Instant Home Insurance Quote

All We Need Is Your Address, NO BS!

Why Home and Auto Insurance Rates Are Rising in 2022

Thanks to an unusual convergence of market trends, ushered in by the pandemic and other disruptive events, you may see a bigger change in your home and auto insurance rates than usual when it comes time to renew your policies this year.

Insurance rates are based on what an insurer thinks it will cost to make you whole in the event of a loss – whether it’s roof damage during a windstorm or a vehicle totaled during a traffic accident. As you’ve likely noticed, pretty much everything costs more than it did even a few years ago.

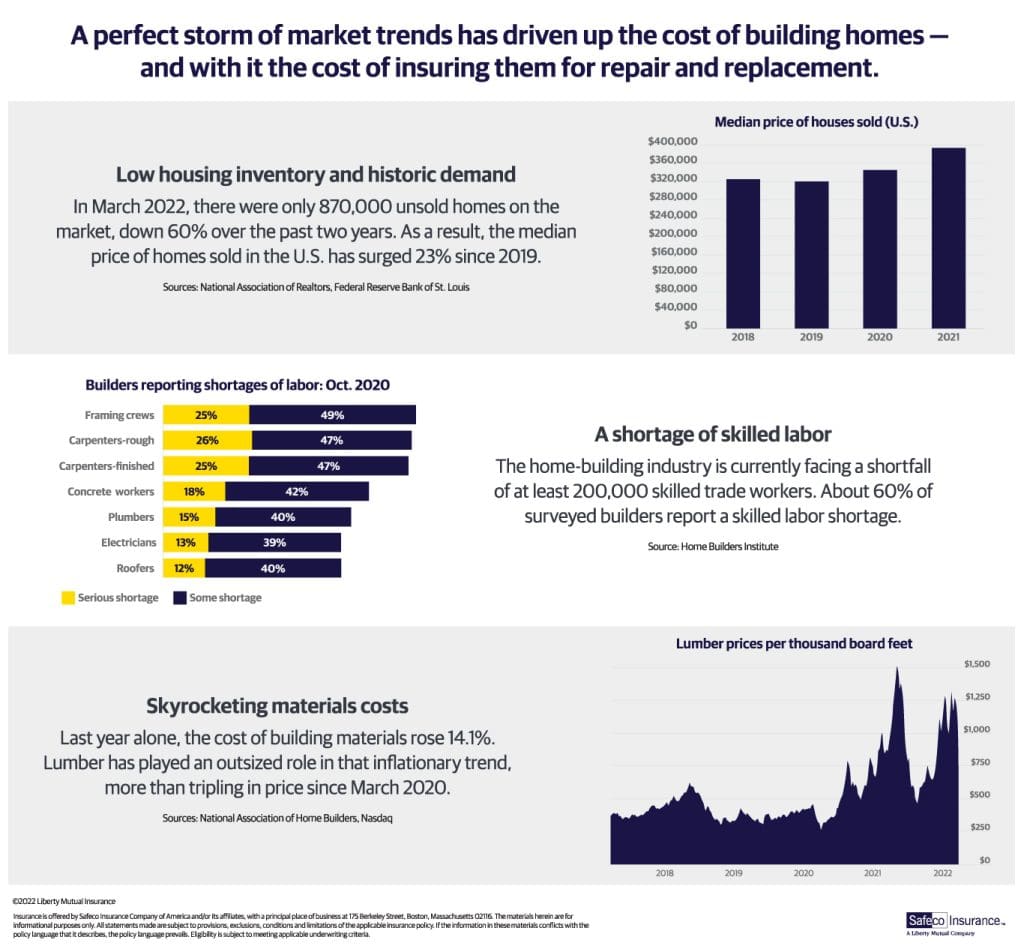

What’s Driving Higher Home Insurance Costs

If you’ve shopped at Home Depot or Lowe’s lately, you’ve certainly seen that the price tags on building materials have risen dramatically. Last year alone, the cost of building materials rose 14.1%, with lumber playing an outsized role in that trend, more than tripling in price since March 2020.

Related Reading: Homeowners Insurance and The Rising Cost of Building Materials

To make matters worse, the home-building industry is facing a shortfall of at least 200,000 skilled laborers, which is driving up construction-related labor costs. Combined with the high cost of construction materials and historically low housing inventory, this has been making home claims much more expensive for insurance companies.

