Getting a Henderson Home Insurance Quote Has Never Been Easier!

Finding the right Henderson homeowners insurance can be confusing and time-consuming. TGS Insurance Agency is here to change that. Our expert home insurance agents do the hard work for you, making your home insurance shopping experience easy and stress-free. To start is simple; enter your address for a free, no-obligation instant quote, and our helpful team will take it from there!

What Does Henderson Home Insurance Cover?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Henderson, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. But not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

Home Insurance Average Cost in Henderson

In Henderson, the average cost of home insurance for TGS Insurance customers is $962 per year. While the cost of your policy will depend on several factors, such as the value and age of your home, your location, and your credit score, our agents can help you find the coverage you need at a price you can afford. We’ll work with you to customize your coverage and ensure you’re not sacrificing anything important to save money.

Average Homeowners Insurance Cost by Coverage Level in Henderson

The cost to replace your home is essential to determine the dwelling coverage you need on your home insurance policy; this limit directly impacts your home insurance premium. On top of affecting your average annual costs, having an accurate replacement cost can prevent you from being underinsured if a covered loss takes your entire house. These are the average annual home insurance costs in Henderson, North Carolina, based on dwelling coverage limits associated with the policy.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $734.79 |

| $200,000.00 - $299,999.00 | $1,052.44 |

| $300,000.00 - $399,999.00 | $1,264.95 |

| $400,000.00 - $499,999.00 | $1,403.02 |

| $500,000.00-$599,999.00 | $1,661.97 |

How the Age of Your Henderson Home Affects Your Insurance

The main difference between older and newer houses is that older homes pose a larger risk to insurance carriers. Older homes are more susceptible to fires and issues with plumbing and roofing. It would also be more expensive for carriers to repair older homes, so your premium will be higher. To avoid high premiums on older homes, keep up with home maintenance. If you update your home systems, your insurance carrier will not see them as a big risk.

How Does Location Affect Your Home Insurance in Henderson?

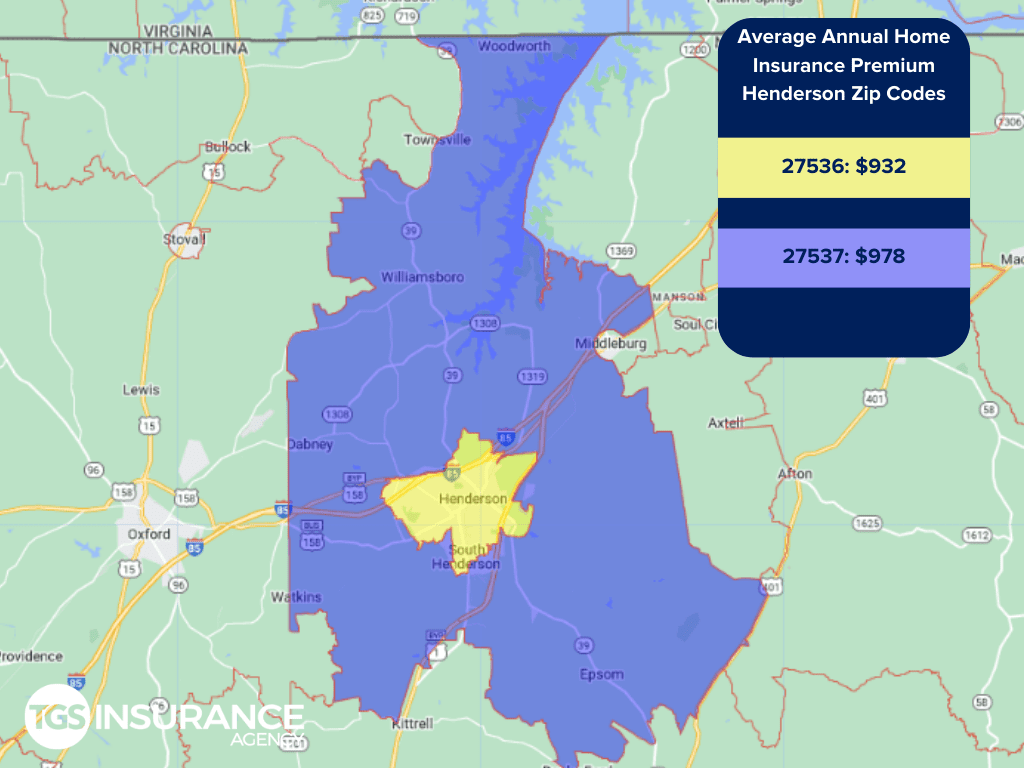

Just like your auto insurance, location is an important factor in determining your home insurance rates in Henderson. For example, your premium may be higher if your city has a history of perils like vandalism, theft, or even in an area with a weather risk. Conversely, your location could positively impact and lower your premium. The ZIP code with the highest average premium in Henderson is 27537. The average cost for that ZIP code is $978. Below is a comparison of the average cost of home insurance within the ZIP codes of Henderson:

