Car Insurance Discounts For Students

If you add a young driver to your policy, you may see the increase and think, “how am I going to pay for this?” Parents who recently added a new teen driver to their auto insurance policy can typically expect their rates to double. For younger drivers, their rates usually stay high until age 25. But if your teen driver gets good grades, you can immediately reduce their car insurance rates! Read on to see other ways you can get car insurance discounts for students.

Key Takeaways

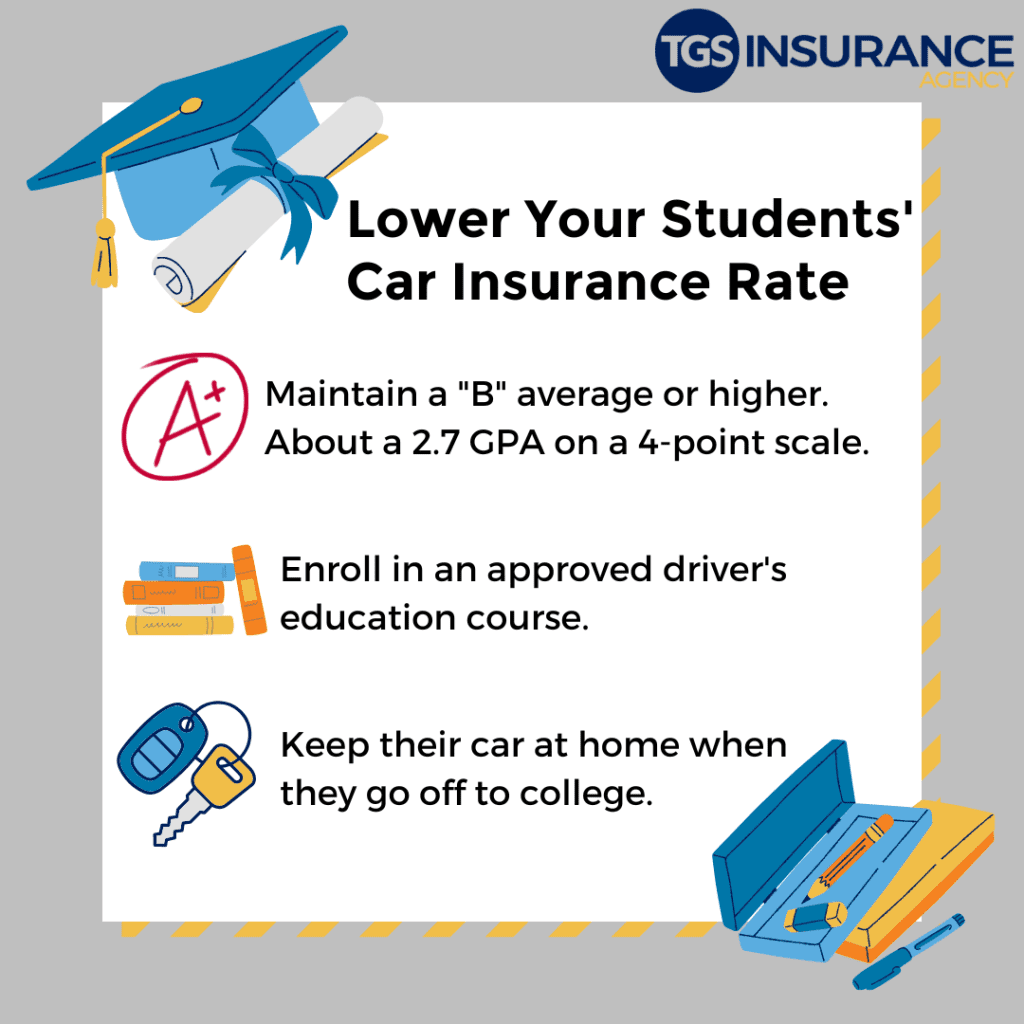

- Maintaining a “B” average or better can score significant discounts.

- A driver’s education course can also save you money for your young driver.

- All of the carriers’ discounts are similar. Contact an agent to see which one fits you best.

Table of Contents

Good Grades Lead to Better Rates

Many auto insurance providers offer a good student discount. That’s great news for parents of B-average and above students! The discount eligibility varies from carrier to carrier, so make sure you call an agent to see if you and your teen qualify. Here are some carriers that have good student discounts.

Nationwide

The baseline to qualify for the Nationwide good student discount is that your young driver must be between 16 and 24. Aside from that, they need to be enrolled full-time in either high school or college and maintain a “B” average or higher.

As most carriers require, there must be proof in the form of a signed report card. These signed report cards may need to be produced multiple times a year or just at your renewal- depending on the terms of your policy. On top of a good student discount, Nationwide also offers a safe driver discount. This rewards young drivers for having a clean record, which means no at-fault accidents or moving violations in the past five years.

Allstate

Allstate refers to its good student discount as a “smart student discount.” Students must be under 24 and unmarried to be eligible for this discount. They also need to maintain a GPA of 2.7 or above (on a 4-point scale); complete the Allstate teenSmart program, a version of driver’s ed. The caveat to this discount is that the student must attend school over 100 miles from where the car is stored or garaged.

Safeco

Like other carriers, Safeco requires an average of “B” or better to attain a good student discount. Safeco also has a ‘student away from home’ saving option for students who live over 100 miles from the address and car listed on the policy.

Progressive

Progressive has multiple discounts for students:

Good Student Discount: Students must maintain a “B” average or better

Distant Student Discount: This is for students under 22 years old who live over 100 miles from home. They also cannot have their vehicle at school.

Teen Driver Discount: This is for 18 and under drivers new to their parent’s policy.

Distance Makes the Discounts Greater

As you may have noticed in some of the carrier’s discount requirements, the student must be 100 miles or more from the vehicle they drive. This may seem counterintuitive, but you still need to insure the car your teen drives when they come home so that you can get some discounts!

These “student away” and “distant student” discounts can save you as much as 25% on your auto insurance premium if you meet all the requirements. The average conditions are that the student does not have a car at school, they go to school over 100 miles from home, and age requirements vary by carrier.

Please confirm with your agent if you are eligible for this discount.

Drivers’ Education to Lower Students’ Auto Insurance Rates

A driver’s education course is required in Texas to obtain your learner’s permit and driver’s license. Why not capitalize on it? Enrolling your child in a carrier-approved driver’s education course could lead to significant savings on their car insurance.

The course required in Texas is only 6 hours and can be online or in person. Student drivers must complete on-road hours before becoming legal on the roads. Before taking a driver’s education course, it is a good idea to check with your carrier and see which ones in your area qualify you for a discount.

The qualifications for this discount will vary by state and company.

Find the Best Car Insurance Discounts With TGS

At TGS, we are determined to find you the best auto insurance for the most outstanding deal. We will help you combine discounts, get the perfect coverage, and stay safe. We work with over 35 top-rated carriers to give you the ideal options. Don’t worry about the endless shopping of policies; we do everything for you. Call us to determine how much you can save on your car insurance.

Explore Other Auto Insurance Discounts and Savings:

Senior Auto Insurance Discounts

Healthcare Workers’ Car Insurance Discounts

Auto Insurance Discounts for First Responders

Low-Mileage Car Insurance Discounts

2023 Car Insurance Discounts Guide