Instant Landlord Insurance Quote

Protect Your Rental Property with Florida Landlord Insurance

Owning rental property in Florida offers great opportunities, but it also comes with unique challenges and risks. From hurricanes and flooding to tenant-related damages and legal liabilities, Florida landlords face potential financial pitfalls that could impact their bottom line. That’s where Florida landlord insurance comes in. Designed specifically for property owners who rent out homes, condos, or apartments, this specialized coverage protects your investment from costly damages, legal issues, and loss of rental income. Whether you’re managing a single-family home along the coast or multiple rental units across the state, having the right insurance is crucial to safeguarding your property and your financial future. At TGS Insurance, we make it simple to find tailored coverage that meets Florida’s unique needs—so you can rent your property with confidence.

Key Takeaways

- Florida landlord insurance protects your rental property from weather events, tenant-related risks, and loss of rental income.

- Essential coverages include property damage, liability protection, and optional add-ons like flood and hurricane insurance.

- TGS Insurance helps Florida landlords find the right policy at the best rate, tailored to their unique needs.

Table of Contents

What is Florida Landlord Insurance?

Florida landlord insurance, also known as rental property insurance, is a policy specifically designed for property owners who rent out their homes, condos, or apartments. This coverage helps protect the building, liability risks, and loss of rental income if the property becomes uninhabitable due to a covered event.

What Does Florida Landlord Insurance Cover?

- Property Damage: Covers damage to your building caused by hazards like fire, storms, lightning, vandalism, and more.

- Liability Protection: If someone is injured on your property, landlord insurance helps cover legal fees and medical costs.

- Loss of Rental Income: If a covered event renders your property uninhabitable, this coverage helps replace lost income.

- Optional Coverages:

- Flood Insurance: Essential in Florida’s flood-prone areas.

- Hurricane & Windstorm Coverage: Often required in high-risk zones.

- Equipment Breakdown: Covers essential systems like HVAC units.

- Vandalism & Theft: Protection against damage or loss caused by tenants or third parties.

Common Risks for Florida Landlords

Florida’s unique climate and geography bring specific risks to property owners:

- Hurricanes & Tropical Storms

- Flooding & Storm Surges

- High Humidity & Mold Issues

- Tenant-Related Damages

Having the right landlord insurance policy can provide peace of mind and financial protection against these potential challenges.

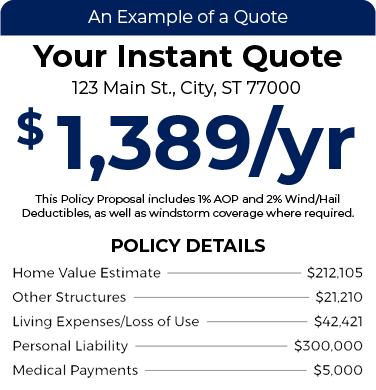

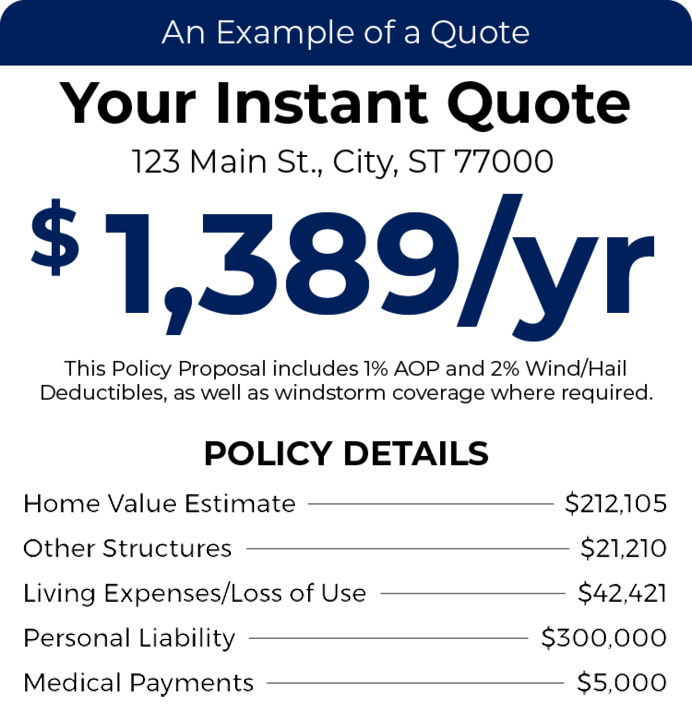

Cost Factors for Florida Landlord Insurance

Several elements can impact the cost of your landlord insurance policy:

- Location: Properties in coastal or flood-prone areas may face higher premiums.

- Property Type & Age: Older homes or multi-unit dwellings can influence rates.

- Coverage Limits & Deductibles: Higher coverage limits and lower deductibles can increase costs.

- Security & Safety Features: Upgrades like storm shutters, security systems, and updated roofing can help lower premiums.

Why Choose TGS Insurance for Florida Landlord Insurance?

At TGS Insurance Agency, we simplify the process of finding the right landlord insurance policy for your Florida property. We compare rates from top carriers to find you the best coverage at the lowest price. Plus, our team of licensed agents understands Florida’s unique insurance needs and will tailor a policy that protects your investment. Don’t leave your rental property exposed to risks. Get a Florida Landlord Insurance policy tailored to your needs and budget. Contact TGS Insurance today for a hassle-free quote and start safeguarding your investment.

Landlord Insurance FAQS

No, landlord insurance is not legally required in the state of Florida. However, it’s strongly recommended to protect your investment. Without coverage, you could be responsible for costly repairs, legal fees, or lost rental income out of pocket, putting your finances at significant risk.

Yes, landlords can require tenants to have renters insurance as part of the lease agreement. This helps protect both the tenant’s belongings and the landlord from potential liability.

Typically, landlord insurance does not cover routine appliance repairs due to wear and tear. However, it may cover damage caused by covered events like fires or storms. Adding equipment breakdown coverage can help protect against certain appliance failures.