Shopping For Cheap Charleston Home Insurance Is Easier Than You Think

As an independent agency, we represent 55+ top-rated insurance carriers, which allows us to offer comprehensive insurance options to meet your every need. The best part? Our highly qualified homeowners insurance agents do the hard work for you, making your home insurance shopping process easy and stress-free. Your savings start with an instant, free quote. Our agents are ready to help you further customize your quote and find any discounts you might qualify for!

We shop. You Save. Yes, it really is that easy.

What is Covered in Charleston Home Insurance?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Charleston, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. But not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

How Much Does Charleston Home Insurance Cost?

On average, a TGS customer in Charleston would pay $2,716 per year for home insurance. Home insurance rates vary based on several factors, including your home’s age, value, and location, as well as your credit score and desired coverage levels. This average is based on policies with an average home value of $302,824 and includes windstorm and hail coverage with a 2% deductible. TGS Insurance Agency offers customizable options to all our customers so you can find the right policy and pay what you want. Get started with a free instant home insurance quote by providing your address above.

Average Charleston Home Insurance Cost By Coverage Level

Dwelling coverage is a fundamental element of home insurance that protects the physical structure of your home against covered hazards. The intention is to cover the expenses of repairing or rebuilding your home if it is damaged or destroyed due to a covered event. The amount of dwelling coverage needed depends on the cost of rebuilding your home. Your home insurance covers the policy limit- which is coverage for up to a specified dollar amount. It is critical to ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding your home in case of a complete loss. Dwelling coverage limits can significantly impact home insurance premiums, with higher limits resulting in higher premiums since the insurance company is assuming more risk.

In Charleston, South Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $2,317 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $3,694 in Charleston, South Carolina.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $2,124.52

$200,000.00 - $299,999.00 $2,316.62

$300,000.00 - $399,999.00 $2,919.89

$400,000.00 - $499,999.00 $3,693.67

$500,000.00-$599,999.00 $4,550.42

$600,000.00-$699,999.00 $5,178.73

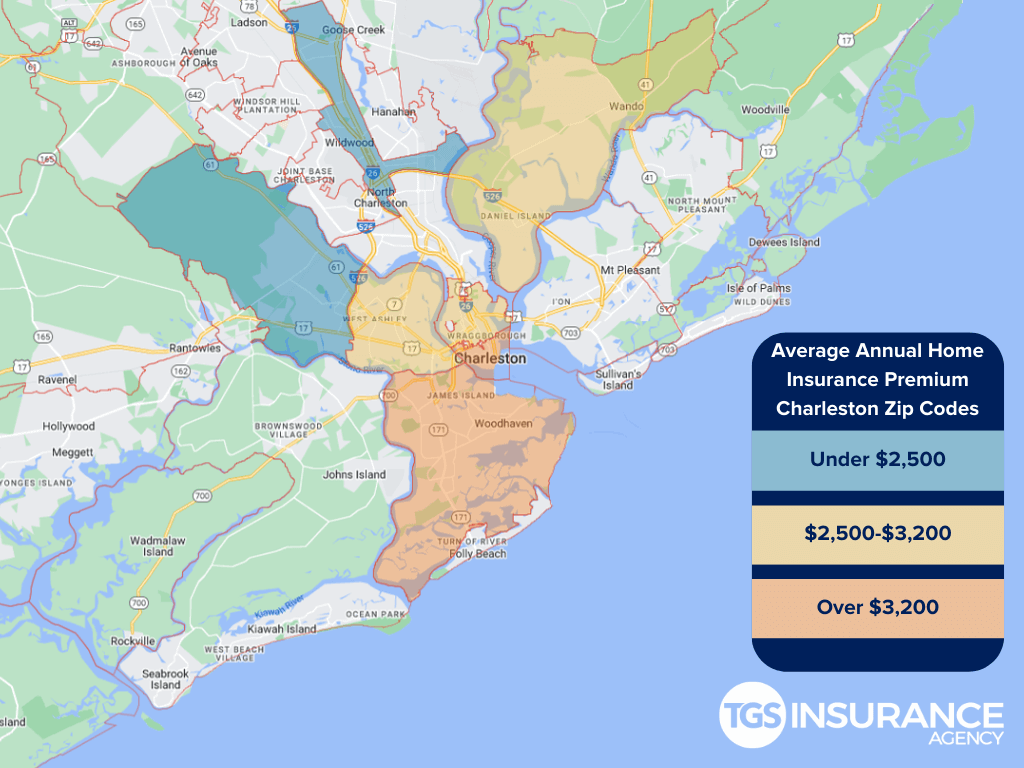

Does My Location Affect Home Insurance Premiums in Charleston?

Determining home insurance rates is very similar to determining auto insurance rates. Providers look at factors in your area, like the potential dangers you face and the crime rates. Your premiums could be lower if you live in a relatively low crime rate area. If your area is known for having floods or severe weather, you may have to pay more for your premium. In Charleston, the ZIP code with the highest average premium is 29401. The average cost for that ZIP code is $3,479. Below is a comparison of the average cost of home insurance within ZIP codes of Charleston:

Charleston Zip Codes TGS Insurance Agency Covers

29401 29406 29409 29414 29424

29403 29407 29412 29423 29492

If your zip code is not listed, fret not! We have access to amazing rates for homeowners all across South Carolina. Simply enter your address above to get started with a free instant quote.