Shopping For Cheap Beaufort Home Insurance Is Easier Than You Think

As an independent agency, we represent 55+ top-rated insurance carriers, which allows us to offer comprehensive insurance options to meet your every need. The best part? Our highly qualified homeowners insurance agents do the hard work for you, making your home insurance shopping process easy and stress-free. Your savings start with an instant, free quote. Our agents are ready to help you further customize your quote and find any discounts you might qualify for!

We shop. You Save. Yes, it really is that easy.

What is Covered in Beaufort Home Insurance?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Beaufort, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. However not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

What Does Home Insurance Cost in Beaufort?

Homeowners insurance in Beaufort costs $2,203 a year, or $184 a month, for TGS customers. The cost of your home insurance premium will vary based on a few different things. This can be from your credit, location, value of your home, and what year your home was built. It is normal for your home insurance to vary from this average and other numbers you see online. The great thing about it is that you can completely customize your coverage.TGS has helped over 15,000 customers save on their home insurance premiums. To lock in your savings, type your address above for an instant quote!

Average Home Insurance Quotes in Beaufort by Coverage Level

Dwelling coverage is a critical aspect of home insurance that protects your home’s physical structure from covered hazards. Typically, your home insurance policy provides coverage up to a specified dollar amount, known as the policy limit. Ensuring that your dwelling coverage limit is sufficient to rebuild your home in the event of a total loss is critical. Since the insurance company assumes more risk, dwelling coverage limits may significantly impact home insurance premiums, with higher limits resulting in higher premiums. Below is a breakdown of the average home insurance premium based on dwelling coverage limits.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $1,834.70

$200,000.00 - $299,999.00 $1,965.06

$300,000.00 - $399,999.00 $2,458.63

$400,000.00 - $499,999.00 $3,085.08

$500,000.00 - $599,999.00 $3,846.54

$600,000.00 - $699,999.00 $4,254.66

How the Age of Your Beaufort Home Affects Your Insurance

The main difference between older and newer houses is that older homes pose a larger risk to insurance carriers. Older homes are more susceptible to fires and issues with plumbing and roofing. It would also be more expensive for carriers to repair older homes, so your premium will be higher. To avoid high premiums on older homes, keep up with home maintenance. If you update your home systems, your insurance carrier will not see them as a big risk.

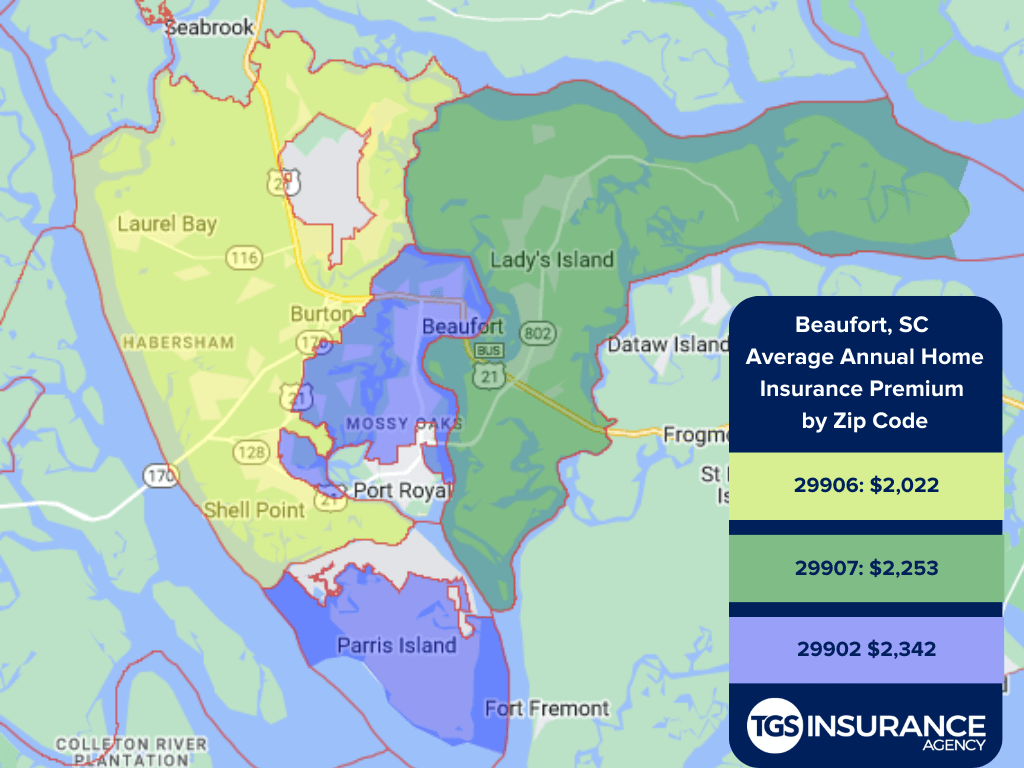

How Does Location Affect Your Home Insurance in Beaufort?

Just like your auto insurance, location is an important factor in determining your home insurance rates in Beaufort. For example, your premium may be higher if your city has a history of perils like vandalism, theft or even in an area with a weather risk. Conversely, your location could positively impact and lower your premium. In Beaufort, the ZIP code with the highest average premium is 29901. The average cost for that ZIP code is $2,745. Below is a comparison of the average cost of home insurance within ZIP codes of Beaufort:

Beaufort Zip Codes We Insure

- 29901

- 29902

- 29906

- 29907

Don’t see your zip code? It’s okay! At TGS Insurance Agency, we have access to a wide range of insurance carriers and products to help homeowners throughout South Carolina save money on their home insurance. Get a free, instant quote today and protect yourself, your family, and your home from the unexpected.