Get an Instant Fletcher Home Insurance Quote!

With over 55 top-rated insurance carriers at our disposal, we pride ourselves on being an independent agency that can offer comprehensive Fletcher home insurance options to meet your every need. Our team of highly qualified homeowners insurance agents will do the heavy lifting for you, making your home insurance shopping process a breeze. Get started with an instant, free quote today, and let us help you customize your policy to find any discounts you qualify for. We shop, you save – it’s that simple!

Fletcher Home Insurance Coverage

The beauty of home insurance is that it can be tailored to fit you and your situation. Typically, a standard home insurance policy covers the following:

- Coverage for your home and other structures on your property, like detached garages

- Coverage for your belongings inside your home, like clothes and furniture

- Liability coverage for guests that may be injured on your property

- It covers additional living expenses if you need temporary lodging while your home is being repaired

Cost of Home Insurance in Fletcher

In Fletcher, the average home insurance costs $932 per year for TGS Insurance customers. The cost of your home insurance is based on several different factors, including, but not limited to:

- The value of your home.

- Where your home is.

- How old your home is.

- The number of residents in your home.

- Your credit score.

These factors set a base for your home insurance, and then you can customize your coverage. The more coverage you choose to have, the more your yearly premium will be. TGS Insurance is here to help you find the best price without sacrificing any coverage you want.

Average Fletcher Home Insurance Cost By Coverage Level

Dwelling coverage is a fundamental element of home insurance that protects the physical structure of your home against covered hazards. The intention is to cover the expenses of repairing or rebuilding your home if it is damaged or destroyed due to a covered event. The amount of dwelling coverage needed depends on the cost of rebuilding your home. Your home insurance covers the policy limit- which is coverage for up to a specified dollar amount. It is critical to ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding your home in case of a complete loss. Dwelling coverage limits can significantly impact home insurance premiums, with higher limits resulting in higher premiums since the insurance company is assuming more risk.

In Fletcher, North Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $885 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $1,179 in Fletcher, North Carolina.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $595.73 |

| $200,000.00 - $299,999.00 | $885.05 |

| $300,000.00 - $399,999.00 | $1,071.58 |

| $400,000.00 - $499,999.00 | $1,178.91 |

Fletcher Home Insurance Quotes and Your Home’s Age

Many factors go into calculating your home insurance premium, including your home’s age. Typically, older homes are more expensive to insure because their structure and other components tend to be outdated (Ex. using galvanized piping instead of PEX) and experienced years of all-around wear and tear.

Age is not the only influencing factor for your home insurance premium. Carriers look at a variety of other things, including:

- Attractive nuisances

- Pet breeds

- Claims history

- Credit score

- Crime rate

- Location

- Marital status

- Size

- Replacement cost

- And much more!

