Finding Affordable New Bern Home Insurance Made Simple

At TGS Insurance Agency, we leverage our relationships with several top-rated carriers to find you the best coverage and prices. Our online quoting tool makes getting a home insurance quote easier and faster than ever- all we need is your address! Our agents are ready to review your quote to assure you are getting the coverage you need and not overpaying for coverage you don’t.

We shop, and you save time and money; it really is that easy.

What is Included in New Bern Home Insurance?

There are a few standard forms of home insurance that offer different levels of protection. This varies from different perils coverage and how much protection you want. Most of these forms include coverage- at some level- for:

- Dwelling

- Other Structures

- Personal Property

- Loss of Use

- Personal Liability

- Medical Payments

Having these coverages at the base of every standard home policy allows everyone to be somewhat protected. You can choose whether or not you have more coverage in one area compared to another. All of this is based on your unique lifestyle in New Bern.

What Does Home Insurance Cost in New Bern?

Homeowners insurance in New Bern costs $2,638 a year, or $219.83 a month, for TGS customers. The cost of your home insurance premium will vary based on a few different things. This can be from your credit, location, value of your home, and what year your home was built. It is normal for your home insurance to vary from this average and other numbers you see online. The great thing about it is that you can completely customize your coverage. TGS has helped over 15,000 customers save on their home insurance premiums. To lock in your savings, type your address above for an instant quote!

Average New Bern Home Insurance Cost By Coverage Level

Dwelling coverage is a fundamental element of home insurance that protects the physical structure of your home against covered hazards. The intention is to cover the expenses of repairing or rebuilding your home if it is damaged or destroyed due to a covered event. The amount of dwelling coverage needed depends on the cost of rebuilding your home. Your home insurance covers the policy limit- which is coverage for up to a specified dollar amount. It is critical to ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding your home in case of a complete loss. Dwelling coverage limits can significantly impact home insurance premiums, with higher limits resulting in higher premiums since the insurance company is assuming more risk.

In New Bern, North Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $2,696 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $4,136 in New Bern, North Carolina.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $2,143.76 |

| $200,000.00 - $299,999.00 | $2,695.87 |

| $300,000.00 - $399,999.00 | $3,397.18 |

| $400,000.00 - $499,999.00 | $4,136.41 |

| $500,000.00-$599,999.00 | $4,909.58 |

New Bern Home Insurance Cost By Home Age

The age of your home is also a factor considered when carriers determine your home insurance premium. The age matters because older homes might be more expensive to rebuild after a total covered loss, especially if they must bring them up to modern safety and building codes. If you have an older home and are looking for ways to keep your premiums low, stay up to date on home maintenance and replace older systems in your home.

