Get an Instant Sanford Home Insurance Quote!

With over 55 top-rated insurance carriers at our disposal, we pride ourselves on being an independent agency that can offer comprehensive Sanford home insurance options to meet your every need. Our team of highly qualified homeowners insurance agents will do the heavy lifting for you, making your home insurance shopping process a breeze. Get started with an instant, free quote today, and let us help you customize your policy to find any discounts you qualify for. We shop, you save – it’s that simple!

What Does Sanford Home Insurance Cover?

Most home insurance policies include some level of the following types of coverage.

Coverage A covers damages to your home

Coverage B covers damages to additional structures on your property such as detached garages, sheds, or fences

Coverage C covers damage to personal property such as furniture, electronics, and clothes

Coverage D covers additional living expenses if your home becomes uninhabitable due to a covered loss

Coverage E covers personal liability including coverage for claims arising from accidents on your property

Coverage F covers medical expenses for injuries occurring on your property for those outside of your household

When it comes to home insurance in Sanford, there’s no shortage of options. A standard policy typically covers a variety of losses, including damage caused by weather, theft, and accidents. But not all policies are created equal. That’s why it’s important to work with a knowledgeable agent who can help you navigate the complexities of home insurance and tailor your coverage to fit your needs. Whether you need more protection for your personal belongings or additional liability coverage, we’ve got you covered.

What Does Home Insurance Cost in Sanford?

Homeowners insurance in Sanford costs $1,410 a year, or $117.50 a month, for TGS customers. The cost of your home insurance premium will vary based on a few different things. This can be from your credit, location, value of your home, and what year your home was built. It is normal for your home insurance to vary from this average and other numbers you see online. The great thing about it is that you can completely customize your coverage.TGS has helped over 15,000 customers save on their home insurance premiums. To lock in your savings, type your address above for an instant quote!

Average Home Insurance Quotes in Sanford by Coverage Level

Dwelling coverage is a critical aspect of home insurance that protects your home’s physical structure from covered hazards. Typically, your home insurance policy provides coverage up to a specified dollar amount, known as the policy limit. Ensuring that your dwelling coverage limit is sufficient to rebuild your home in the event of a total loss is critical. Since the insurance company assumes more risk, dwelling coverage limits may significantly impact home insurance premiums, with higher limits resulting in higher premiums. Below is a breakdown of the average home insurance premium based on dwelling coverage limits.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $905.60

