As the air turns crisp and leaves start piling up, fall brings more than pumpkin spice and footballāitās also natureās reminder to prepare your home for the colder months ahead. A few proactive maintenance steps now can save you from major headaches (and potential insurance claims) later.

Whether itās a leaky roof, burst pipe, or fire hazard hiding in your chimney, small seasonal chores can make a big difference in preventing costly damage and keeping your homeāand insurance recordāin good shape.

Hereās your fall home maintenance checklist designed to help you protect your home, reduce risks, and head into winter with confidence.

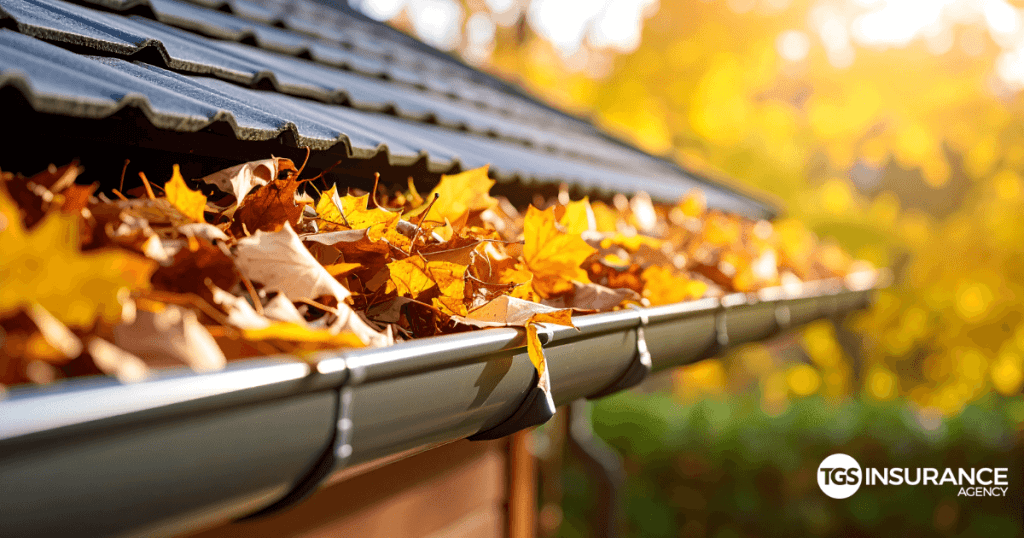

1. Clean Gutters and Downspouts

When leaves and debris clog your gutters, water can back up under shingles or pool near your foundation, leading to leaks, wood rot, and even structural issues. Most home insurance policies wonāt cover damage caused by lack of maintenance, so this oneās important.

Pro tip: After cleaning, flush gutters with a hose to check for proper drainage and make sure downspouts direct water at least 3ā4 feet away from your homeās foundation.

2. Inspect Your Roof

Fall is the perfect time to look for missing shingles, cracked flashing, or soft spots that could lead to leaks once snow or heavy rain hits. A damaged roof can turn into a costly claim fastāespecially if water infiltrates your attic or insulation.

Use binoculars from the ground or hire a professional for a full inspection. Spotting small issues early can prevent larger damage your insurance might not fully cover if itās deemed āpreventable.ā

3. Check Windows and Doors for Drafts

Gaps around windows and doors not only drive up heating costs but can also let in moisture that leads to mold or wood damage. Use weather stripping or caulk to seal cracks, and consider upgrading older windows with energy-efficient options.

Bonus: Many insurers offer discounts for improvements that make your home more energy efficient or resilient against damage.

4. Service Your HVAC System

Before temperatures drop, schedule a professional inspection of your heating system. Change filters, clean vents, and make sure your furnace or heat pump is ready to handle the season.

A well-maintained system not only prevents mid-winter breakdowns but also reduces the risk of fireāone of the most common homeowners insurance claims during the colder months.

5. Inspect and Clean Your Chimney and Fireplace

If you use a fireplace or wood stove, make sure your chimney is clean and free of creosote buildup, which is highly flammable. A quick inspection by a certified chimney sweep each fall can prevent one of the leading causes of winter house fires.

Insurance tie-in: Many homeowners policies cover fire damage, but not if the insurer determines it resulted from neglect or improper maintenanceāso regular cleaning is a must.

6. Check Smoke and Carbon Monoxide Detectors

With more heating use and fireplaces running, fire safety should be at the top of your list. Replace batteries in smoke detectors and carbon monoxide alarms and test them to ensure theyāre working properly.

If your home doesnāt already have interconnected alarms, consider upgradingāsome smart models can even alert your phone if smoke or CO is detected while youāre away.

7. Drain and Store Outdoor Hoses and Sprinklers

Frozen water lines can lead to burst pipes and floodingāboth major insurance headaches. Disconnect and drain outdoor hoses, shut off exterior faucets, and blow out your sprinkler system before freezing temperatures arrive.

Even if you live in a milder climate, a sudden cold snap can cause damage that your insurance may only partially cover if itās considered preventable.

8. Examine Your Trees and Landscaping

Strong winds, heavy rain, or ice can turn overgrown branches into dangerous projectiles. Trim any limbs that hang over your roof or near power lines.

Not only does this prevent property damage, but it can also reduce liability risks if a fallen branch injures someone or damages a neighborās propertyāa scenario that can easily become an insurance claim.

9. Check for Foundation Cracks and Drainage Issues

Walk around your home and look for cracks in the foundation or uneven soil where water may pool. Use caulk or sealant for small cracks, and make sure your yard slopes slightly away from your home to keep water from seeping in.

Even minor foundation issues can become expensive repairs, and most home insurance policies wonāt cover damage caused by water intrusion due to poor drainage.

10. Prepare an Emergency Kit

From power outages to sudden storms, itās smart to have an emergency kit ready. Include flashlights, extra batteries, blankets, bottled water, a first-aid kit, and backup chargers for your devices.

A small amount of preparation can prevent chaos laterāand ensure your family stays safe if the unexpected happens.

Bonus: Review Your Homeowners Insurance Coverage

Fall is also the perfect time to review your homeowners insurance policy. Do you know whatās coveredāand whatās notāif a storm damages your roof, a tree falls, or a pipe bursts?

As home repair and rebuilding costs rise, itās worth confirming that your dwelling coverage matches your homeās current replacement value. Consider adding endorsements for things like water backup or service line coverage if theyāre not already included.

Why a Fall Home Maintenance Checklist Matters for Insurance

Checking a few items off your fall home maintenance checklist now can save you thousands laterānot to mention the stress of filing a claim or paying out of pocket for preventable damage.

At TGS Insurance Agency, we know your home is more than just a placeāitās where life happens. Our agents are here to help you find the right coverage that protects it all, no matter the season. Get started with a free instant quote today.

Instant Home Insurance Quote

Recent Home Insurance Articles:

- Thanksgiving Fire Safety: Protect Your Home, Your Family, and Your Peace of Mind

- Fall Home Maintenance Checklist: Prevent Costly Insurance Claims Before Winter

- Who Needs to be Listed on Homeowners Insurance

- Does Homeowners Insurance Cover Mold?

- Actual Cash Value vs. Replacement Value: Whatās the Difference, and Where Does Market Value Fit In?