Getting a Summerville Home Insurance Quote is as Easy as 1-2-3!

Getting the best homeowner’s insurance in Summerville is easy when you use TGS Insurance’s proprietary online quoting tool for a free, no-obligation quote. Did we mention it only takes 15 seconds?

- Enter your address

- View your quote

- Customize your coverage with the guidance of one of our expert independent agents

What is Covered in Summerville Home Insurance?

Don’t let unexpected losses threaten your home and personal belongings. With home insurance in Summerville, you can have peace of mind knowing you’re covered against various risks. A standard policy typically covers your home’s structure, personal belongings, liability, and additional living expenses. But not all policies are created equal, so it’s important to work with an agent who can help you customize your coverage to fit your unique needs. Whether you need more protection for your high-value items or want to add coverage for specific risks like earthquakes or floods, we’ve got you covered.

What Does Home Insurance Cost in Summerville?

Homeowners insurance in Summerville costs $1,648 a year among TGS Insurance customers. The cost of your home insurance premium will vary based on a few different things. This can be from your credit, location, value of your home, and what year your home was built. It is normal for your home insurance to vary from this average and other numbers you see online. The great thing about it is that you can completely customize your coverage.TGS has helped over 15,000 customers save on their home insurance premiums. To lock in your savings, type your address above for an instant quote!

Average Home Insurance Quotes in Summerville by Coverage Level

Dwelling coverage is a critical aspect of home insurance that protects your home’s physical structure from covered hazards. Typically, your home insurance policy provides coverage up to a specified dollar amount, known as the policy limit. Ensuring that your dwelling coverage limit is sufficient to rebuild your home in the event of a total loss is critical. Since the insurance company assumes more risk, dwelling coverage limits may significantly impact home insurance premiums, with higher limits resulting in higher premiums. Below is a breakdown of the average home insurance premium based on dwelling coverage limits.

Dwelling Coverage Limits Average Annual Premium (incl. Windstorm & Hail Coverage)

$100,000.00 - $199,999.00 $1,320.35

$200,000.00 - $299,999.00 $1,458.88

$300,000.00 - $399,999.00 $1,810.64

$400,000.00 - $499,999.00 $2,205.63

$500,000.00-$599,999.00 $2,684.18

$600,000.00-$699,999.00 $3,128.76

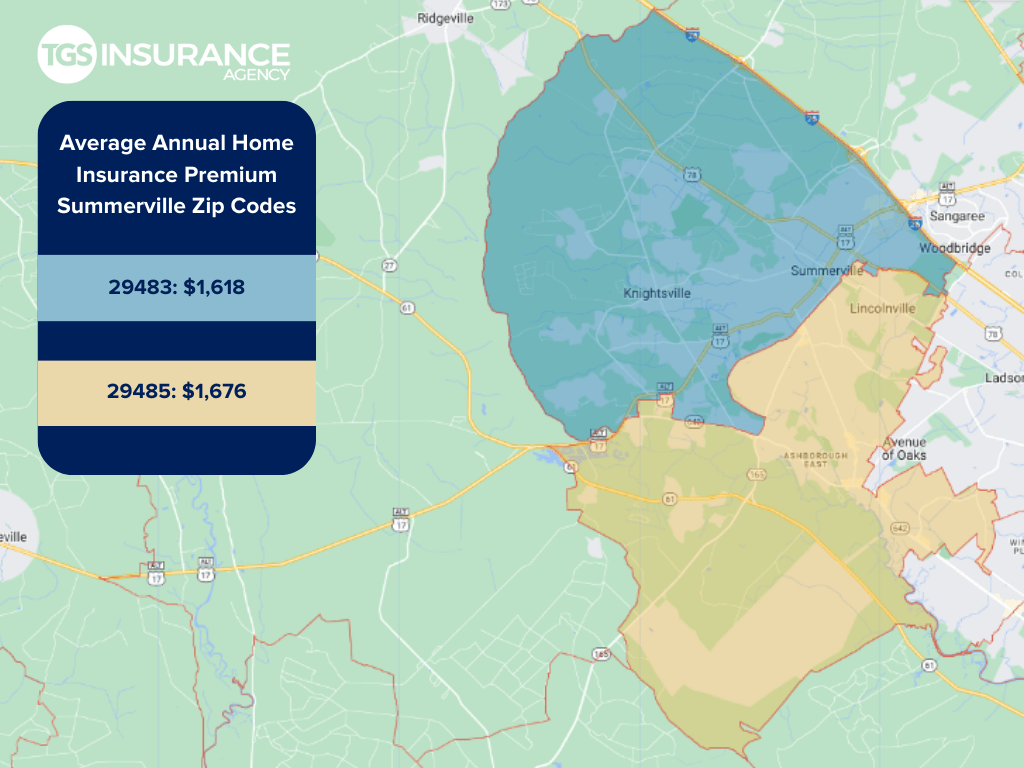

Does My ZIP Code Affect Home Insurance Premiums in Summerville?

Insurance carriers look at more than your home state when pricing your premium- they can get as specific as your ZIP Code. For example, in South Carolina, when you are closer to the coast, you may experience higher annual premiums because of your risks of perils like flooding and hurricanes. In Summerville, the ZIP code 29483 is the area with the lowest premium of $1,618 for TGS customers. The ZIP code with the highest premium is 29485, costing TGS customers an average of $1,676 a year.

Summerville Zip Codes We Insure

- 29483

- 29485

Don’t see your zip code? It’s okay! At TGS Insurance Agency, we have access to a wide range of insurance carriers and products to help homeowners throughout South Carolina save money on their home insurance. Get a free, instant quote today and protect yourself, your family, and your home from the unexpected.