Getting a Fort Mill Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Fort Mill is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents

What is Covered in Fort Mill Home Insurance?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Fort Mill, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. But not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

What is the Average Cost of Home Insurance in Fort Mill?

In Fort Mill, the average cost of home insurance for TGS Insurance customers is $843 per year. While the cost of your policy will depend on several factors, such as the value and age of your home, your location, and your credit score, our agents can help you find the coverage you need at a price you can afford. We’ll work with you to customize your coverage and ensure you’re not sacrificing anything important to save money.

Average Cost of Fort Mill Home Insurance by Dwelling Coverage Amount

Typical home insurance includes dwelling coverage which covers the costs of repairing or rebuilding your home if it sustains damage or is destroyed due to a covered event. The limit of your dwelling coverage should match the rebuilding cost of your home, and the higher the limit, the more substantial the impact on home insurance premiums since the insurance company bears more risk. For TGS customers with a $350,000 dwelling coverage limit, their premium averages about $807 per year.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $629.57

$200,000.00 - $299,999.00 $664.62

$300,000.00 - $399,999.00 $806.70

$400,000.00 - $499,999.00 $969.33

$500,000.00-$599,999.00 $1,117.84

$600,000.00-$699,999.00 $1,207.23

Does My Location Affect Home Insurance Premiums in Fort Mill?

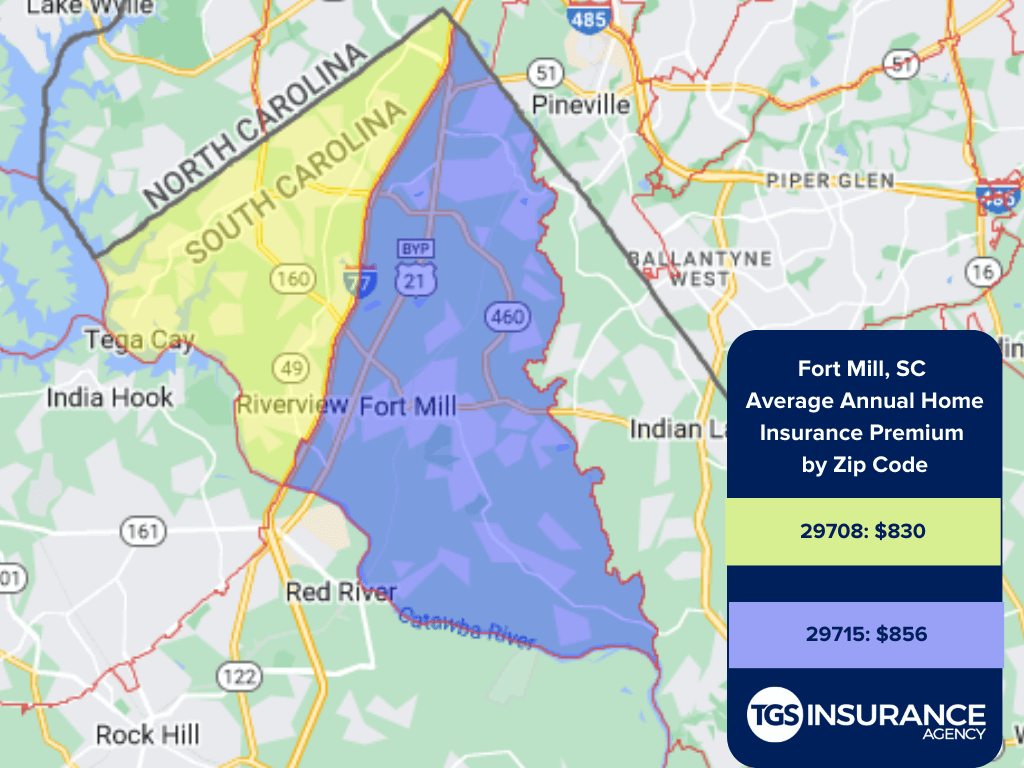

Determining home insurance rates is very similar to determining auto insurance rates. Providers look at factors in your area, like the potential dangers you face and the crime rates. Your premiums could be lower if you live in a relatively low crime rate area. If your area is known for having floods or severe weather, you may have to pay more for your premium. In Fort Mill, the ZIP code with the highest average premium is 29715. The average cost for that ZIP code is $856 annually. Below is a comparison of the average cost of auto insurance within ZIP codes of Fort Mill:

Fort Mill Zip Codes TGS Insurance Agency Covers

- 29707

- 29708

- 29715

If your zip code is not listed, fret not! We have access to amazing rates for homeowners all across South Carolina. Simply enter your address above to get started with a free instant quote.