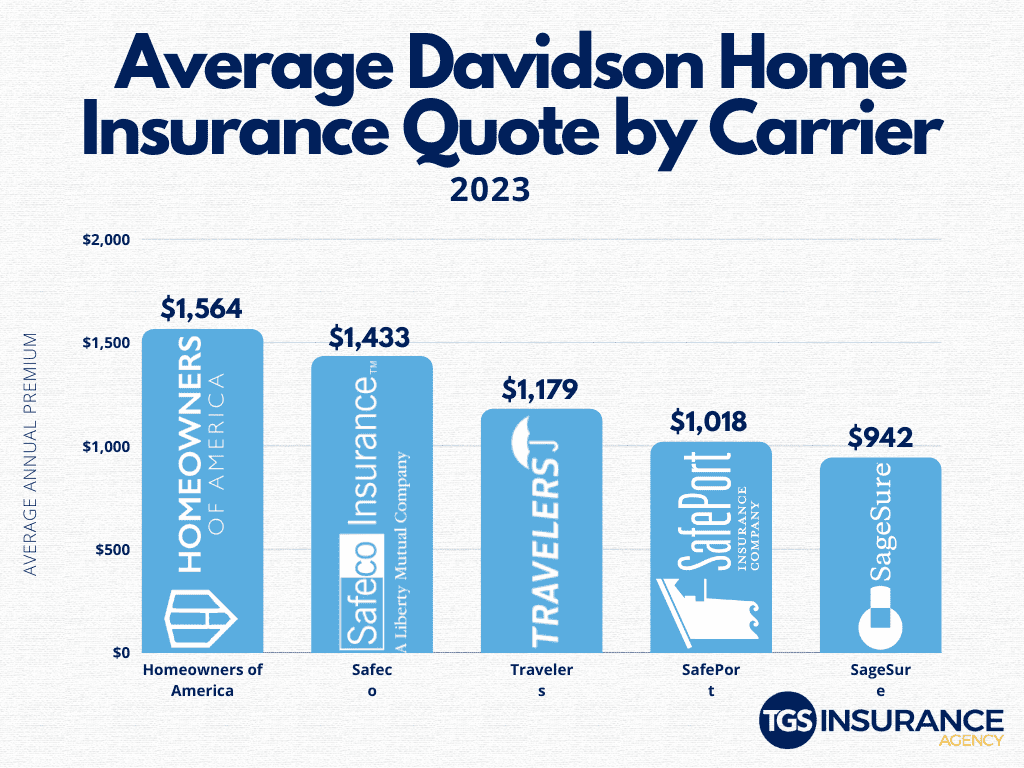

When searching for a new home insurance policy, you want to ensure it fits your needs and is within your budget. The carrier you decide to use is one of the biggest factors affecting your premium cost. Carrier rates differ because they have different ways of determining your risk to them. Say your house is a bit older- one carrier may see that as not a huge deal, but another will take that seriously and charge you more for your premium. In Davidson, the least expensive carrier is SageSure; on average, Davidson residents pay $942 a year. Here is a breakdown of the five most popular carriers in Davidson and how their averages differ.

When picking which carrier is right for you, the cheapest may not always be the best. But there is no need for endless days of researching, quoting, and aggravation. At TGS, we shop around for you. You get all the prices and coverages given to you. Then you can decide which is your perfect match!

Davidson Zip Codes TGS Insurance Agency Insures

- 28036

Don’t worry if you don’t see your zip code above! We can find incredible rates for homeowners throughout North Carolina. Enter your address above for a free instant home insurance quote.