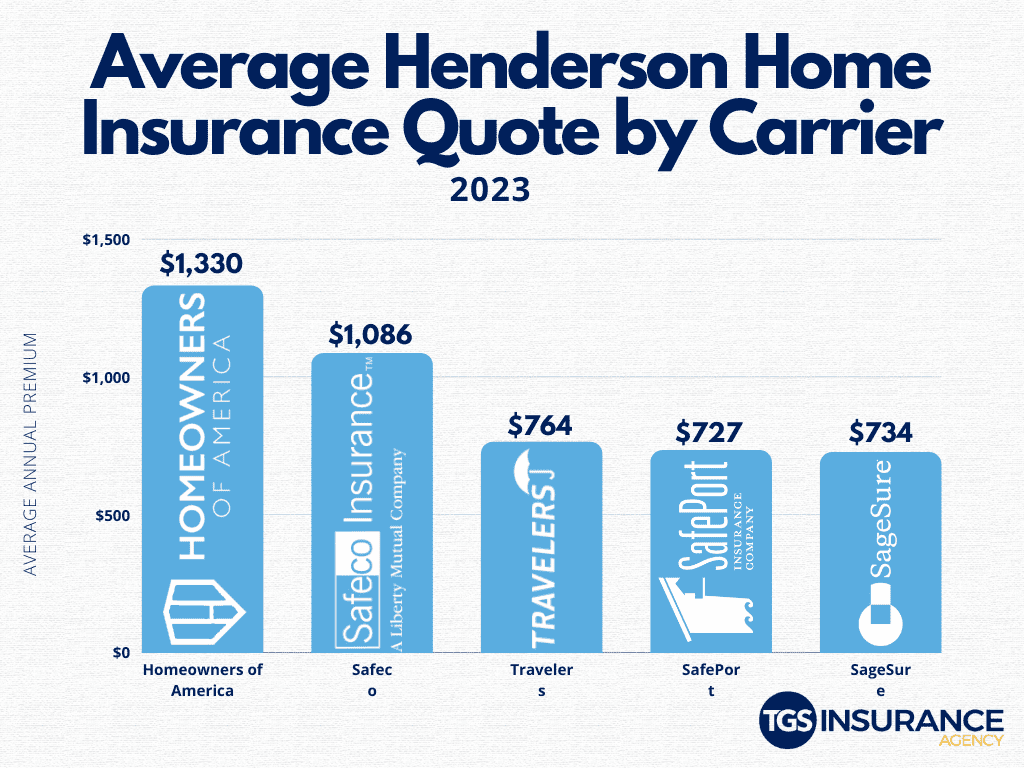

Compare Henderson Home Insurance Premiums By Carrier

The price is often the most influential factor when considering a home insurance policy. Because each carrier sets its rates, sometimes the same type of coverage can vary in price among different carriers. Two of our most popular carriers in Henderson are SageSure and SafePort. Home insurance quotes from TGS Insurance for SageSure average $727 annually. Home insurance quotes for SafePort run more expensive at $734 per year.

A lot of things involve picking the right home insurance carrier. You want to make sure the carrier you choose is right for you! Here are some questions to ask yourself when picking a home insurance carrier.

- What is their price for the coverage I want?

- What are the company’s history and reputation?

- Have you heard anything about the company?

- Do they offer the coverage I am looking for?

- Are there discounts available?

- Is it easy and convenient to work with them?

At TGS Insurance Agency, we work with over 55+ ‘A-rated’ home insurance carriers to help you make the right decision for your home. Use these questions and call one of our agents to find the right fit for you.

Henderson Zip Codes TGS Insurance Agency Covers

- 27536

- 27537

If your zip code is not on the list, fret not! We have access to amazing rates for homeowners all across North Carolina. Simply enter your address above to get start with a free instant quote.