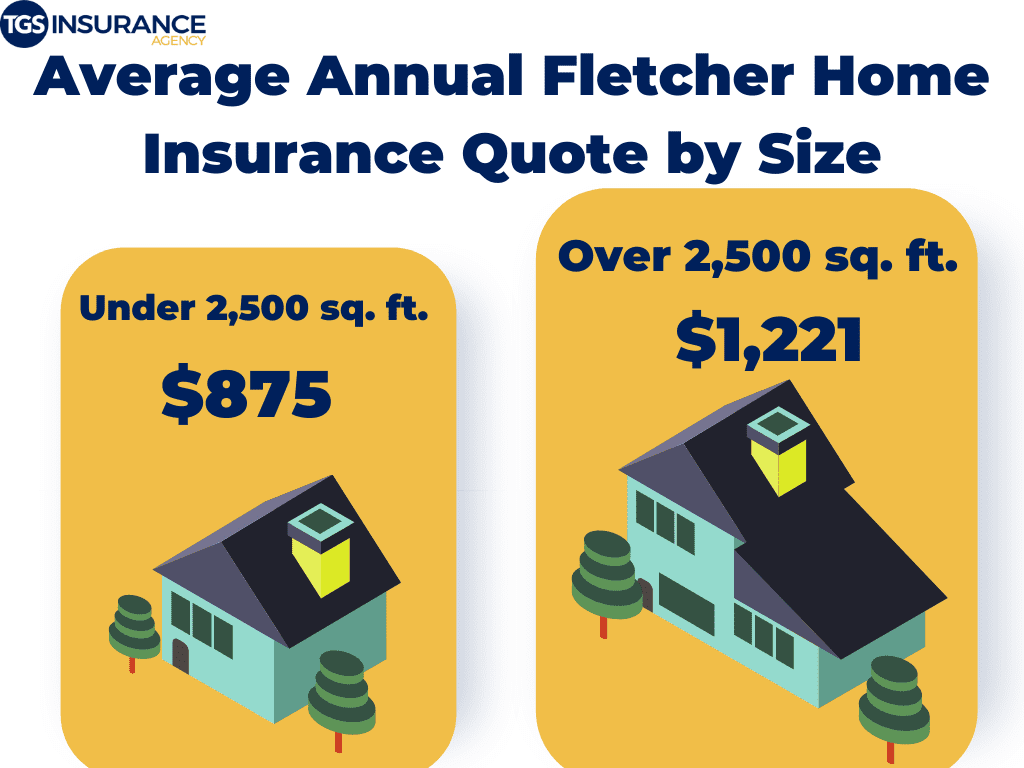

How the Size of Your Fletcher Home Affects the Cost of Insurance

Another thing that will affect the cost of your Fletcher home insurance is the size of your home. Insurance carriers look at the square footage of your home to determine the replacement cost. If you have a larger house, your replacement cost will be higher. Because of the higher replacement cost, your home insurance premium will be higher than that of smaller houses. Some other factors that affect your replacement cost are:

- Building materials used to build your home

- Features in your home like fireplaces or a jetted tub

- The age of your home

In Fletcher, houses that are over 2,500 square feet cost $1,221 per year. Houses under 2,500 square feet have an average annual premium of $875.

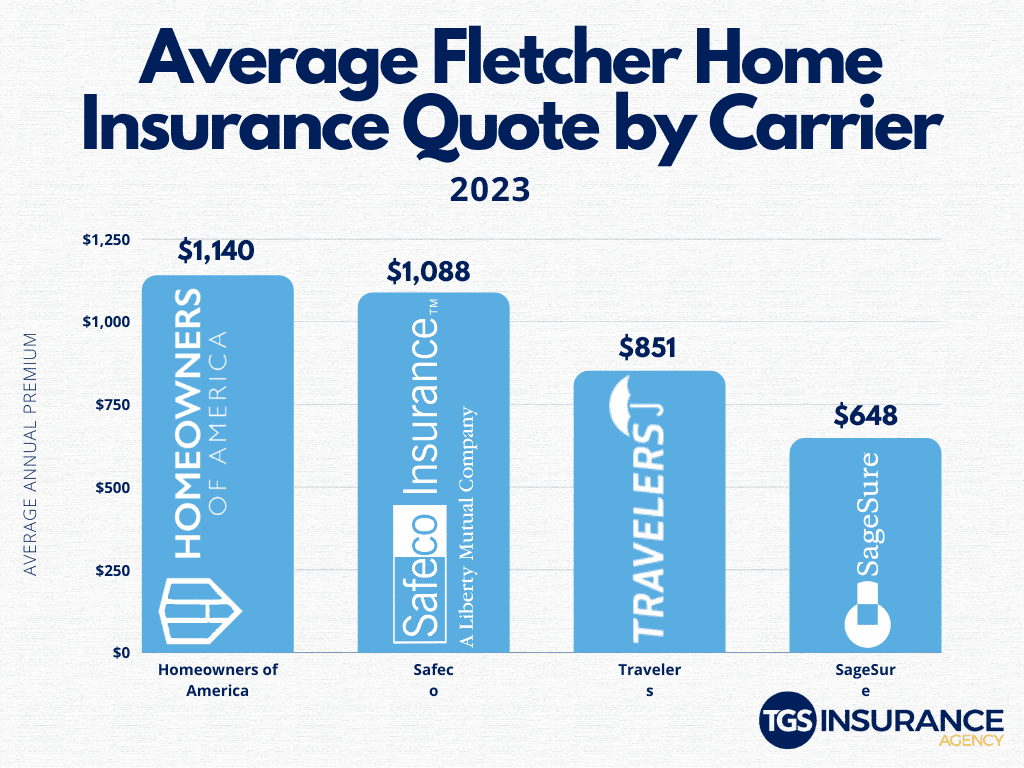

Best Fletcher Home Insurance Carriers

Knowing who will give you a competitive premium in your area is a big part of choosing your home insurance. Among TGS customers, the most popular carrier in Fletcher is SageSure. The average annual premium with SageSure is $648. Other popular carriers are Travelers and Safeco. Choosing a carrier is more than just the price; however, here at TGS Insurance Agency, we know that price is one of the more important factors. Check out the table below to see the average price for Fletcher based on the insurance provider.

Fletcher Zip Codes TGS Insurance Agency Covers

- 28732

If your zip code is not listed, fret not! We have access to amazing rates for homeowners all across North Carolina. Simply enter your address above to get started with a free instant quote.