$200,000.00 - $299,999.00 $1,339.18

$300,000.00 - $399,999.00 $1,692.00

$400,000.00 - $499,999.00 $1,949.10

$500,000.00-$599,999.00 $2,400.51

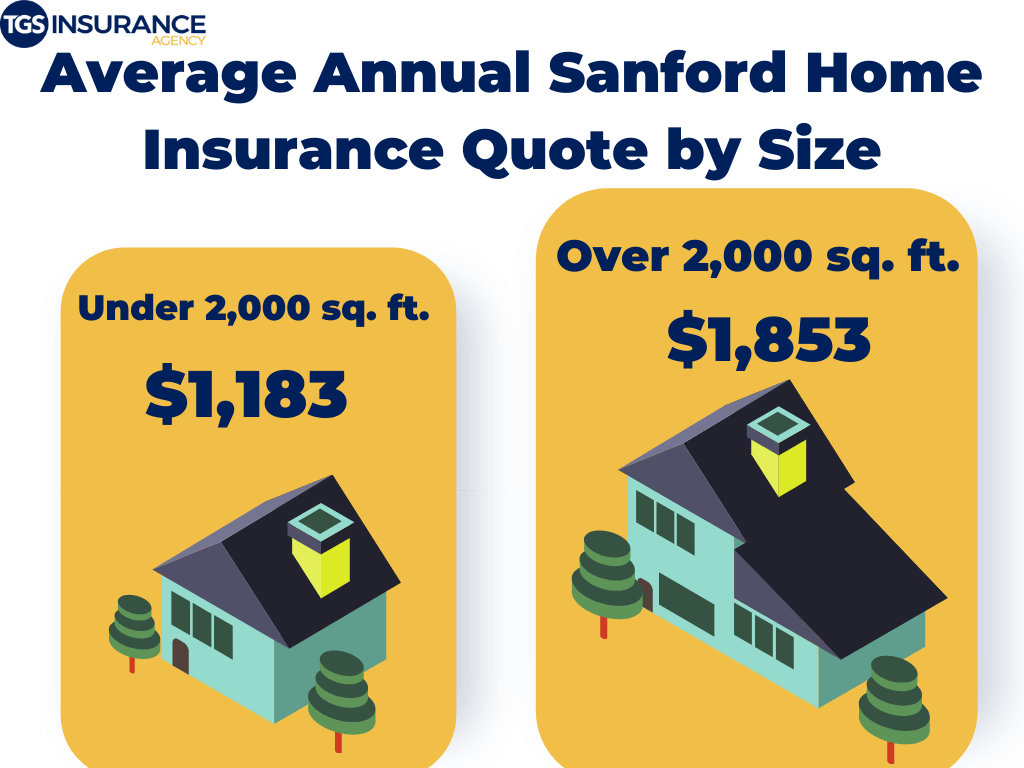

How Sanford Home Insurance is Affected By the Size of Your Home

When it comes to determining the cost of your home insurance, there’s a lot that goes into it. Carriers will look at your home’s age, location, and size- among other things. The size of your home is a factor because it affects your replacement cost.

If you have a house with higher square footage, your home will be more expensive to rebuild if a total covered loss damages it. If you think about it, a larger house requires more building materials, time, and manpower to rebuild from the ground up. It goes the other way for smaller homes. If you have less house to rebuild, your home insurance premium will be lower.

Looking at the numbers, houses in Sanford, North Carolina, that are over 2,000 square feet average about $1,454 per year to insure. At the same time, houses that are under 2,000 square feet cost $964 to insure a year.

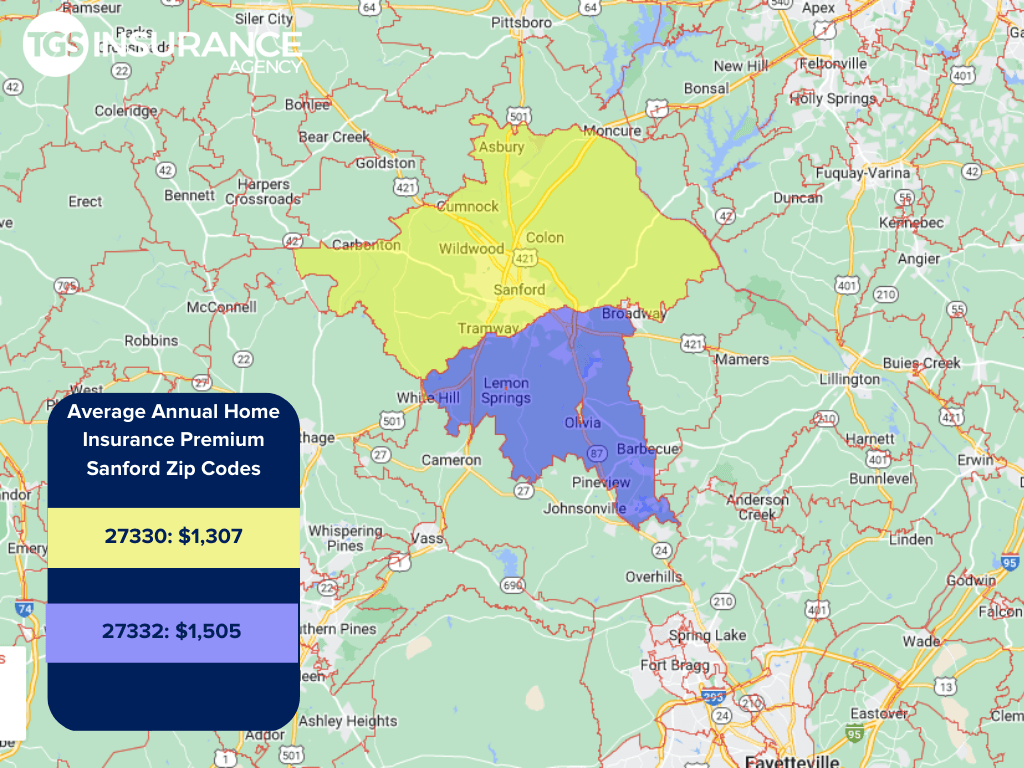

How Does Your Location in Sanford Affect Your Home Insurance?

