Get an Instant Wilmington Home Insurance Quote!

With over 55 top-rated insurance carriers at our disposal, we pride ourselves on being an independent agency that can offer comprehensive Wilmington home insurance options to meet your every need. Our team of highly qualified homeowners insurance agents will do the heavy lifting for you, making your home insurance shopping process a breeze. Get started with an instant, free quote today, and let us help you customize your policy to find any discounts you qualify for. We shop, you save – it’s that simple!

Wilmington Homeowners Insurance Coverage Explained

Your home is more than just a building – it’s where memories are made and cherished. That’s why having the right home insurance in Wilmington is so important. A standard policy typically covers losses caused by weather, theft, and accidents and includes essential coverages like protection for your home’s structure, personal belongings, liability, and additional living expenses. But every homeowner’s needs differ, so working with a trusted agent who can help you customize your coverage is important. From adding flood insurance to increasing your liability limits, we’re here to help you protect what matters most.

Cost of Home Insurance in Wilmington

In Wilmington, the average home insurance costs $4,630 per year for TGS Insurance customers. The cost of your home insurance is based on several different factors, including, but not limited to:

- The value of your home.

- Where your home is.

- How old your home is.

- The number of residents in your home.

- Your credit score.

These factors set a base for your home insurance, and then you can customize your coverage. The more coverage you choose to have, the more your yearly premium will be. TGS Insurance is here to help you find the best price without sacrificing any coverage you want.

Average Home Insurance Quotes in Wilmington by Coverage Level

Dwelling coverage is a critical aspect of home insurance that protects your home’s physical structure from covered hazards. Typically, your home insurance policy provides coverage up to a specified dollar amount, known as the policy limit. Ensuring that your dwelling coverage limit is sufficient to rebuild your home in the event of a total loss is critical. Since the insurance company assumes more risk, dwelling coverage limits may significantly impact home insurance premiums, with higher limits resulting in higher premiums. Below is a breakdown of the average home insurance premium based on dwelling coverage limits.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $3,199.77

$200,000.00 - $299,999.00 $4,106.58

$300,000.00 - $399,999.00 $5,123.83

$400,000.00 - $499,999.00 $6,175.86

$500,000.00-$599,999.00 $7,214.86

$600,000.00-$699,999.00 $8,313.61

$700,000.00-$799,999.00 $9,199.43

Wilmington Home Insurance Quotes and Your Home’s Age

Many factors go into calculating your home insurance premium, including your home’s age. Typically, older homes are more expensive to insure because their structure and other components tend to be outdated (Ex. using galvanized piping instead of PEX) and experienced years of all-around wear and tear.

Age is not the only influencing factor for your home insurance premium. Carriers look at a variety of other things, including:

- Attractive nuisances

- Pet breeds

- Claims history

- Credit score

- Crime rate

- Location

- Marital status

- Size

- Replacement cost

- And much more!

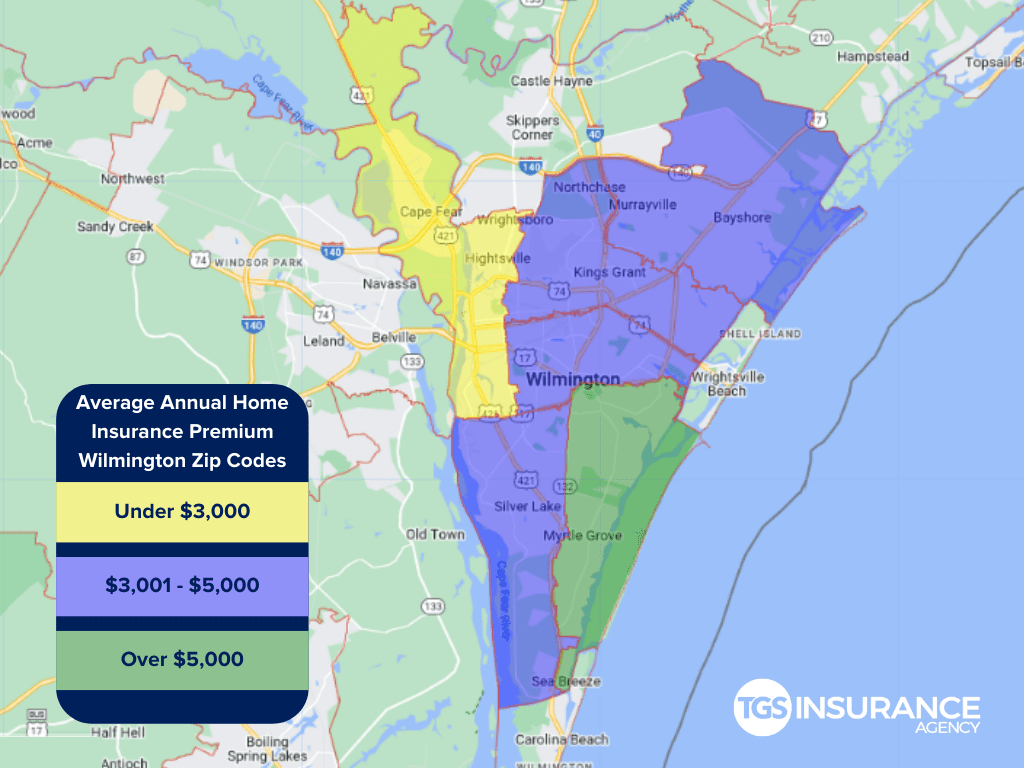

Does My Location Affect Home Insurance Premiums in Wilmington?

Determining home insurance rates is very similar to determining auto insurance rates. Providers look at factors in your area, like the potential dangers you face and the crime rates. Your premiums could be lower if you live in a relatively low crime rate area. If your area is known for having floods or severe weather, you may have to pay more for your premium. In Wilmington, the ZIP code with the highest average premium is 28409. The average cost for that ZIP code is $5,074. Below is a comparison of the average cost of auto insurance within the ZIP codes of Wilmington:

How Different Insurance Carriers in Wilmington Differ in Price

When searching for a new home insurance policy, you want to ensure it fits your needs and is within your budget. The carrier you decide to use is one of the biggest factors affecting your premium cost. Carrier rates differ because they have different ways of determining your risk to them. Say your house is a bit older- one carrier may see that as not a huge deal, but another will take that seriously and charge you more for your premium. In Wilmington, the least expensive carrier is Hippo, and on average, Wilmington residents pay $3,969 a year with travelers.

When picking which carrier is right for you, the cheapest may not always be the best. But there is no need for endless days of researching, quoting, and aggravation. At TGS, we shop around for you. You get all the prices and coverages given to you. Then you can decide which is your perfect match!

Wilmington Zip Codes We Insure

- 28401

- 28403

- 28405

- 28409

- 28411

- 28412

Don’t see your zip code? It’s okay! At TGS Insurance Agency, we have access to a wide range of insurance carriers and products to help homeowners throughout North Carolina save money on their home insurance. Get a free, instant quote today and protect yourself, your family, and your home from the unexpected.