With hurricane season in full force, South Carolina residents living on the coast must protect their homes from the upcoming storms. Understanding how windstorm insurance works in these areas is the first step in adequately protecting your home. The South Carolina Wind and Hail Underwriting Association, also known as Wind Pool, is an association of insurance providers. Its primary purpose is to offer wind and hail coverage to properties and businesses in the coastal region. This is a last resort after attempting to obtain coverage through the standard insurance market.

Table of Contents

- What is the South Carolina Wind Pool?

- What Coverage Does the Wind Pool Offer?

- What Does Wind Pool Not Cover?

- Who is Eligible for South Carolina Wind Pool?

- South Carolina Windstorm Zone Map

- Why Would I Have to Get Wind Pool Insurance?

- Does South Carolina Require Windstorm Insurance?

- Calculating Your Rates With Wind Pool

- Additional Windstorm Insurance Options With TGS

What is the South Carolina Wind Pool?

This program started in 1971. The South Carolina Legislature required insurance to be available to at-risk coastal homes. This was necessary because some residents and businesses were denied wind and hail coverage due to their location on the coast. The law protects all land designated “beach” by the legislature.

What Coverage Does the Wind Pool Offer?

With Wind Pool coverage, you can receive up to $1.3 million in protection. This will include dwelling structure, personal property, loss of use, and increased rebuilding costs. Wind Pool coverage is available for single-family homes, multi-family dwellings, mobile homes, and condos. Commercial businesses are also available for coverage.

The Wind Pool offers protection against certain losses caused by predetermined perils. This covers any damage caused by wind or hail events. Coverage is also available for replacement costs in single-family dwellings built after 1950. With replacement cost coverage, a flood policy must also be active at the time of the damage, or else there will be actual cash value coverage.

What Does Wind Pool Not Cover?

Some requirements must be met for your home to be covered under Wind Pool.

- Your property must be in a defined coastal territory.

- Your property cannot be over water.

- Your property must have a roof that is in good condition (determined by the insurance provider).

- Your property must not be used for illegal or immoral purposes.

As with most insurance policies, your property will be inspected to ensure it meets the Southern Building Code and the Federal Flood Construction and Zoning guidelines. These inspections may happen every one to five years.

Who is Eligible for South Carolina Wind Pool?

