Shopping For Cheap Laurinburg Home Insurance Is Easier Than You Think

As an independent agency, we represent 55+ top-rated insurance carriers, which allows us to offer comprehensive insurance options to meet your every need. The best part? Our highly qualified homeowners insurance agents do the hard work for you, making your home insurance shopping process easy and stress-free. Your savings start with an instant, free quote. Our agents are ready to help you further customize your quote and find any discounts you might qualify for!

We shop. You Save. Yes, it really is that easy.

Laurinburg Home Insurance Coverage: The Basics

If you’re like most homeowners in Laurinburg, your home is your most valuable asset, and you should protect it as such. It’s important to understand that when you create your home insurance policy, it should meet your individual needs. Insurance companies offer different levels of coverage, endorsements, and protections with varying conditions and limitations that enable policies to be customized. With that in mind, the most common types of coverage you will see on a homeowners insurance policy include:

- Dwelling coverage for the structure of your home.

- Other structures coverage for structures not attached to your home, like detached garages, sheds, and fences.

- Personal property coverage for replacing and repairing furniture, electronics, clothing, etc.

- Loss of use coverage for additional living expenses if you need to stay somewhere else while your home is being repaired.

- Personal liability coverage for legal bills if someone gets injured on your property or you cause damage and get sued.

- Medical payment coverage helps cover medical expenses for nonhousehold members injured on your property.

How Much Does Laurinburg Home Insurance Cost?

On average, a TGS customer in Laurinburg would pay $1,476 per year for home insurance. Home insurance rates vary based on several factors, including your home’s age, value, and location, as well as your credit score and desired coverage levels. This average is based on policies with an average home value of $253,219 and includes windstorm and hail coverage with a 2% deductible. TGS Insurance Agency offers customizable options to all our customers so you can find the right policy and pay what you want. Get started with a free instant home insurance quote by providing your address above.

Home Insurance in Laurinburg Cost by Dwelling Coverage Limit

Dwelling coverage limits are one of the key factors that insurers consider when setting premiums. You’ll generally pay a higher premium if you choose a high dwelling coverage limit. However, it’s important to ensure adequate coverage to protect your home during a loss. If you have a mortgage on your home, your lender may require you to have a certain amount of dwelling coverage to protect your investment.

In Laurinburg, North Carolina, a policy with $200,000-$299,999 in dwelling coverage costs an average of $1,494 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000-$499,999 in dwelling coverage will pay an average of $2,314 in Laurinburg, North Carolina.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $1,044.21 |

