Finding Affordable Mount Pleasant Home Insurance Made Simple

At TGS Insurance Agency, we leverage our relationships with several top-rated carriers to find you the best coverage and prices. Our online quoting tool makes getting a home insurance quote easier and faster than ever- all we need is your address! Our agents are ready to review your quote to assure you are getting the coverage you need and not overpaying for coverage you don’t.

We shop, and you save time and money; it really is that easy.

Mount Pleasant Home Insurance Coverage

The beauty of home insurance is that it can be tailored to fit you and your situation. Typically, a standard home insurance policy covers the following:

- Coverage for your home and other structures on your property, like detached garages

- Coverage for your belongings inside your home, like clothes and furniture

- Liability coverage for guests that may be injured on your property

- It covers additional living expenses if you need temporary lodging while your home is being repaired

What is the Average Cost of Home Insurance in Mount Pleasant?

In Mount Pleasant, the average cost of home insurance for TGS Insurance customers is $3,314 per year. While the cost of your policy will depend on several factors, such as the value and age of your home, your location, and your credit score, our agents can help you find the coverage you need at a price you can afford. We’ll work with you to customize your coverage and ensure you’re not sacrificing anything important to save money.

Average Mount Pleasant Home Insurance Cost By Coverage Level

Dwelling coverage is a fundamental element of home insurance that protects the physical structure of your home against covered hazards. The intention is to cover the expenses of repairing or rebuilding your home if it is damaged or destroyed due to a covered event. The amount of dwelling coverage needed depends on the cost of rebuilding your home. Your home insurance covers the policy limit- which is coverage for up to a specified dollar amount. It is critical to ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding your home in case of a complete loss. Dwelling coverage limits can significantly impact home insurance premiums, with higher limits resulting in higher premiums since the insurance company is assuming more risk.

In Mount Pleasant, South Carolina, if you need $200,000 in dwelling coverage, you’ll pay an average of $2,668 per year. However, if your home is worth more, you’ll want more coverage, so homeowners wanting $400,000 in dwelling coverage will pay an average of $3,940 in Mount Pleasant, South Carolina.

How Does Location Affect Your Home Insurance in Mount Pleasant?

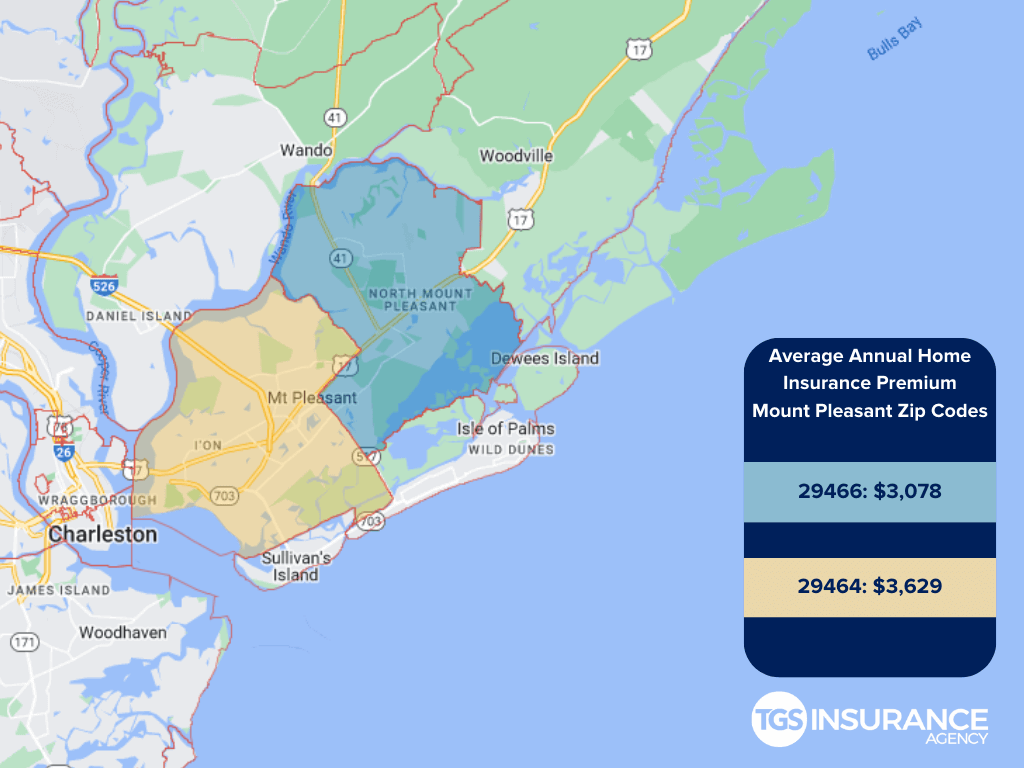

Just like your auto insurance, location is an important factor in determining your home insurance rates in Mount Pleasant. For example, your premium may be higher if your city has a history of perils like vandalism, theft or even in an area with a weather risk. Conversely, your location could positively impact and lower your premium. In Mount Pleasant, the ZIP code with the highest average premium is 29464. The average cost for that ZIP code is $3,629. Below is a comparison of the average cost of home insurance within ZIP codes of Mount Pleasant:

Mount Pleasant Zip Codes We Insure

- 29464

- 29466

Don’t see your zip code? It’s okay! At TGS Insurance Agency, we have access to a wide range of insurance carriers and products to help homeowners throughout South Carolina save money on their home insurance. Get a free, instant quote today and protect yourself, your family, and your home from the unexpected.