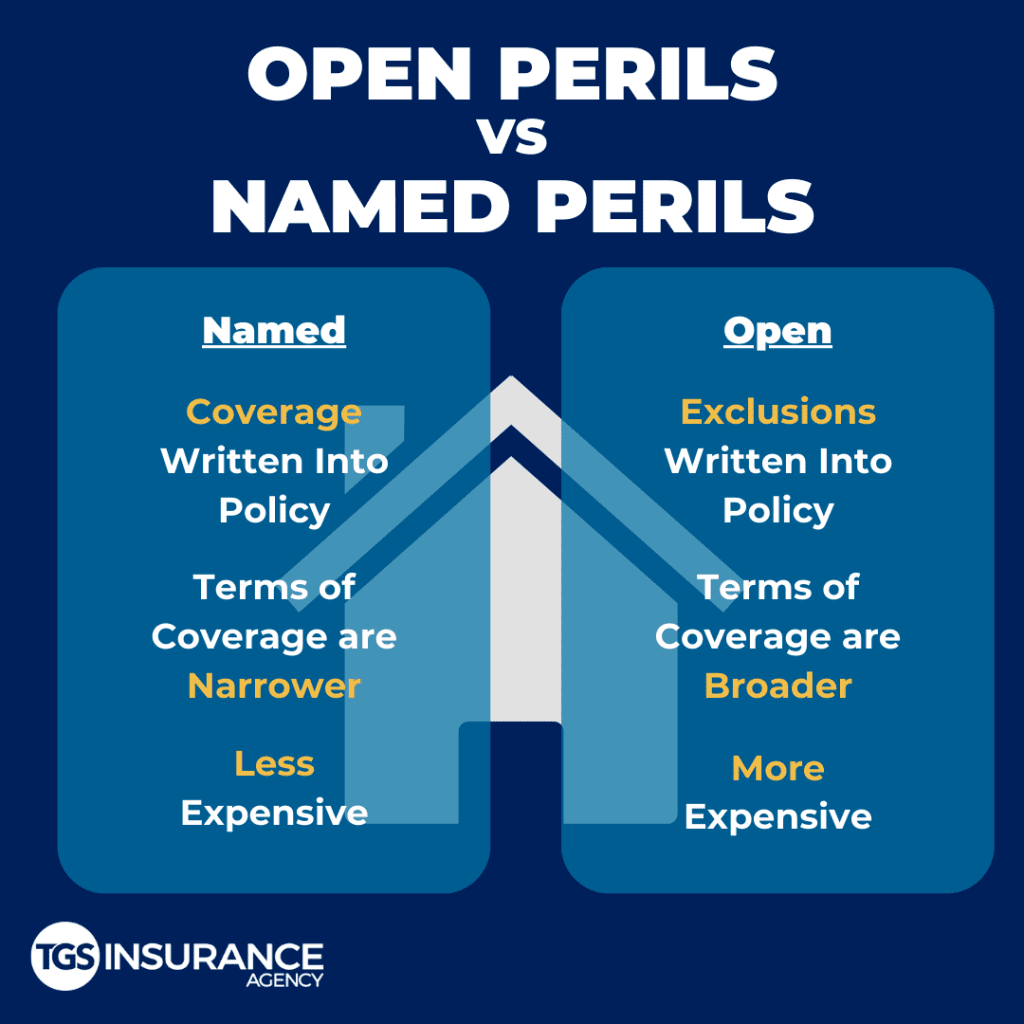

Insurance policies cover you in the event of a “peril,” which is something that causes or can cause a loss. Events that constitute perils vary from policy to policy. So what is open peril vs. named peril coverage? Coverage for “open perils” means you are possibly covered in the event of any peril unless it has been specifically excluded from your policy. Coverage for “named perils” means you’re only covered against the perils that are outlined in your policy.

What is Open Peril Coverage?

Open perils, also referred to as “all perils,” means that your insurance company will cover you if anything happens to your belongings or home unless it is a named exclusion on your policy. Unless items are specifically excluded, you’re covered!

Should I Get Open Perils Coverage?

The full coverage of your home and belongings is what attracts people to this type of coverage. The downside is that it is more expensive than named peril coverage, but this is because of the extensive protection you have. For example, if your home floods and your TV is damaged and you file a claim, unless your policy specifically calls out flooding as an exclusion, insurance will approve your claim.

TGSI Tip: Deciding between open perils and named perils coverage can help you pick which homeowners policy you want! HO-5 and HO-3 differ mostly between their coverage of perils.

What is a Named Peril?

Named perils refers to a list of 16 bad things that could happen to your personal property or dwelling that could be covered by your insurer. Named perils only give you protection over what is specifically written into your policy. If a peril is NOT listed in your policy, it is not covered and you, as the homeowner, will have to pay out-of-pocket. So back to the example, if your home flooded and it ruins your TV and your policy specifically calls out flooding as an exclusion, insurance will not cover your loss and will deny your claim.

Should I Get Named Perils Coverage?

The good thing about named perils coverage is that it typically carries a lower premium than open perils. You also have the option to get additional policies to fill in the gaps of coverage. For example, if you do not have hail damage covered in your named perils, you can add that on to your homeowners policy to ensure you don’t have to pay out-of-pocket. So if you are deciding between open peril vs. named peril coverage, it’s good to look at how much you can comfortably spend.

What Are The 16 Named Perils in Insurance?

If the following things happen to any of your personal property- things you own- you will be able to file a claim and get compensation. Keep in mind that if these perils happen to your belongings outside your home, you will also be covered!

- Fire or lightning

- Theft

- Vandalism

- Windstorms and hail

- Smoke or ash

- Explosions

- Damage caused by vehicles

- Damage caused by aircrafts

- Falling objects

- Freezing of household systems

- Sudden/accidental tearing, cracking, burning or bulging of home systems

- Weight of ice, snow and sleet

- Water overflow or discharge (plumbing, air conditioning and other appliances)

- Power surges

- Riots

- Volcanic Eruptions

Open Perils vs. Named Perils FAQs

No, it depends on the type of peril coverage you have. If you have open perils coverage then you are automatically covered by all perils unless they are specifically excluded from your policy.

No, a peril is not the same as a hazard. A peril is the cause of a loss where a hazard is a condition, action or habit that increases the likelihood of a peril happening.

Instant Home Insurance Quote

Recent Home Insurance Articles:

- Does Home Insurance Cover Vacation Rentals? Here’s What You Need to Know

- Home Insurance Coverage Gaps You Might Not Know Exist—Until It’s Too Late

- Grilling Safety Tips for a Secure Memorial Day BBQ

- How to Change Home Insurance with Escrow: A Step-by-Step Guide

- Pool Safety Tips for Homeowners: Stay Cool and Covered This Summer