Comparison Shop Home Insurance in Elon from Multiple Carriers Instantly!

Being an independent insurance agency means we shop and compare the best Elon homeowners insurance options on your behalf to find you the best combination of cost and coverage. You’ll love doing business with us if you want an easier insurance experience. How do you get started? Easy! All we need is your address; you’ll get an instant quote in 15 seconds or less. After that, our agents will tailor and further customize your policy to fit your specific insurance needs. Did we mention we re-shop your policy renewal to ensure you are still getting the best deal year after year?

You’re one click away from never worrying about home insurance again!

Elon Home Insurance Coverage

The beauty of home insurance is that it can be tailored to fit you and your situation. Typically, a standard home insurance policy covers the following:

- Coverage for your home and other structures on your property, like detached garages

- Coverage for your belongings inside your home, like clothes and furniture

- Liability coverage for guests that may be injured on your property

- It covers additional living expenses if you need temporary lodging while your home is being repaired

How Much Does Elon Home Insurance Cost?

On average, a TGS customer in Elon would pay $1,012 per year for home insurance. Home insurance rates vary based on several factors, including your home’s age, value, and location, as well as your credit score and desired coverage levels. This average is based on policies with an average home value of $312,962 and includes windstorm and hail coverage with a 2% deductible. TGS Insurance Agency offers customizable options to all our customers so you can find the right policy and pay what you want. Start with a free instant home insurance quote by providing your address above.

Average Elon Home Insurance Cost By Coverage Level

Dwelling coverage is a fundamental element of home insurance that protects the physical structure of your home against covered hazards. The intention is to cover the expenses of repairing or rebuilding your home if it is damaged or destroyed due to a covered event. The amount of dwelling coverage needed depends on the cost of rebuilding your home. Your home insurance covers the policy limit- which is coverage for up to a specified dollar amount. It is critical to ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding your home in case of a complete loss. Dwelling coverage limits can significantly impact home insurance premiums, with higher limits resulting in higher premiums since the insurance company is assuming more risk.

In Elon, North Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $924 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $1,298 in Elon, North Carolina.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $657.35 |

| $200,000.00 - $299,999.00 | $923.96 |

| $300,000.00 - $399,999.00 | $1,040.44 |

| $400,000.00 - $499,999.00 | $1,297.50 |

| $500,000.00-$599,999.00 | $1,506.89 |

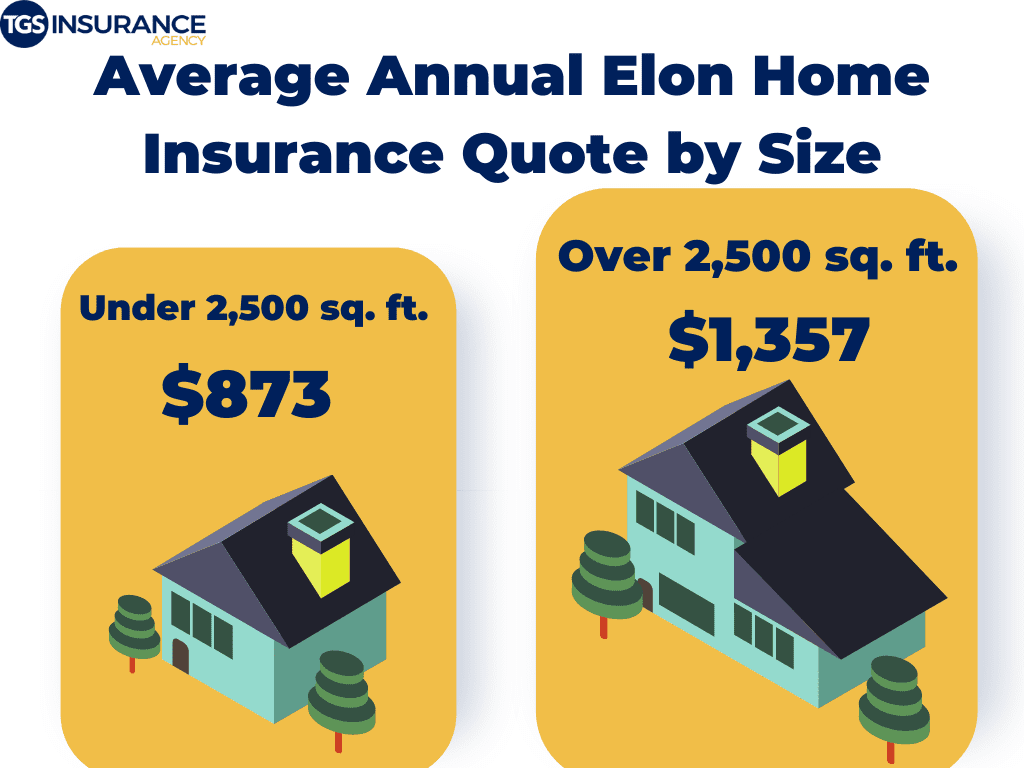

Does the Size of My Elon Home Affect My Insurance Rates?

The size of your home is a factor in your home insurance cost. Larger homes with more square footage often have more belonging inside, which is inherently more expensive to replace if they were to be destroyed by a covered peril. Also, your home’s size directly correlates to your home’s replacement cost, severely influencing the amount you will pay in homeowners insurance.

In Elon, North Carolina, houses that are over 2,500 square feet will cost you an average of $1,357 per year. Houses that are under 2,500 square feet have an average annual premium of $873 per year.

Who is the Most Popular Home Insurance Carrier in Elon, North Carolina?

We want you to find the perfect homeowners insurance in Elon, North Carolina. Knowing what the best insurance carriers in your area charge for home insurance is a great way to know if your policy is competitive. We pulled together some data from TGS customers in your area and found that SageSure is the most popular in Elon. People with SageSure pay an average of $774 annually. Another popular carrier in Elon is SafePort. SafePort’s rates differ slightly from SageSure, having an average cost of $833 a year. Check out our data below for the five most popular carriers in Elon and their average annual home insurance premiums.

Zip Codes in Elon We Insure

- 27244

Don’t see your zip code? Not a problem! We can help homeowners throughout North Carolina find the best home coverage for their needs. Start with a free instant quote by providing your address above.