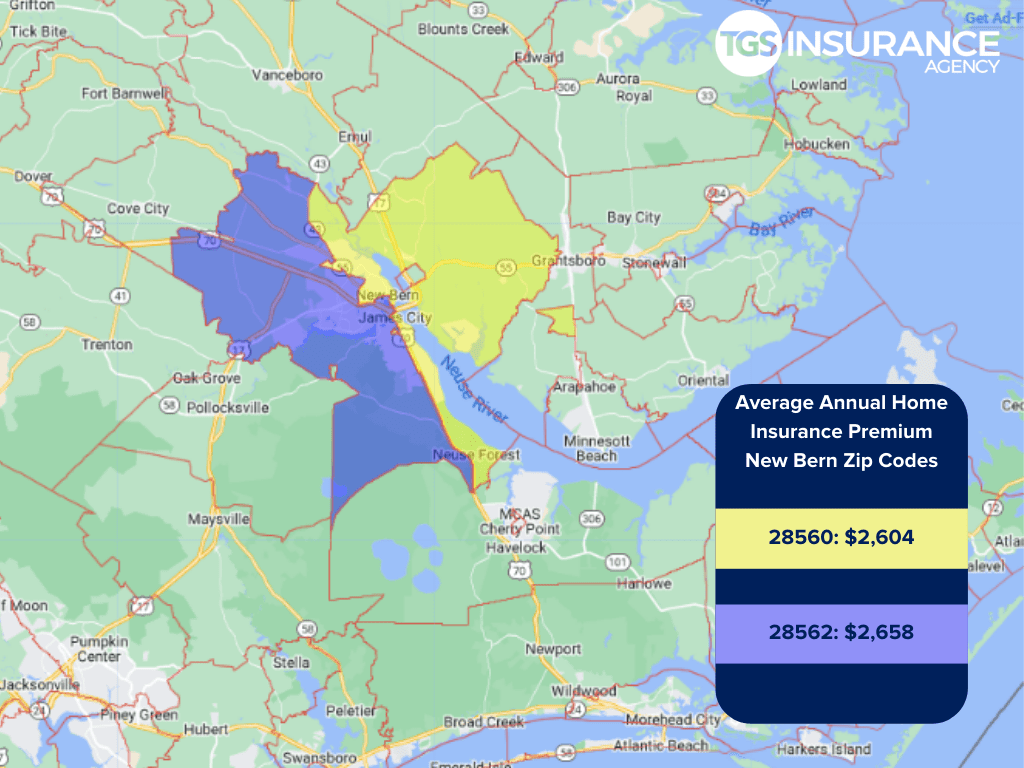

How Does My ZIP Code Affect My Home Insurance?

While some factors regarding your location, such as the probability of severe weather, are calculated at the city or county level. Some factors are analyzed as specifically as your zip code or neighborhood. Since the size and build of your home are usually consistent within neighborhoods, the location of your home plays a significant role in determining your risk of covered perils. In New Bern, the ZIP code 28560 has the lowest premium of $2,604 for TGS customers. The ZIP code with the highest premium is 28562, costing TGS customers an average of $2,658 a year.

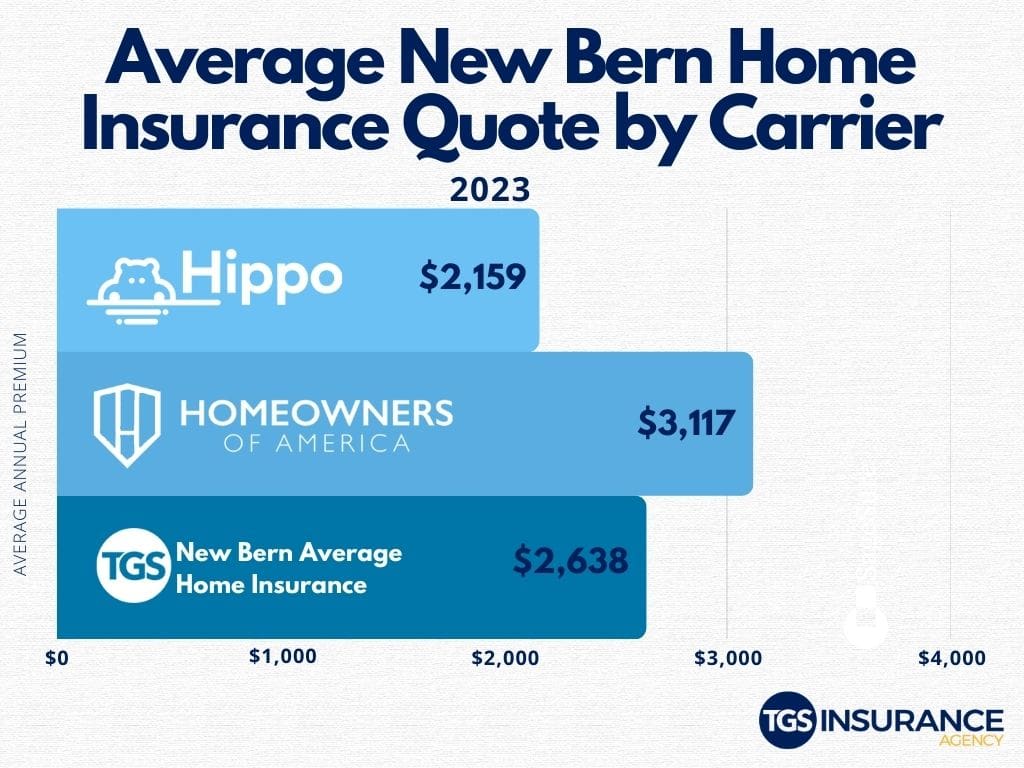

New Bern Home Insurance Rates By Company

Choosing your home insurance provider is about more than the price, even though we know the cost is undoubtedly a factor. Because each provider sets their rates, the same coverage can vary between carriers. The top carrier in New Bern is Hippo. When insured by Hippo, TGS customers in New Bern pay an average of $2,159. Looking at the numbers, an overwhelming number of people in your area have chosen Hippo over our next most popular carrier, Homeowners of America. The average premium for Homeowners of America is $3,117 for TGS Insurance customers. Here is a breakdown of the different carriers used in New Bern.

Zip Codes in New Bern TGS Insurance Covers

- 28560

- 28562

Don’t see your zip code? We still cover you! We make shopping for the best home insurance easy and hassle-free for all residents throughout North Carolina. Start today with a free, instant quote!