| $200,000.00 - $299,999.00 | $1,493.61 |

| $300,000.00 - $399,999.00 | $1,905.82 |

| $400,000.00 - $499,999.00 | $2,314.36 |

| $500,000.00-$599,999.00 | $2,730.70 |

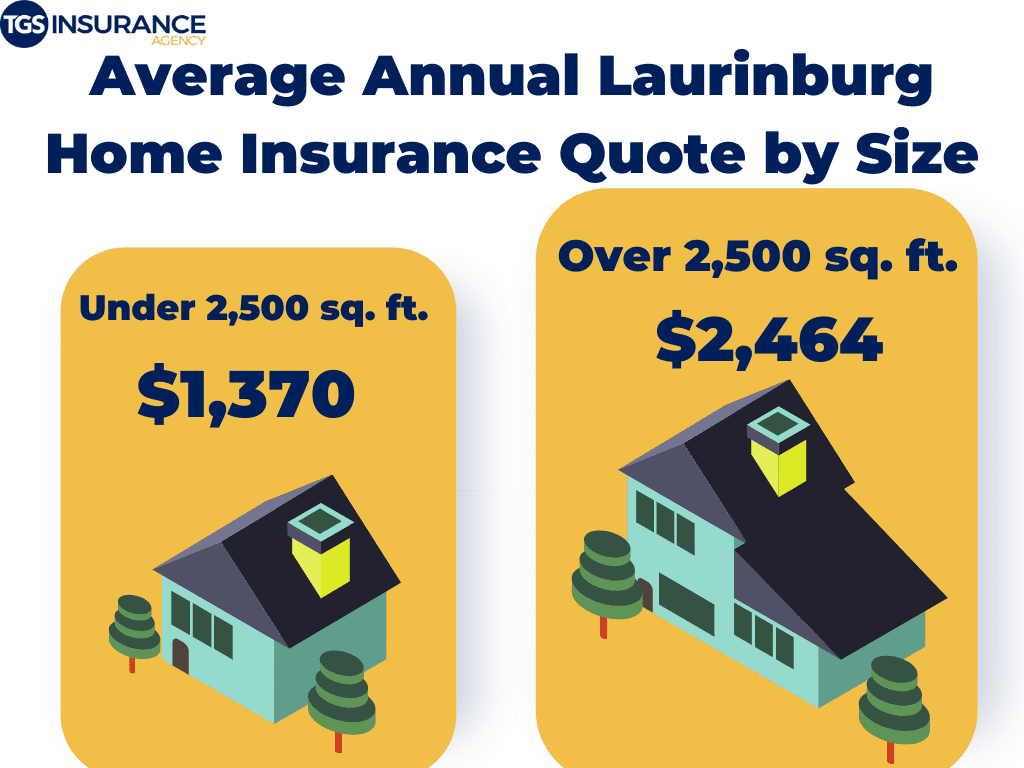

How the Size of Your Laurinburg Home Affects the Cost of Insurance

Another thing that will affect the cost of your Laurinburg home insurance is the size of your home. Insurance carriers look at the square footage of your home to determine the replacement cost. If you have a larger house, your replacement cost will be higher. Because of the higher replacement cost, your home insurance premium will be higher than that of smaller houses. Some other factors that affect your replacement cost are:

- Building materials used to build your home

- Features in your home like fireplaces or a jetted tub

- The age of your home

In Laurinburg, houses that are over 2,500 square feet cost $2,464 per year. Houses under 2,500 square feet have an average annual premium of $1,370.

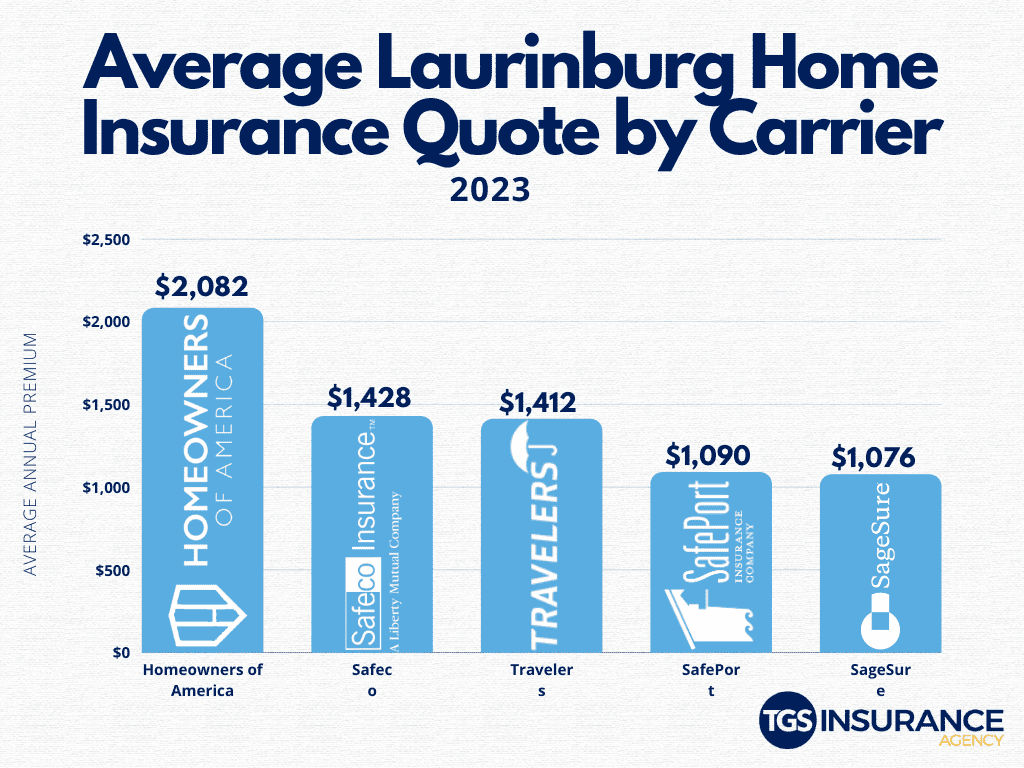

Best Laurinburg Home Insurance Carriers

Knowing who will give you a competitive premium in your area is a big part of choosing your home insurance. Among TGS customers, the most popular carrier in Laurinburg is SageSure. The average annual premium with SageSure is $1,076. Other popular carriers are SafePort and Travelers. Choosing a carrier is more than just the price; however, here at TGS Insurance Agency, we know that price is one of the more important factors. Check out the table below to see the average price for Laurinburg based on the insurance provider.

Laurinburg Zip Codes TGS Insurance Agency Insures

- 28352

Don’t worry if you don’t see your zip code above! We can find incredible rates for homeowners throughout North Carolina. Enter your address above for a free instant home insurance quote.