Getting a Mooresville Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Mooresville is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents

What Does Mooresville Home Insurance Cover?

Most home insurance policies include some level of the following types of coverage.

Coverage A covers damages to your home

Coverage B covers damages to additional structures on your property such as detached garages, sheds, or fences

Coverage C covers damage to personal property such as furniture, electronics, and clothes

Coverage D covers additional living expenses if your home becomes uninhabitable due to a covered loss

Coverage E covers personal liability including coverage for claims arising from accidents on your property

Coverage F covers medical expenses for injuries occurring on your property for those outside of your household

When it comes to home insurance in Mooresville, there’s no shortage of options. A standard policy typically covers a variety of losses, including damage caused by weather, theft, and accidents. But not all policies are created equal. That’s why it’s important to work with a knowledgeable agent who can help you navigate the complexities of home insurance and tailor your coverage to fit your needs. Whether you need more protection for your personal belongings or additional liability coverage, we’ve got you covered.

What Does Home Insurance Cost in Mooresville?

Homeowners insurance in Mooresville costs $1,228 a year, or $102.33 a month, for TGS customers. The cost of your home insurance premium will vary based on a few different things. This can be from your credit, location, value of your home, and what year your home was built. It is normal for your home insurance to vary from this average and other numbers you see online. The great thing about it is that you can completely customize your coverage.TGS has helped over 15,000 customers save on their home insurance premiums. To lock in your savings, type your address above for an instant quote!

Average Homeowners Insurance Cost by Coverage Level in Mooresville

The cost to replace your home is essential to determine the dwelling coverage you need on your home insurance policy; this limit directly impacts your home insurance premium. On top of affecting your average annual costs, having an accurate replacement cost can prevent you from being underinsured if a covered loss takes your entire house. These are the average annual home insurance costs in Mooresville, North Carolina, based on dwelling coverage limits associated with the policy.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $709.25

$200,000.00 - $299,999.00 $1,027.61

$300,000.00 - $399,999.00 $1,251.38

$400,000.00 - $499,999.00 $1,440.73

$500,000.00 - $599,999.00 $1,659.67

$600,000.00 - $699,999.00 $1,956.61

How the Age of Your Mooresville Home Affects Your Insurance

The age of your home can affect your insurance in many ways. Older homes are more at risk of electrical, plumbing, and heating/cooling complications. These issues increase the risk of fire and water damage in homes. Also, older homes can be less structurally sound than newer homes. This could lead to more damage when natural disasters-like hurricanes- come through. All of these can result in higher insurance premiums. In contrast, newer homes may be immune to these issues, making them cheaper to insure.

How Does Location Affect Your Home Insurance in Mooresville?

