Being a safe driver is commendable and you can be rewarded by your insurance provider for it. With all the different options that are available for auto insurance, picking the right one can be challenging without some guidance. One option for drivers is usage-based car insurance.

What is Usage-Based Car Insurance?

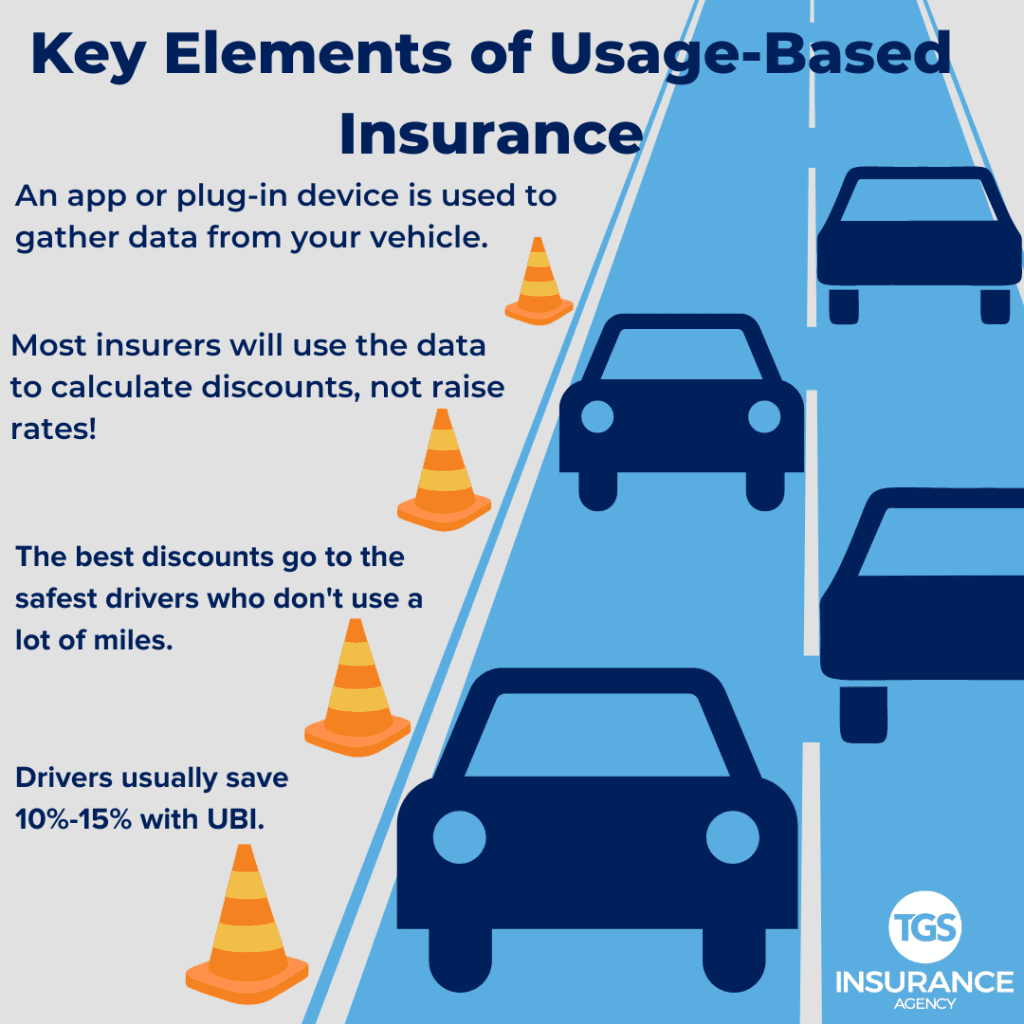

Usage-Based Insurance (UBI) is a type of auto insurance that utilizes in-vehicle telecommunications devices (telematics) to track mileage and driving behaviors of users. The basic concept behind usage-based insurance is for providers to monitor a driver’s behavior in order to more closely align them with a premium rate.

What are the Advantages of Usage-Based Car Insurance?

When it comes to usage-based insurance, the biggest benefit is the personalization it gives to your policy. It gives providers access to your driving data: hard braking, speed, and time you spend in the car. For lower-risk drivers, this gives them a chance to lower their rates and be rewarded for safe driving. By incentivizing customers to adopt safer driving habits, they have control of their own rates.

Along with tailoring rates to fit you as an individual and unique driver, usage-based insurance has many safety benefits. It allows for your car to be tracked and recovered if it’s stolen and improves accident response time. Providers can accurately estimate accident damages by analyzing your data during a wreck. Overall, fewer miles and safe driver habits contribute to fewer accidents, congestion, and vehicle emissions which benefits society overall.

What are the Disadvantages of Usage-Based Car Insurance?

Even though personalized rates and rewards for your good driving sound nice, there are some concerns that come along with it. The main one being privacy. Having a company track your mileage, watch how fast you go and when you hit the brakes suddenly can be nerve-racking and hard to wrap your head around. Do you really want someone collecting data from inside your car?

To combat this, some states have required providers to disclose tracking practices and devices. Some providers even limit the data they collect. Even though this may not be for everyone, information sharing is growing everyday through smartphones and social media networks, so adding it to insurance may not seem far-fetched. If you are a good candidate for lowering your rates through usage-based insurance, maybe you should start thinking about adding it to your auto insurance.

What Is The Difference Between Usage Based-Insurance and By-The-Mile Insurance?

The main difference between by-the-mile insurance and usage-based insurance is that usage-based insurance can lower your rates by tracking safe driving habits. By-the-mile charges a flat rate monthly fee, then adds to the rate based on how many miles you drive that month (usually a few cents per mile).

The thought behind it is that even if you are a safe driver, the more time you are on the road, the more likely you are to get into an accident. By-the-mile is clearly not for everyone and can end up hurting your rates if you have a long daily commute.

By-the-mile Auto Insurance: pay a base rate and then a small cost, often less than 10 cents, per mile they drive.

Usage-Based Insurance: drivers sign up for a base premium but can get a discount based on safe driving habits. Most likely, it will not raise drivers rates

Who Is A Good Candidate For Usage-Based Insurance?

Since auto insurance is required in Texas, usage-based insurance coverage can be beneficial for folks who have safe behind-the-wheel habits or those who simply don’t drive a lot. If you are diligent about not using your phone on the road, and avoid sudden acceleration and braking, it could lead to big savings. Most programs will not raise your rates for bad driving habits, but some will.

Say you work from home or just really don’t like to drive but still have a car. Usage-based insurance can be a great way to get lower rates than a typical policy and still be safely insured. Many major insurers will offer at least up to 20% in savings for avoiding dangerous driving situations, with some offering as much as 40% off.

Usage based insurance can be right for you if:

- You drive less than 12,785 miles per year. That’s the average number of annual miles driven according to the Federal Highway Administration. If you drive that or more, you probably are not going to save on premiums through usage-based insurance.

- You drive safely. Since driving style is tracked, they can penalize you for hard-braking and speeding.

- You don’t mind being tracked. Having daily tracking in your car may not be for everyone, and that’s okay! Make sure you are comfortable with your provider having data about your car- and possibly your location- before you choose usage-based insurance coverage

Who Offers the Best Usage-Based Insurance?

We broke down some of our top carriers’ usage-based insurance insurance policies! TGS strives to make finding your perfect policy easy and fast! Contact one of our agents to get a quote about your auto insurance.