Getting an Eden Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Eden is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents

Eden Home Insurance Coverage: The Basics

If you’re like most homeowners in Eden, your home is your most valuable asset, and you should protect it as such. It’s important to understand that when you create your home insurance policy, it should meet your individual needs. Insurance companies offer different levels of coverage, endorsements, and protections with varying conditions and limitations that enable policies to be customized. With that in mind, the most common types of coverage you will see on a homeowners insurance policy include:

- Dwelling coverage for the structure of your home.

- Other structures coverage for structures not attached to your home, like detached garages, sheds, and fences.

- Personal property coverage for replacing and repairing furniture, electronics, clothing, etc.

- Loss of use coverage for additional living expenses if you need to stay somewhere else while your home is being repaired.

- Personal liability coverage for legal bills if someone gets injured on your property or you cause damage and get sued.

- Medical payment coverage helps cover medical expenses for nonhousehold members injured on your property.

How Much Does Eden Home Insurance Cost?

On average, a TGS customer in Eden would pay $878 per year for home insurance. Home insurance rates vary based on several factors, including your home’s age, value, and location, as well as your credit score and desired coverage levels. This average is based on policies with an average home value of $234,711 and includes windstorm and hail coverage with a 2% deductible. TGS Insurance Agency offers customizable options to all our customers so you can find the right policy and pay what you want. Get started with a free instant home insurance quote by providing your address above.

Home Insurance in Eden Cost by Dwelling Coverage Limit

Dwelling coverage limits are one of the key factors that insurers consider when setting premiums. You’ll generally pay a higher premium if you choose a high dwelling coverage limit. However, it’s important to ensure adequate coverage to protect your home during a loss. If you have a mortgage on your home, your lender may require you to have a certain amount of dwelling coverage to protect your investment.

In Eden, North Carolina, a policy with $200,000-$299,999 in dwelling coverage costs an average of $954 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000-$499,999 in dwelling coverage will pay an average of $1,429 in Eden, North Carolina.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $660.42 |

| $200,000.00 - $299,999.00 | $954.48 |

| $300,000.00 - $399,999.00 | $1,180.46 |

| $400,000.00 - $499,999.00 | $1,428.61 |

| $500,000.00-$599,999.00 | $1,640.14 |

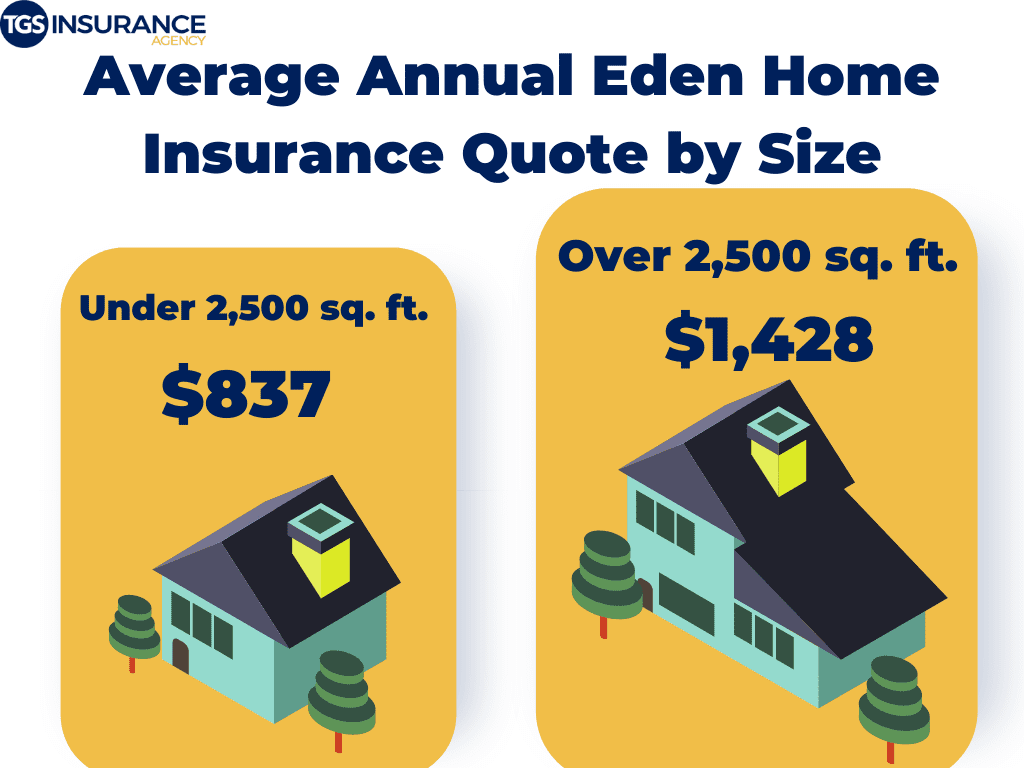

Does the Size of My Eden Home Affect My Insurance Rates?

