Finding Affordable Orangeburg Home Insurance Made Simple

At TGS Insurance Agency, we leverage our relationships with several top-rated carriers to find you the best coverage and prices. Our online quoting tool makes getting a home insurance quote easier and faster than ever- all we need is your address! Our agents are ready to review your quote to assure you are getting the coverage you need and not overpaying for coverage you don’t.

We shop, and you save time and money; it really is that easy.

What Does Orangeburg Home Insurance Cover?

Most home insurance policies include some level of the following types of coverage.

Coverage A covers damages to your home

Coverage B covers damages to additional structures on your property such as detached garages, sheds, or fences

Coverage C covers damage to personal property such as furniture, electronics, and clothes

Coverage D covers additional living expenses if your home becomes uninhabitable due to a covered loss

Coverage E covers personal liability including coverage for claims arising from accidents on your property

Coverage F covers medical expenses for injuries occurring on your property for those outside of your household

When it comes to home insurance in Orangeburg, there’s no shortage of options. A standard policy typically covers a variety of losses, including damage caused by weather, theft, and accidents. But not all policies are created equal. That’s why it’s important to work with a knowledgeable agent who can help you navigate the complexities of home insurance and tailor your coverage to fit your needs. Whether you need more protection for your personal belongings or additional liability coverage, we’ve got you covered.

What is the Cost of Home Insurance in Orangeburg, South Carolina?

Your home insurance policy is crafted to fit your needs as a homeowner and protect your home. Your specific policy will look different from anybody else’s since it is built to protect your home and belongings. Look at how Orangeburg compares to other averages.

National Average: $1,477

North Carolina Average: $1,215

Orangeburg, South Carolina Average: $1,563

Your home insurance premium can vary from these averages, but it is always good to compare. If your current homeowners insurance policy is much less expensive than the city average, you may not have enough coverage and be underinsured. If you pay much more than these averages, you could simply be overpaying for home insurance.

Average Homeowners Insurance Cost by Coverage Level in Orangeburg

The cost to replace your home is essential to determine the dwelling coverage you need on your home insurance policy; this limit directly impacts your home insurance premium. On top of affecting your average annual costs, having an accurate replacement cost can prevent you from being underinsured if a covered loss takes your entire house. These are the average annual home insurance costs in Orangeburg, South Carolina, based on dwelling coverage limits associated with the policy.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $1,274.75

$200,000.00 - $299,999.00 $1,413.91

$300,000.00 - $399,999.00 $1,776.08

$400,000.00 - $499,999.00 $2,246.13

$500,000.00-$599,999.00 $2,776.45

Does My ZIP Code Affect Home Insurance Premiums in Orangeburg?

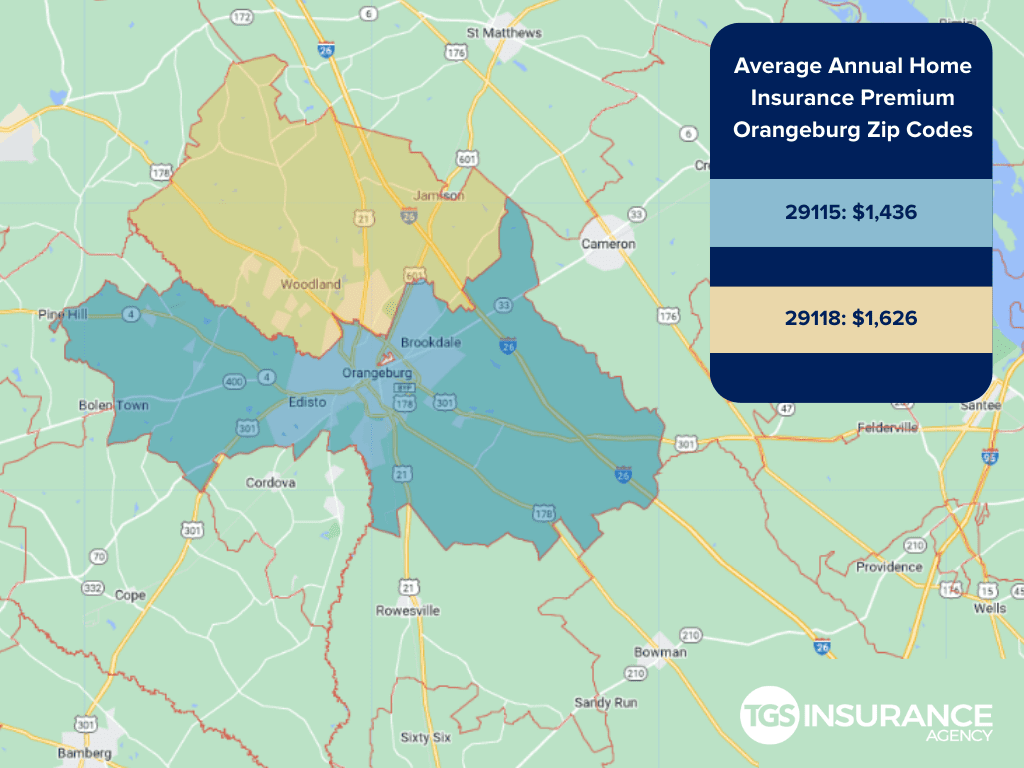

Insurance carriers look at more than your home state when pricing your premium- they can get as specific as your ZIP Code. For example, in South Carolina, when you are closer to the coast, you may experience higher annual premiums because of your risks of perils like flooding and hurricanes. In Orangeburg, the ZIP code 29115 is the area with the lowest premium of $1,436 for TGS customers. The ZIP code with the highest premium is 29118, costing TGS customers an average of $1,626 annually.

Orangeburg Zip Codes TGS Insurance Agency Covers

- 29115

- 29117

- 29118

If your zip code is not listed, fret not! We have access to amazing rates for homeowners all across South Carolina. Simply enter your address above to get started with a free instant quote.