Instant Landlord Insurance Quote

DP1 Insurance Policy for Landlords

Key Takeaways

- A DP1 policy is a form of landlord insurance that is ideal for landlords looking for basic coverage for a rental or those with a property that will be vacant for more than 30 days.

- A DP1 policy pays out on an actual cash value (ACV) basis, so before buying, you’ll want to assess your financial situation to make sure you can afford any out-of-pocket expenses due to a claim.

- A DP1 makes sense for temporary situations, but a DP2 and DP3 policy may be a better option for long-term protection.

Table of Contents

What Is a DP1 Policy?

A DP1 policy also referred to as a Dwelling-Fire Form 1, is a type of insurance policy that protects a home against nine named perils. This type of policy is standard for vacant homes or landlords on a slim budget looking for basic coverage.

What Do DP1 Policies Cover?

A DP1 policy only covers specific perils that are named in the policy. Common perils included in a DP1 policy are:

- Aircrafts

- Fire and lightning

- Hail

- Internal and external explosions

- Riots and civil commotions

- Smoke

- Vehicles

- Volcanic explosions

- Windstorms

Notably, a DP1 policy won’t always cover other common perils, such as vandalism, water damage, frozen pipes, damage from sleet or snow, and even falling trees or branches.

When Do I Need a DP1 Policy?

A DP1 policy is ideal for those renting out a property or have a vacant property and want some basic coverage. Scenarios in which you may want to consider buying a DP1 policy include:

- Cost-saving option for landlord’s with a rental property

- Own a vacant property for more than 30 days

- Landlord’s between tenants

- You purchased a new home and are leaving your old one vacant until it’s sold

- Inherited a house that sits empty until it’s out of probate court and legally yours

As a landlord, you want to protect yourself financially while keeping costs down, which is why a DP1 policy is an attractive option for some. But, a DP1 policy does not cover loss-of-rent coverage. Suppose a named peril causes damage to your property and your renter has to move out temporarily. In that case, you will not be compensated for any lost income.

Suppose you have had a vacant property for more than 30 days. In that case, a DP1 policy will offer you inexpensive coverage without leaving you financially vulnerable to any perils. It may be tempting not to insure the home if it’s left vacant, but that’s quite a risky move leaving you vulnerable to:

- Fire

- Lightning

- Squatters

- Theft/Vandalism

- Undetected water leaks

A DP1 is a fantastic option to cover all your bases. Still, suppose you’re seeking something long-term to protect any financial investments. In that case, a DP2 or DP3 policy may be your best option.

How Does a DP1 Policy Payout?

When considering an insurance policy, how your carrier reimburses you for a claim is always something to note. DP1 policies pay on an actual cash value (ACV) basis, which means replacement cost minus depreciation. When purchasing a landlord policy, consider your financial situation should you be left to pay anything out-of-pocket in the event of a claim. You may want to consider a DP2 or DP3 policy in exchange for a higher premium but a bigger financial safety net.

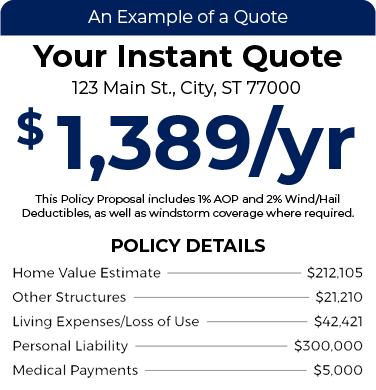

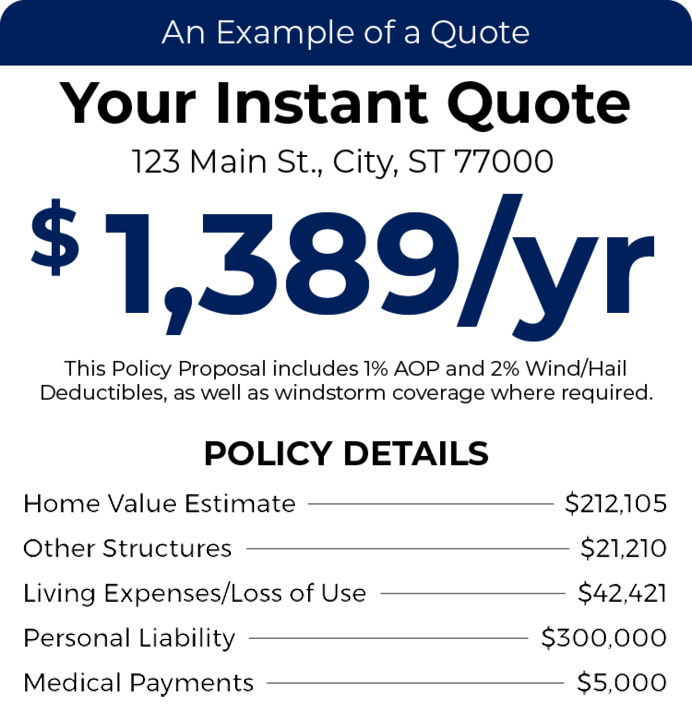

How to Buy a DP1 Policy

The easiest way to get a DP1 policy is to shop around, obtain different quotes from carriers, and then compare coverages and prices. Whether your need for a DP1 policy is temporary or you’re a landlord looking to protect your property investments, understanding your coverage options is crucial. Utilizing a brokerage agency (Like us!) is an easy way to manage your policy because agencies can shop your policy through multiple carriers and manage all the details that come with insurance, making it a stress-free experience. At TGS Insurance, we can do just that and more! We’ll shop your policy yearly at renewal, so you’re always getting the market’s lowest price. Click to get your hassle-free quote now– it’s free and only takes a few seconds.