The size of your home is a factor in your home insurance cost. Larger homes with more square footage often have more belonging inside, which is inherently more expensive to replace if they were to be destroyed by a covered peril. Also, your home’s size directly correlates to your home’s replacement cost, severely influencing the amount you will pay in homeowners insurance.

In Eden, North Carolina, houses that are over 2,000 square feet will cost you an average of $1,428 per year. Houses that are under 2,000 square feet have an average annual premium of $837 per year.

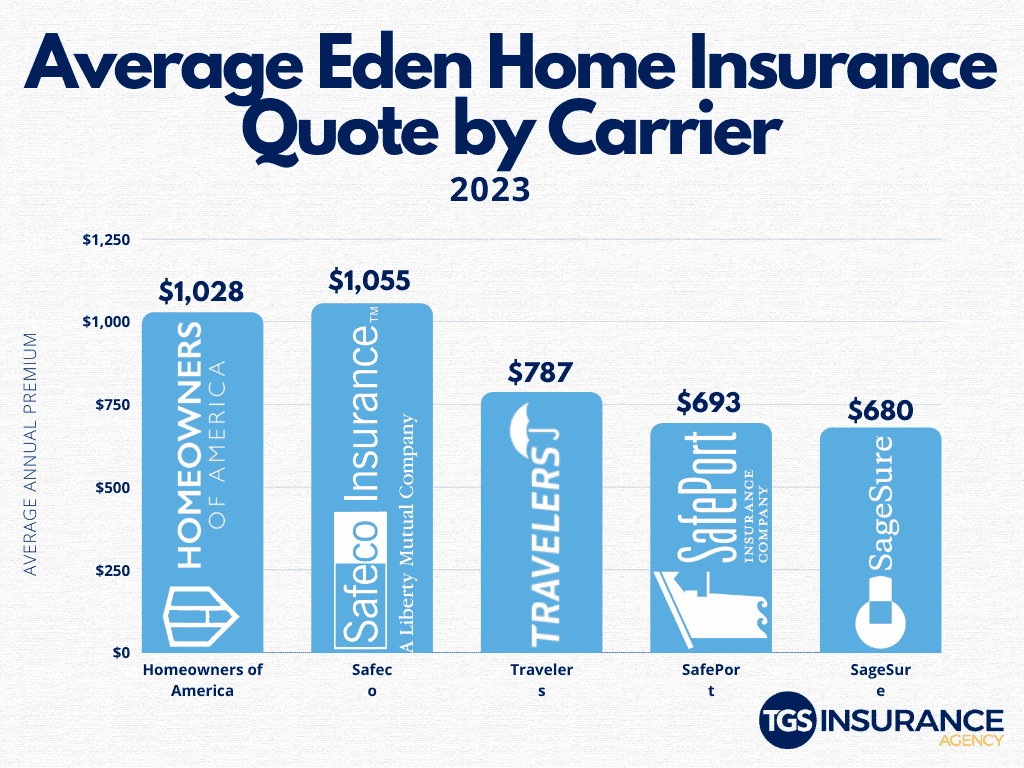

Eden Home Insurance Rates By Company

Choosing your home insurance provider is about more than the price, even though we know the cost is undoubtedly a factor. Because each provider sets their rates, the same coverage can vary between carriers. The top carrier in Eden is Travelers. TGS customers in Eden pay an average of $787 when insured by Travelers. Looking at the numbers, an overwhelming number of people in your area have chosen Travelers over our next most popular carrier, SafePort. The average premium for SafePort is $693 for TGS Insurance customers. Here is a breakdown of the different carriers used in Eden.

Eden Zip Codes We Insure

- 27288

Don’t see your zip code? It’s okay! At TGS Insurance Agency, we have access to a wide range of insurance carriers and products to help homeowners throughout North Carolina save money on their home insurance. Get a free, instant quote today and protect yourself, your family, and your home from the unexpected.