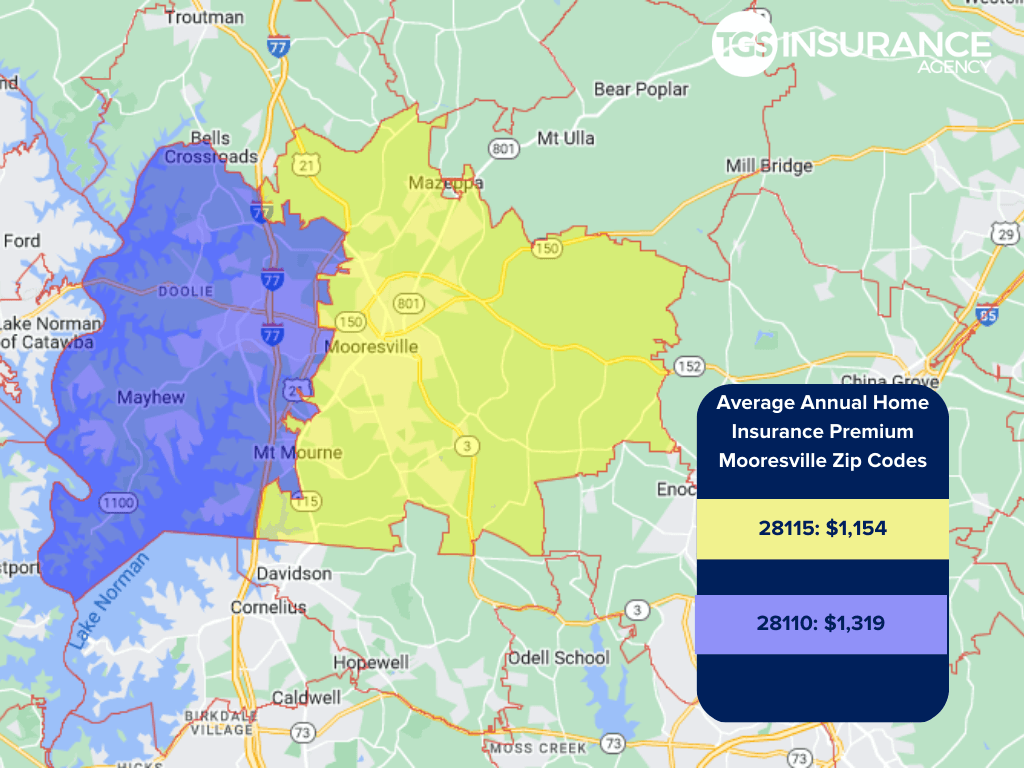

Like your auto insurance, location is important in determining your home insurance rates in Mooresville. For example, your premium may be higher if your city has a history of perils like vandalism, theft, or even in an area with a weather risk. Conversely, your location could positively impact and lower your premium. In Mooresville, the ZIP code with the highest average premium is 28117. The average cost for that ZIP code is $1,319. Below is a comparison of the average cost of home insurance within the ZIP codes of Mooresville:

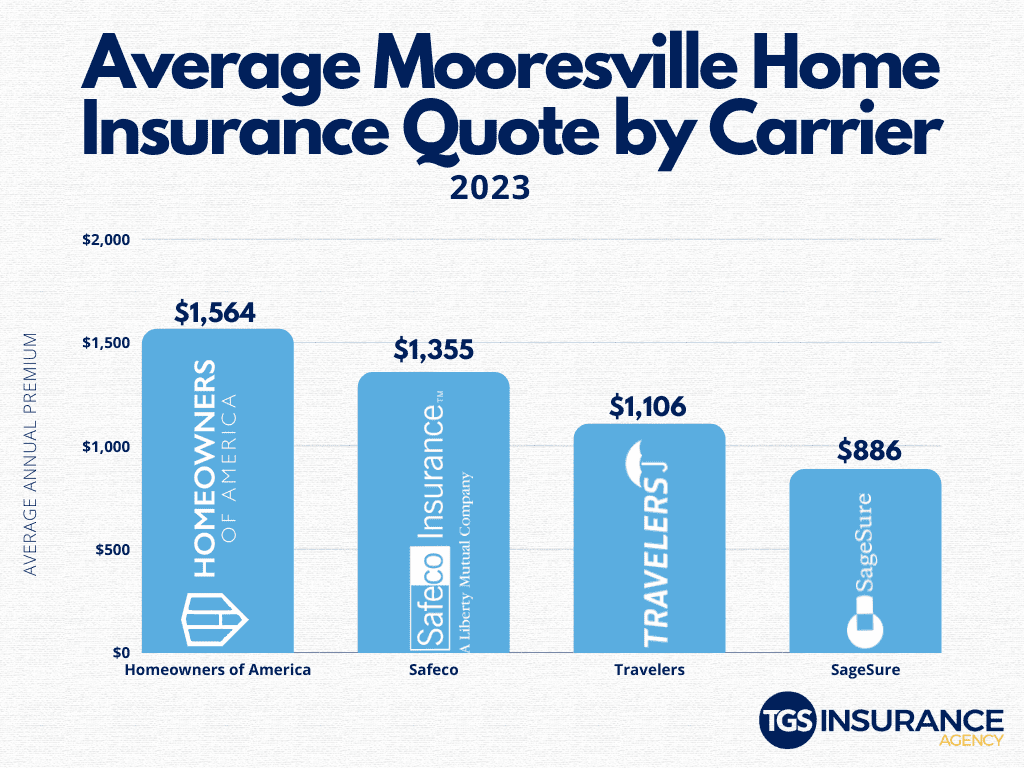

Who is the Most Popular Home Insurance Carrier in Mooresville, North Carolina?

We want you to find the perfect homeowners insurance in Mooresville, North Carolina. Knowing what the best insurance carriers in your area charge for home insurance is a great way to know if your policy is competitive. We pulled together some data from TGS customers in your area and found that Travelers is the most popular in Mooresville. People with Travelers pay an average of $1,106 annually. Another popular carrier in Mooresville is SageSure. SageSure’s rates differ slightly from Travelers, with an average cost of $886 a year. Check out our data below for Mooresville’s four most popular carriers and their average annual home insurance premiums.

Zip Codes in Mooresville We Insure

- 28115

- 28117

Don’t see your zip code? Not a problem! We can help homeowners throughout North Carolina find the best home coverage for their needs. Get started with a free instant quote by providing your address above.