Getting a Myrtle Beach Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Myrtle Beach is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents

What Does Myrtle Beach Home Insurance Cover?

Most home insurance policies include some level of the following types of coverage.

Coverage A covers damages to your home

Coverage B covers damages to additional structures on your property such as detached garages, sheds, or fences

Coverage C covers damage to personal property such as furniture, electronics, and clothes

Coverage D covers additional living expenses if your home becomes uninhabitable due to a covered loss

Coverage E covers personal liability including coverage for claims arising from accidents on your property

Coverage F covers medical expenses for injuries occurring on your property for those outside of your household

When it comes to home insurance in Myrtle Beach, there’s no shortage of options. A standard policy typically covers a variety of losses, including damage caused by weather, theft, and accidents. But not all policies are created equal. That’s why it’s important to work with a knowledgeable agent who can help you navigate the complexities of home insurance and tailor your coverage to fit your needs. Whether you need more protection for your personal belongings or additional liability coverage, we’ve got you covered.

What is the Average Cost of Home Insurance in Myrtle Beach?

In Myrtle Beach, the average cost of home insurance for TGS Insurance customers is $2,360 per year. While the cost of your policy will depend on several factors, such as the value and age of your home, your location, and your credit score, our agents can help you find the coverage you need at a price you can afford. We’ll work with you to customize your coverage and ensure you’re not sacrificing anything important to save money.

Average Cost of Myrtle Beach Home Insurance by Dwelling Coverage Amount

Typical home insurance includes dwelling coverage which covers the costs of repairing or rebuilding your home if it sustains damage or is destroyed due to a covered event. The limit of your dwelling coverage should match the rebuilding cost of your home, and the higher the limit, the more substantial the impact on home insurance premiums since the insurance company bears more risk. TGS customers with a $250,000 dwelling coverage limit average their premium at $2,039 per year.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $1,818.45

$200,000.00 - $299,999.00 $2,039.12

$300,000.00 - $399,999.00 $2,619.78

$400,000.00 - $499,999.00 $3,292.93

$500,000.00 - $599,999.00 $4,294.59

$600,000.00 - $699,999.00 $5,210.04

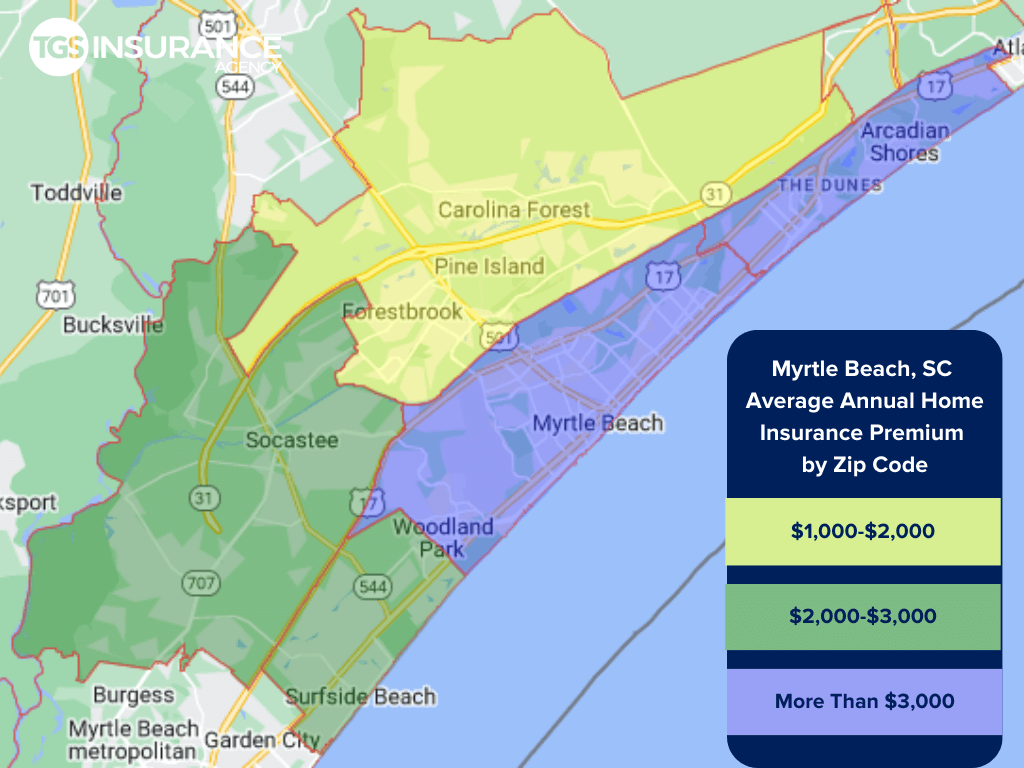

Does My ZIP Code Affect Home Insurance Premiums in Myrtle Beach?

Insurance carriers look at more than your home state when pricing your premium- they can get as specific as your ZIP Code. For example, in South Carolina, when you are closer to the coast, you may experience higher annual premiums because of your risks of perils like flooding and hurricanes. In Myrtle Beach, the ZIP code 29579 has the lowest average premium of $1,961 for TGS customers. The ZIP code with the highest premium is 29572, costing TGS customers an average of $4,972 annually.

Myrtle Beach Zip Codes TGS Insurance Agency Insures

- 29572

- 29575

- 29577

- 29579

- 29588

Don’t worry if you don’t see your zip code above! We can find incredible rates for homeowners throughout South Carolina. Enter your address above for a free instant home insurance quote.