Instant Landlord Insurance Quote

Understanding The DP3 Policy

Key Takeaways

- A DP3 policy is the most popular and comprehensive form of landlord insurance.

- A DP3 policy is an open peril policy, meaning your insurance carrier will cover all perils unless expressly excluded in your policy.

- A DP3 policy will payout with replacement cash value (RCV), which means your policy will cover any losses at the current replacement cost with no depreciation accounting.

Table of Contents

What is A DP3 Policy?

A DP3 policy is a dwelling-fire policy for rented residential properties. These policies are intended for landlords or homeowners renting out homes and not for commercial properties. A DP3 policy covers the property structure and any furnishing or appliances owned by the landlord.

What Do DP3 Policies Cover?

A DP3 policy offers landlords three essential areas of coverage:

- Dwelling and other structures

- Loss-of-rent also referred to as loss-of-use

- Liability

A DP3 policy is an open peril policy, meaning your insurance carrier will cover all perils unless expressly excluded in your policy. While more expensive, a DP3 offers coverage for just about anything, making it one of the most comprehensive policies available! DP1 and DP2 policies are typically named peril policies, which means the carrier will only cover events named explicitly in the policy.

Standard open peril policy exclusions include:

- Earthquakes

- Floods

- Governmental action

- Intentional loss

- Mold

- Neglect or general wear and tear

- Nuclear hazards or acts of war

- Ordinance or law

- Power failure

When Do I Need A DP3 Policy?

If you plan on renting your property without it being your primary residence, you will need a DP3 policy. A robust DP3 policy will provide you with dwelling, loss-of-rent, and personal liability coverage. In contrast, if you opted for an HO-3 homeowners policy, you would have zero coverage. Without a DP3, you would you on the hook financially for any damages due to peril because your homeowners policy would offer zero coverage since the property isn’t your primary home.

Common scenarios in which you need a DP3 policy are:

- A home where the roof is older than 10+ years

- Getting full replacement cost if landlord is unable to afford damage repairs

- High-risk properties where a DP1 or DP2 would offer little to no coverage

- Rental income protection

A DP3 policy can sometimes be used for seasonal homes, vacation homes, or short-term rentals like Airbnb or VRBO. Your insurance agent can help you determine the best policy for your needs.

How Does A DP3 Policy Payout?

An alluring component of a DP3 policy is how a claim is paid out. With DP1 and DP2s, you’ll typically be compensated for a claim with actual cash value (ACV), meaning the value of something minus any depreciation. A DP3 policy will payout with replacement cash value (RCV), which means your policy will cover any losses at the current replacement cost with no depreciation accounting.

RCV can be more expensive upfront in any premiums than ACV. Still, assessing your current financial situation is crucial because it may behoove you to have a more well-rounded DP3 policy.

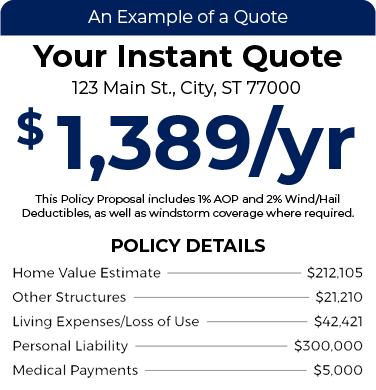

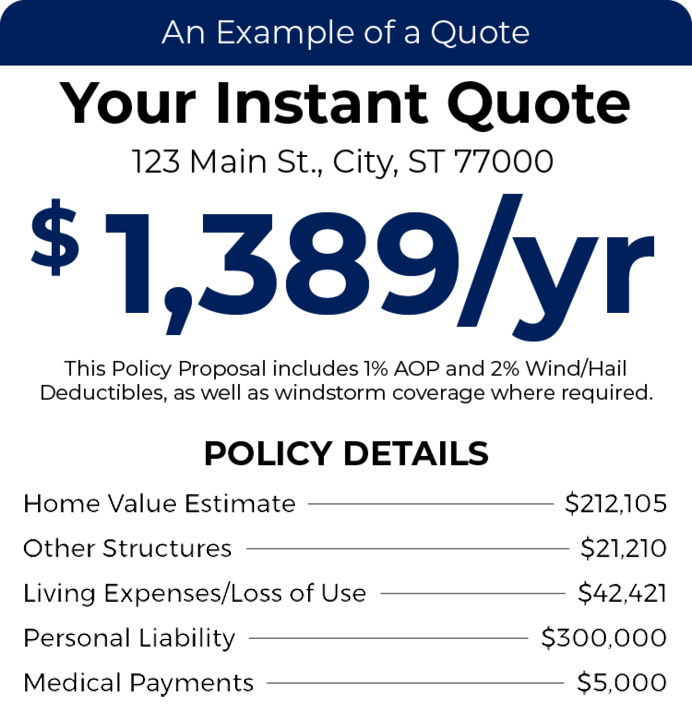

How To Buy A DP3 Policy

The best way to buy a DP3 policy is to shop around, obtain quotes from different carriers, and compare coverage options. You’ll also want to look at your financials to understand where your risks are so you know what type of dwelling-fire policy you need to protect both you and your investments.

Using a brokerage agency, like TGS Insurance, is an easy way to shop and maintain dwelling-fire coverage. At TGSI, we shop your policy across our bank of 40+ carriers to find the best market offers. With our vast expertise, we will provide you with a perfectly crafted policy for your needs and budget. Furthermore, we’ll shop your policy at renewal every year to ensure you always get the best. Click to get your hassle-free quote now– it’s free and only takes a few seconds.