Comparison Shop Home Insurance in Aiken from Multiple Carriers Instantly!

Being an independent insurance agency means we shop and compare the best Aiken homeowners insurance options on your behalf to find you the best combination of cost and coverage. You’ll love doing business with us if you want an easier insurance experience. How do you get started? Easy! All we need is your address; you’ll get an instant quote in 15 seconds or less. After that, our agents will tailor and further customize your policy to fit your specific insurance needs. Did we mention we re-shop your policy renewal to ensure you are still getting the best deal year after year?

You’re one click away from never worrying about home insurance again!

What is Included in Aiken Home Insurance?

There are a few standard forms of home insurance that offer different levels of protection. This varies from different perils coverage and how much protection you want. Most of these forms include coverage- at some level- for:

- Dwelling

- Other Structures

- Personal Property

- Loss of Use

- Personal Liability

- Medical Payments

Having these coverages at the base of every standard home policy allows everyone to be somewhat protected. You can choose whether or not you have more coverage in one area compared to another. All of this is based on your unique lifestyle in Aiken.

What Does Home Insurance Cost in Aiken?

Homeowners insurance in Aiken costs $1,589 a year among TGS Insurance Agency customers. The cost of your home insurance premium will vary based on a few different things. This can be from your credit, location, value of your home, and what year your home was built. It is normal for your home insurance to vary from this average and other numbers you see online. The great thing about it is that you can completely customize your coverage.TGS has helped over 15,000 customers save on their home insurance premiums. To lock in your savings, type your address above for an instant quote!

Average Aiken Home Insurance Cost By Dwelling Coverage Limits

Dwelling coverage is the component of home insurance that protects the physical structure of your home from covered perils. It is designed to cover the cost of repairing or rebuilding your home if it is damaged or destroyed by a covered event. The amount of dwelling coverage you need will depend on the cost of rebuilding your home. Your home insurance policy typically provides coverage up to a specified dollar amount, known as the policy limit. It’s important to ensure that your dwelling coverage limit is high enough to cover the cost of rebuilding your home in the event of a total loss. Dwelling coverage limits can have a significant impact on home insurance premiums. In general, the higher the dwelling coverage limit, the higher the premium since the insurance company will take on more risk.

In Aiken, South Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $1,386 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $2,109 in Aiken, South Carolina.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $1,216.40

$200,000.00 - $299,999.00 $1,385.89

$300,000.00 - $399,999.00 $1,726.87

$400,000.00 - $499,999.00 $2,108.73

$500,000.00-$599,999.00 $2,587.24

$600,000.00-$699,999.00 $2,836.26

How Does My ZIP Code Affect My Home Insurance?

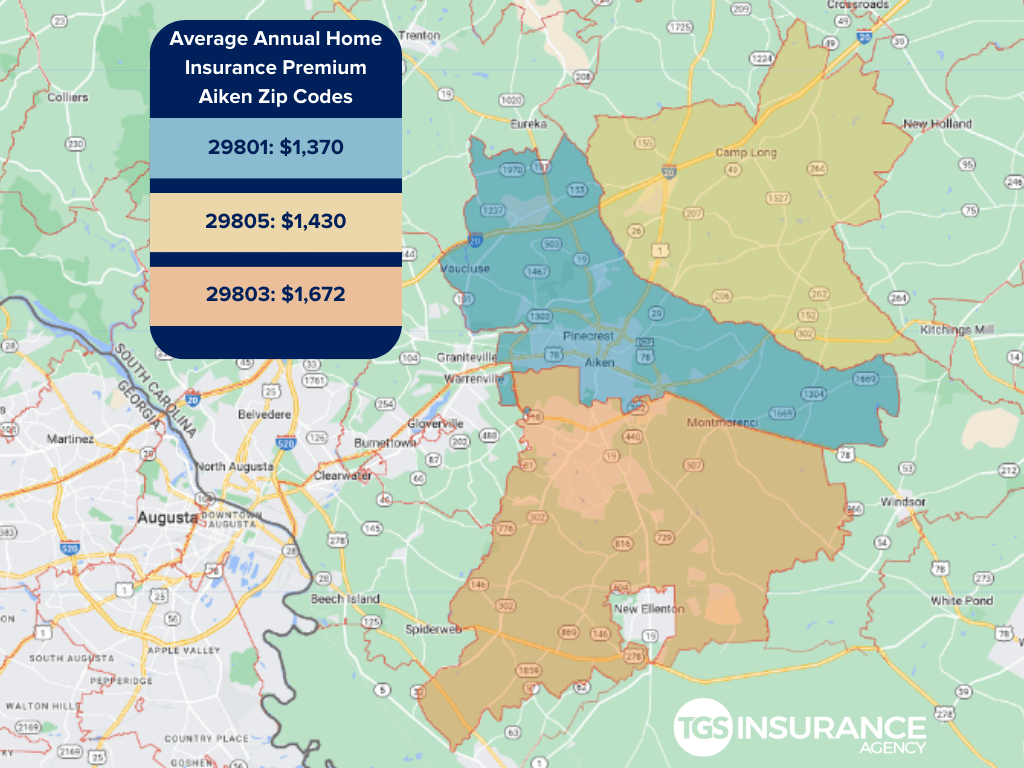

While some factors regarding your location, such as the probability of severe weather, are calculated at the city or county level. Some factors are analyzed as specifically as your zip code or neighborhood. Since the size and build of your home are usually consistent within neighborhoods, the location of your home plays a significant role in determining your risk of covered perils. In Aiken, the ZIP code 29801 has the lowest premium of $1,370 for TGS customers. The ZIP code with the highest premium is 29803, costing TGS customers an average of $1,672 a year.

Aiken Zip Codes We Insure

- 29801

- 29803

- 29805

Don’t see your zip code? It’s okay! At TGS Insurance Agency, we have access to a wide range of insurance carriers and products to help homeowners throughout South Carolina save money on their home insurance. Get a free, instant quote today and protect yourself, your family, and your home from the unexpected.