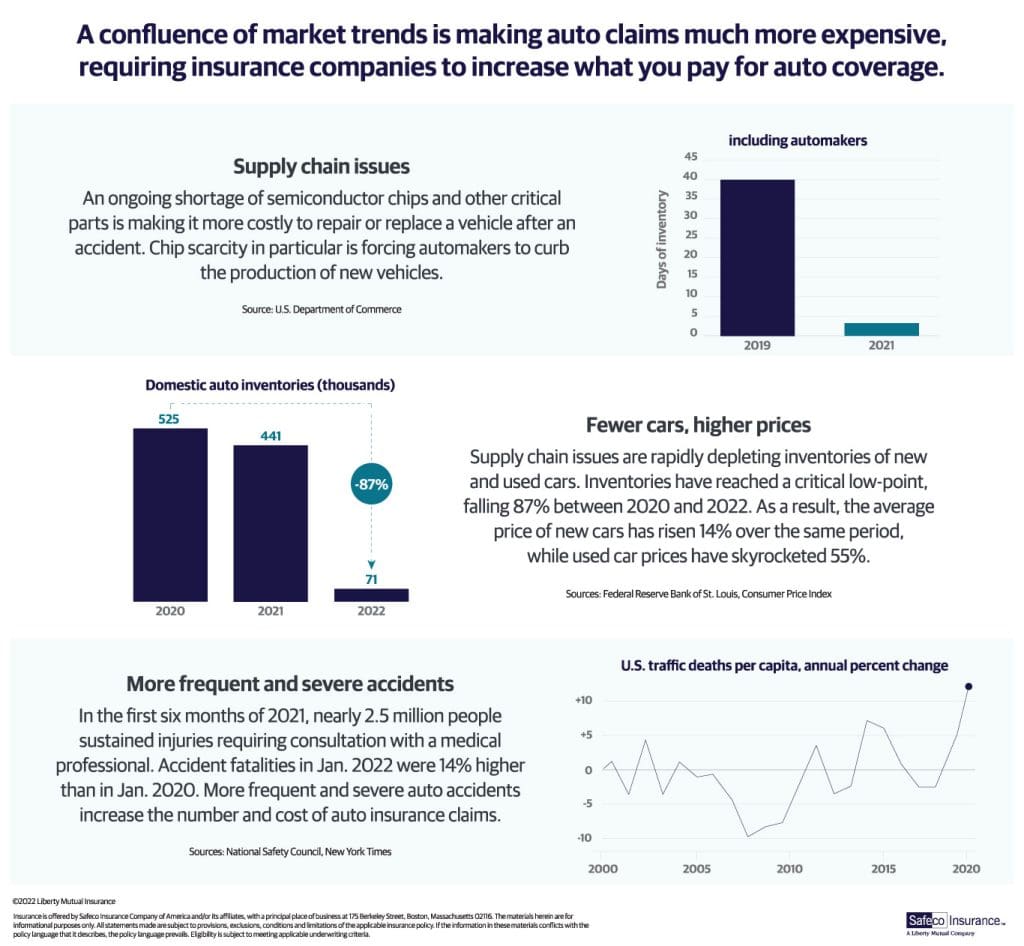

What’s Driving Higher Auto Insurance Costs

An ongoing shortage of microchips and other critical parts like wiring harnesses, plastics, and glass is making it more costly to repair or replace a vehicle after an accident.

Supply chain issues are rapidly depleting inventories of new and used cars. Inventories have reached a critically low point, falling 87% between 2020 and 2022. As a result, the average price of new cars has risen 14% over the same period, while used car prices have skyrocketed 55%.

At the same time, accidents have become more frequent and severe, increasing the number and cost of auto claims. In the first six months of 2021, nearly 2.5 million people sustained injuries requiring consultation with a medical professional. Accident fatalities in Jan. 2022 were 14% higher than in Jan. 2020.

Is It Possible to Avoid The Increasing Insurance Rates?

Keep in mind that savings come in many forms. The value of the coverage you choose today may save you more in the long run than the lowest possible premium. That being said, there are also a few ways to help alleviate the impact of increasing rates:

- Review your current policy. Check to see if your current coverage limits are still your best option.

- Shop your policy across multiple carriers. Every carrier calculates its rates differently so you might be able to find the same coverage available at a better rate from another carrier.

- Take advantage of discounts. Start by reviewing your current discounts and then identify other discounts that you might be eligible for but are not receiving. Keep in mind that carriers offer discounts so your best combination of discounts may require a change in carrier.

Want to save some time? Contact us to review your current coverage or start a new quote: instant home insurance quote or auto insurance quote. We’ll help you explore opportunities for discounts that could offset higher home and auto insurance rates when it comes time to renew.

Sources: National Association of Realtors, Federal Reserve Bank of St. Louis, Home Builders Institute, National Association of Home Builders, Nasdaq, U.S. Department of Commerce, Consumer Price Index, National Safety Council, New York Times

Recent Homeowners Insurance Articles:

- Does Home Insurance Cover Vacation Rentals? Here’s What You Need to Know

- Home Insurance Coverage Gaps You Might Not Know Exist—Until It’s Too Late

- Grilling Safety Tips for a Secure Memorial Day BBQ

- How to Change Home Insurance with Escrow: A Step-by-Step Guide

- Pool Safety Tips for Homeowners: Stay Cool and Covered This Summer