What is the Difference Between Excess Liability Coverage and Umbrella Insurance?

Although different insurance carriers might use either term to apply to different situations, personal excess liability coverage IS umbrella insurance. This can get pretty confusing, but that’s what we’re here for! Let’s take a look at how this type of policy works and how it can help you.

Personal Excess Liability Coverage

Excess liability, also known as umbrella liability, covers losses above the limits of your primary insurance policy. Liability coverage is an important part of your standard home and auto insurance policies. This basic coverage protects you in the event that you are responsible for damages to someone else’s home, other structures, car or personal effects. However, that protection does have a set limit. In order to make sure you will be fully covered in excess of that liability limit, you need to have an umbrella policy.

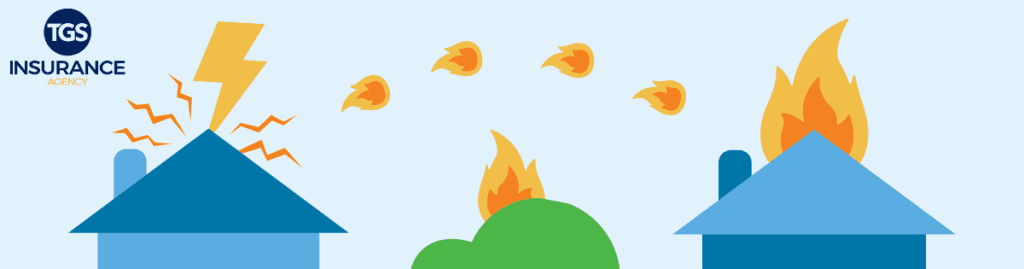

Your homeowners insurance will typically set the limit of your liability coverage at or slightly above the value of your dwelling. Now, imagine a worst-case scenario in which your house has an electrical fire. Wind spreads it to your neighbor’s roof, and your fire burns down two homes.

If the value of your neighbor’s house was higher than yours, then your basic liability coverage won’t be enough! If you have an umbrella policy, you will max out your standard liability coverage first, then the excess liability will kick in and cover the rest.

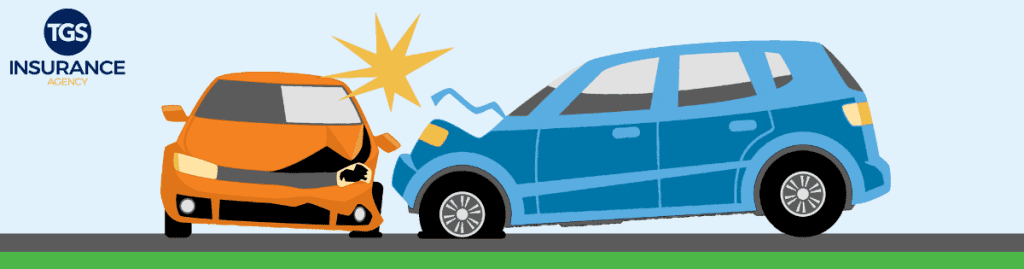

Personal excess liability coverage, or umbrella liability coverage, will work the same way for your auto insurance. Suppose you are responsible for a car accident that injures the other driver. Your standard auto insurance policy will provide some bodily injury/ property damage liability coverage, typically ranging from $100,000 to $850,000. Unfortunately, that’s not enough to cover the driver’s medical bills and auto repair. After you hit your limit, an umbrella policy will cover the excess.

How We Have You Covered

An umbrella policy is a great way to add an extra layer of protection to your primary home or auto insurance. If you’d like an expert opinion on whether or not you need this personal excess liability coverage, we have you covered! Contact a TGS Insurance agent to have us assess your existing policies and make sure you have the coverage you need at a price that works for you.

FAQs: Excess Liability vs. Umbrella Insurance

Yes, an umbrella insurance policy IS personal excess liability coverage.

Depending on the carrier, your insurance history, and the premium of your current home or auto policy, an umbrella insurance policy can be $300-$500 per year. This is a tiny amount compared to the coverage you get from an umbrella policy!

Yes, an umbrella policy still has a limit. Most commonly, personal excess liability covers $300,000-$500,000 beyond the limit of your primary home or auto liability coverage.

Start Your Free Auto Insurance Quote Now

Learn More About Umbrella Insurance:

Umbrella Insurance for Rental Properties