Where you live is one of the biggest factors that affect your home insurance premium. This gets so specific that carriers look at ZIP codes and neighborhoods. If your neighborhood has a higher theft rate than another neighborhood a few blocks down, your rates will be higher. Because carriers are very particular with risk evaluations, rates vary greatly-even within the same city. Below is a breakdown of the average annual premium for home insurance in Sanford:

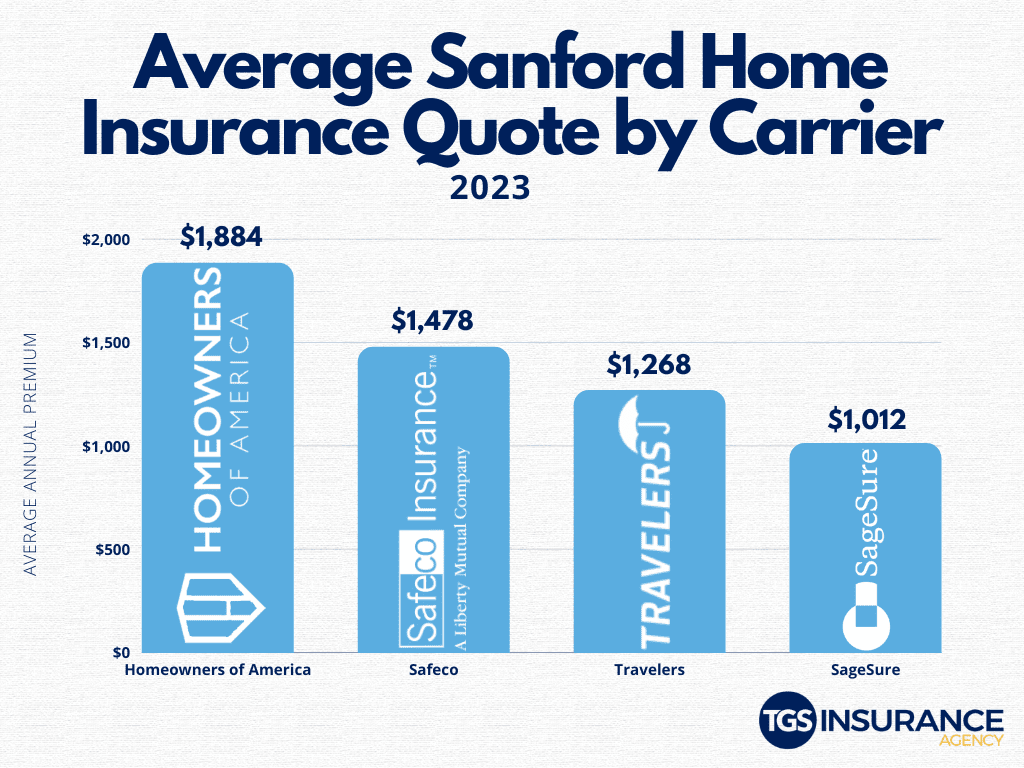

Best Sanford Home Insurance Carriers

Knowing who will give you a competitive premium in your area is a big part of choosing your home insurance. Among TGS customers, the most popular carrier in Sanford is SageSure. The average annual premium with SageSure is $1,012. Other popular carriers are Travelers and Safeco. Choosing a carrier is more than just the price; however, here at TGS Insurance Agency, we know that price is one of the more important factors. Check out the table below to see the average price for Sanford based on the insurance provider.

Sanford Zip Codes TGS Insurance Agency Covers

- 27330

- 27332

If your zip code is not listed, fret not! We have access to amazing rates for homeowners all across North Carolina. Simply enter your address above to get started with a free instant quote.