Get an Instant Summerfield Home Insurance Quote!

With over 55 top-rated insurance carriers at our disposal, we pride ourselves on being an independent agency that can offer comprehensive Summerfield home insurance options to meet your every need. Our team of highly qualified homeowners insurance agents will do the heavy lifting for you, making your home insurance shopping process a breeze. Start with an instant, free quote today, and let us help you customize your policy to find any discounts you qualify for. We shop, you save – it’s that simple!

Summerfield Home Insurance Coverage

The beauty of home insurance is that it can be tailored to fit you and your situation. Typically, a standard home insurance policy covers the following:

- Coverage for your home and other structures on your property, like detached garages

- Coverage for your belongings inside your home, like clothes and furniture

- Liability coverage for guests that may be injured on your property

- It covers additional living expenses if you need temporary lodging while your home is being repaired

What is the Average Cost of Home Insurance in Summerfield?

In Summerfield, the average cost of home insurance for TGS Insurance customers is $1,283 per year. While the cost of your policy will depend on several factors, such as the value and age of your home, your location, and your credit score, our agents can help you find the coverage you need at a price you can afford. We’ll work with you to customize your coverage and ensure you’re not sacrificing anything important to save money.

Average Homeowners Insurance Cost by Coverage Level in Summerfield

The cost to replace your home is essential to determine the dwelling coverage you need on your home insurance policy; this limit directly impacts your home insurance premium. On top of affecting your average annual costs, having an accurate replacement cost can prevent you from being underinsured if a covered loss takes your entire house. These are the average annual home insurance costs in Summerfield, North Carolina, based on dwelling coverage limits associated with the policy.

| Dwelling Coverage Limits | Average Annual Premium (incl. Windstorm & Hail Coverage) |

|---|---|

| $100,000.00 - $199,999.00 | $661.22 |

| $200,000.00 - $299,999.00 | $942.95 |

| $300,000.00 - $399,999.00 | $1,156.78 |

| $400,000.00 - $499,999.00 | $1,372.01 |

| $500,000.00-$599,999.00 | $1,529.41 |

Summerfield Home Insurance Cost By Home Age

The age of your home is also a factor when carriers determine your home insurance premium. The age matters because older homes might be more expensive to rebuild after a total covered loss, especially if they must bring them up to modern safety and building codes. If you have an older home and you are looking for ways to keep your premiums low, be sure to stay up to date on home maintenance and replace older systems in your home.

Who is the Most Popular Home Insurance Carrier in Summerfield, North Carolina?

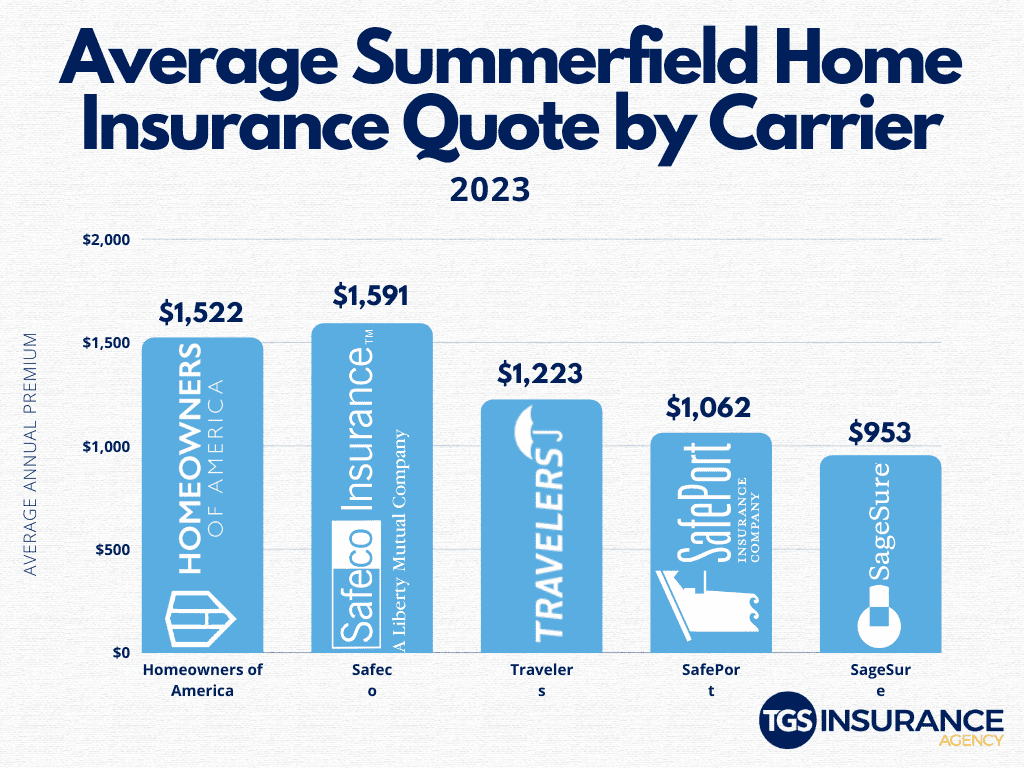

We want you to find the perfect homeowners insurance in Summerfield, North Carolina. Knowing what the best insurance carriers in your area charge for home insurance is a great way to know if your policy is competitive. We pulled together some data from TGS customers in your area and found that SafePort is the most popular in Summerfield. People with SafePort pay an average of $1,062 annually. Another popular carrier in Summerfield is Travelers. Travelers’ rates differ a bit from SafePort, having an average cost of $1,223 a year. Check out our data below for the five most popular carriers in Summerfield and their average annual home insurance premiums.

Summerfield Zip Codes We Insure

- 27358

Don’t see your zip code? It’s okay! At TGS Insurance Agency, we have access to a wide range of insurance carriers and products to help homeowners throughout North Carolina save money on their home insurance. Get a free, instant quote today and protect yourself, your family, and your home from the unexpected.