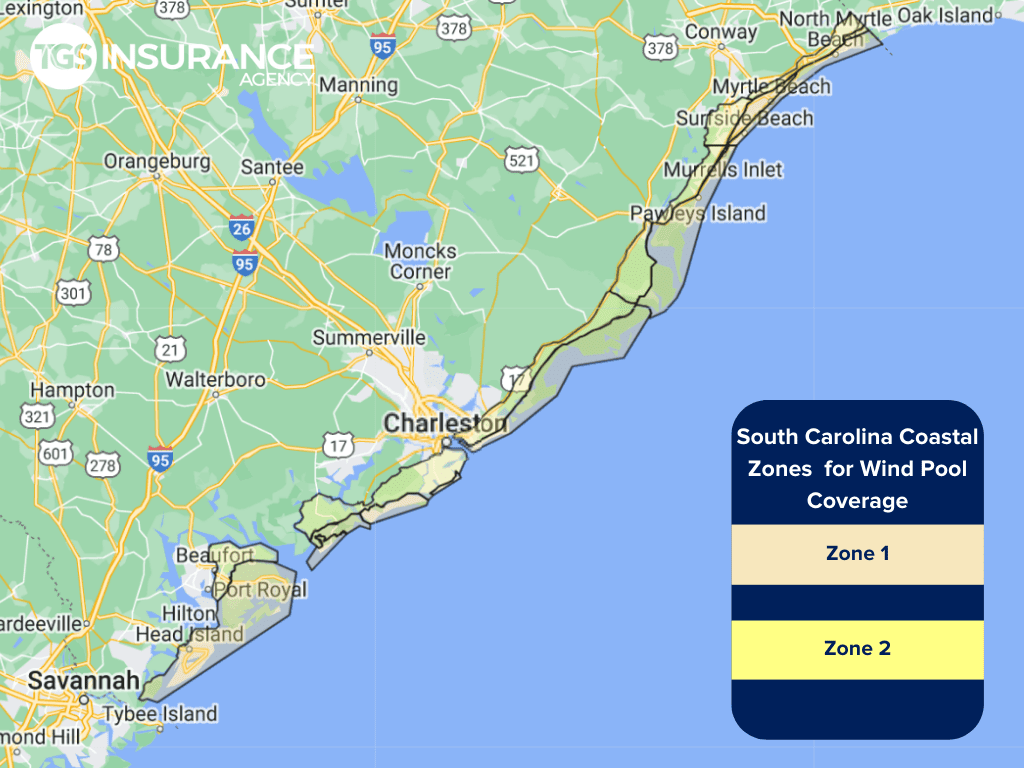

Two zones can obtain coverage because they are in the defined Coastal Area. They are labeled as Zone 1 and Zone 2. The ZIP Codes that are eligible are:

| 29412 | 29440 | 29464 | 29566 | 29576 | 29585 | 29920 |

| 29429 | 29451 | 29466 | 29568 | 29577 | 29588 | 29926 |

| 29438 | 29455 | 29482 | 29572 | 29579 | 29907 | 29928 |

| 29439 | 29458 | 29487 | 29575 | 29582 | 29915 |

If you are in these ZIP Codes, it is recommended that you shop for wind and hail coverage in the standard insurance market before you look at Wind Pool. This is a last resort for those denied coverage in the standard market. The South Carolina Wind and Hail Underwriting Association has an eligibility checker.

South Carolina Windstorm Zone Map

You can obtain South Carolina Wind Pool Coverage in one of these highlighted areas.

Why Would I Have to Get South Carolina Wind Pool Insurance?

According to the state of South Carolina, Wind Pool is a last resort for those in a high-risk coastal area. It is recommended that you first try to shop your policy in the standard market, then you are denied to apply for Wind Pool.

Does South Carolina Require Windstorm Insurance?

In South Carolina, if you have a loan out on your home, you must have either wind and hail coverage or names storm coverage. Under Wind Pool, you will have wind and hail coverage. Even if you do not have a house loan, getting windstorm insurance is a good idea. The cost of completely rebuilding your home can be astronomical to pay out of pocket. Having windstorm insurance is necessary because many high-risk areas are in danger of damage from windstorms (tornadoes, hurricanes, hail, etc.).

Calculating Your Rates With Wind Pool

Insurance providers calculate your premium based on many different factors. A lot of this includes the risk of the location of your home. Homeowners determined to be at higher risk may see a higher premium than those with a lower determined risk. Wind Pool assesses homes based on a variety of traditional factors. These can include your home’s coverage, deductible, and type of construction.

The idea behind WInd Pool is to maintain reasonable rates for everyone. This gives homeowners an opportunity after being denied for being too high risk.

Additional Windstorm Insurance Options With TGS Insurance Agency

Getting the right windstorm insurance shouldn’t be complicated. To protect your home, you should shop for your policy through different home insurance carriers. Lucky for you, that is just what we do here at TGS! We shop your policy among private and government-backed providers so you can get the best policy that fits your budget! With over 55 A-rated carriers to choose from, you will find your perfect policy with us.

Instant Home Insurance Quote

Recent Home Insurance Articles:

- Thanksgiving Fire Safety: Protect Your Home, Your Family, and Your Peace of Mind

- Fall Home Maintenance Checklist: Prevent Costly Insurance Claims Before Winter

- Who Needs to be Listed on Homeowners Insurance

- Does Homeowners Insurance Cover Mold?

- Actual Cash Value vs. Replacement Value: What’s the Difference, and Where Does Market Value Fit In?