Finding Affordable Columbia, South Carolina Home Insurance Made Simple

At TGS Insurance Agency, we leverage our relationships with several top-rated carriers to find you the best coverage and prices. Our online quoting tool makes getting a home insurance quote easier and faster than ever- all we need is your address! Our agents are ready to review your quote to assure you are getting the coverage you need and not overpaying for coverage you don’t.

We shop, and you save time and money; it really is that easy.

What is Covered in Columbia Home Insurance?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Columbia, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. But not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

How Much is Home Insurance in Columbia, South Carolina?

Columbia home insurance costs an average of $1,532 per year for TGS Insurance customers. This average is factored with policies with a 2% wind and hail coverage deductible and an average home value of $301,455. The cost of your home insurance premium will vary based on a few different things. This can be your credit, where you live, how much your house is worth, and the age of your home. Our instant home quote tool shops for you to find the best rates with just your address. After your instant quote, connect with one of our agents to further customize your coverage!

Home Insurance in Columbia Cost by Dwelling Coverage Limit

Dwelling coverage limits are one of the key factors that insurers consider when setting premiums. You’ll generally pay a higher premium if you choose a high dwelling coverage limit. However, it’s important to ensure adequate coverage to protect your home during a loss. If you have a mortgage on your home, your lender may require you to have a certain amount of dwelling coverage to protect your investment.

In Columbia, South Carolina, a policy with $200,000-$299,999 in dwelling coverage costs an average of $1,348 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000-$499,999 in dwelling coverage will pay an average of $2,008 in Columbia, South Carolina.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $1,139.92

$200,000.00 - $299,999.00 $1,348.31

$300,000.00 - $399,999.00 $1,685.83

$400,000.00 - $499,999.00 $2,007.57

$500,000.00-$599,999.00 $2,308.97

$600,000.00-$699,999.00 $2,459.87

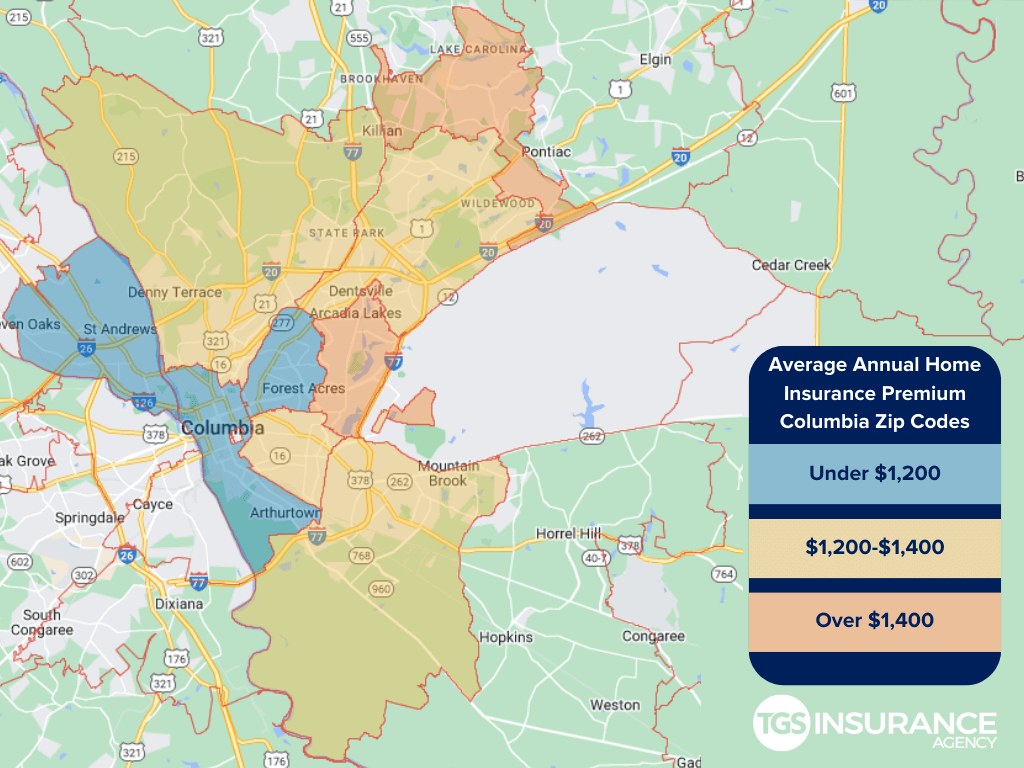

How Does My ZIP Code Affect My Home Insurance?

While some factors regarding your location, such as the probability of severe weather, are calculated at the city or county level. Some factors are analyzed as specifically as your zip code or neighborhood. Since the size and build of your home are usually consistent within neighborhoods, the location of your home plays a significant role in determining your risk of covered perils. In Columbia, the ZIP code 29201 is the area with the lowest premium of $1,112 for TGS customers. The ZIP code with the highest premium is 29229, costing TGS customers an average of $1,788 a year.

Zip Codes in Columbia TGS Insurance Covers

29201 29204 29207 29210 29225

29202 29205 29208 29212 29229

29203 29206 29209 29223

Don’t see your zip code? We’ve got you covered! We make shopping for the best home insurance easy and hassle-free for all residents throughout South Carolina. Get started today with a free, instant quote!