Finding Affordable Rock Hill Home Insurance Made Simple

At TGS Insurance Agency, we leverage our relationships with several top-rated carriers to find you the best coverage and prices. Our online quoting tool makes getting a home insurance quote easier and faster than ever- all we need is your address! Our agents are ready to review your quote to assure you are getting the coverage you need and not overpaying for coverage you don’t.

We shop, and you save time and money; it really is that easy.

What is Included in Rock Hill Home Insurance?

There are a few standard forms of home insurance that offer different levels of protection. This varies from different perils coverage and how much protection you want. Most of these forms include coverage- at some level- for:

- Dwelling

- Other Structures

- Personal Property

- Loss of Use

- Personal Liability

- Medical Payments

Having these coverages at the base of every standard home policy allows everyone to be somewhat protected. You can choose whether or not you have more coverage in one area compared to another. All of this is based on your unique lifestyle in Rock Hill.

What is the Cost of Home Insurance in Rock Hill, South Carolina?

Your home insurance policy is crafted to fit your needs as a homeowner and protect your home. Your specific policy will look different from anybody else’s since it is built to protect your home and belongings. Look at how Rock Hill compares to other averages.

National Average: $1,477

North Carolina Average: $1,215

Rock Hill, South Carolina Average: $1,157

Your home insurance premium can vary from these averages, but it is always good to compare. If your current homeowners insurance policy is much less expensive than the city average, you may not have enough coverage and be underinsured. If you pay much more than these averages, you could be overpaying for home insurance.

Average Home Insurance Quotes in Rock Hill by Coverage Level

Dwelling coverage is a critical aspect of home insurance that protects your home’s physical structure from covered hazards. Typically, your home insurance policy provides coverage up to a specified dollar amount, known as the policy limit. Ensuring that your dwelling coverage limit is sufficient to rebuild your home in the event of a total loss is critical. Since the insurance company assumes more risk, dwelling coverage limits may significantly impact home insurance premiums, with higher limits resulting in higher premiums. Below is a breakdown of the average home insurance premium based on dwelling coverage limits.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $925.96

$200,000.00 - $299,999.00 $1,017.09

$300,000.00 - $399,999.00 $1,244.93

$400,000.00 - $499,999.00 $1,516.84

$500,000.00-$599,999.00 $1,881.60

$600,000.00-$699,999.00 $2,116.40

How Does Your Location in Rock Hill Affect Your Home Insurance?

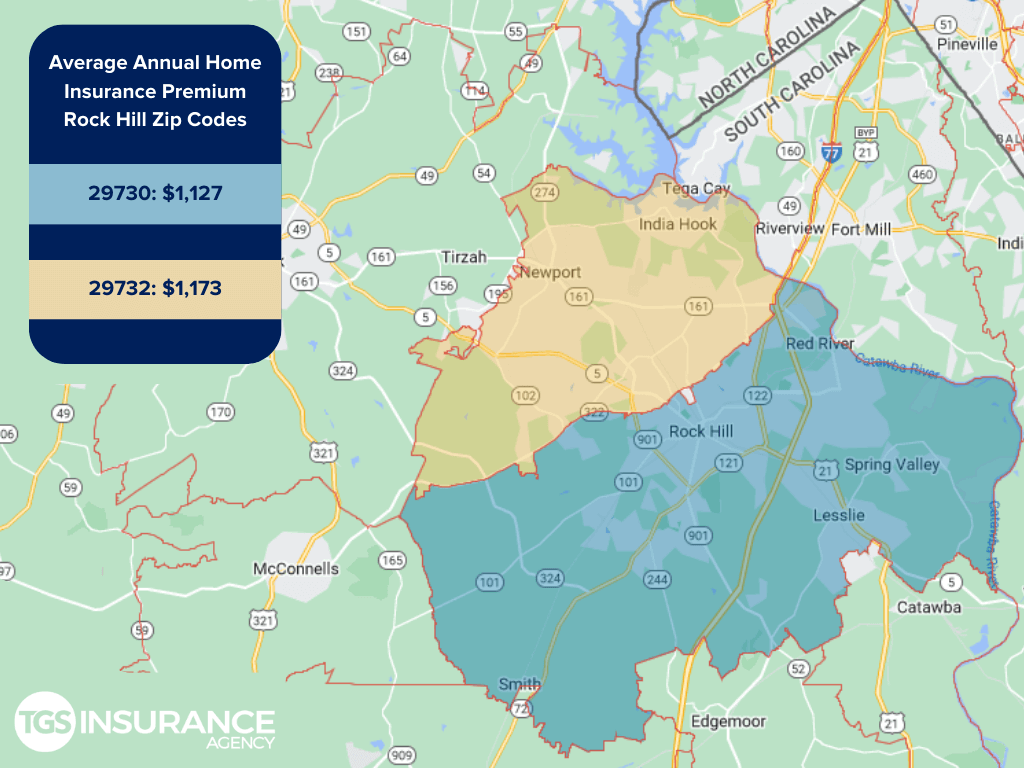

Where you live is one of the biggest factors that affect your home insurance premium. This gets so specific that carriers look at ZIP codes and neighborhoods. If your neighborhood has a higher theft rate than another neighborhood a few blocks down, your rates will be higher. Because carriers are very particular with risk evaluations, rates vary greatly-even within the same city. Below is a breakdown of the average annual premium for home insurance in Rock Hill:

Rock Hill Zip Codes TGS Insurance Agency Insures

- 29730

- 29732

- 29733

Don’t worry if you don’t see your zip code above! We can find incredible rates for homeowners throughout South Carolina. Enter your address above for a free instant home insurance quote.