Frisco

Frisco Auto Insurance

Frisco, Texas, has a population of about 211,000. According to txdot.gov, Frisco experienced over a 35.66% increase in annual car accidents since 2010. With residents commuting an average of 30.1 minutes daily, the roads are seemingly becoming more congested, and safety needs to be a top priority. Frisco car insurance is not only legally required but a safety necessity for you, your passengers, pedestrians, and other drivers.

Frisco Auto Insurance: The Basics

With so much reliance on personal vehicles in Frisco, it’s crucial to ensure you have proper car coverage so that you are covered in the event of an accident. In Texas, you are required to carry liability auto insurance with 30/60/25 minimum coverage limits. Liability insurance only provides financial assistance to pay for damages or injuries to other vehicles or drivers in an accident that you cause. If you carry only liability insurance, any repairs to your vehicle will come out of pocket for you. Carrying only liability insurance, especially at the minimum coverage limits, is a considerable financial risk; because of this risk, less than 0.20% of auto policies that we write in Texas are for minimum liability only. For drivers seeking coverage that provides financial protection should anything happen to their own vehicle, regardless of fault, collision and comprehensive coverages can be added. Other popular optional coverages include:

- Uninsured and underinsured motorist coverage

- Medical payments coverage

- Personal injury protection (PIP)

- Rental reimbursement coverage

- New car replacement coverage

What is the Cost of Car Insurance in Frisco?

The average cost of full coverage car insurance in Frisco is $936.61 per year among TGS Insurance Agency customers. It is important to note that many factors determine the price of your premium. While many people know that insurers factor in the car they drive, their own driving record, and the coverages they select, some may be surprised to hear that factors such as gender, credit history, and marital status are also considered.

Does My Location Affect Car Insurance Rates in Frisco?

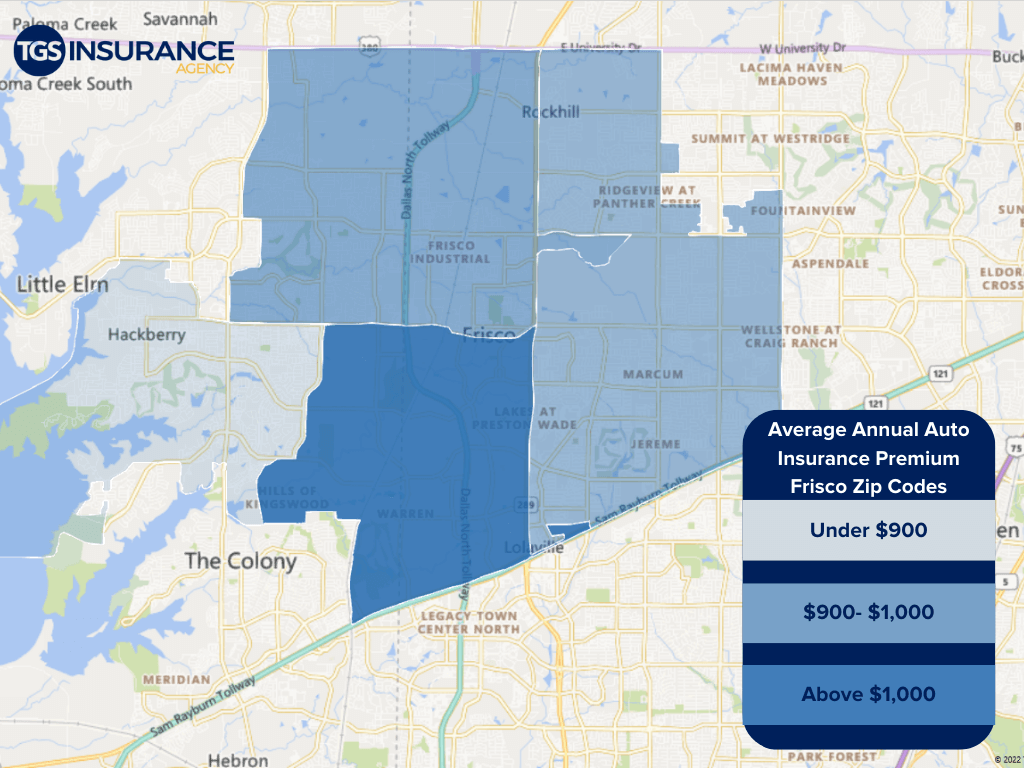

Determining auto insurance rates is very similar to determining home insurance rates. Providers look at factors in your area, like the potential dangers you face and the crime rates. Your premiums could be lower if you live in a relatively low crime rate area. You could be a perfectly safe driver, but it is not just you on the road! If your area is known for having a higher-than-average amount of uninsured motorists, you may have to pay more for your premium. In Frisco, the ZIP code with the lowest average premium is 75033. The average cost for that ZIP code is $943.13. Below is a comparison of the average cost of auto insurance within the ZIP codes of Frisco:

Compare Frisco Car Insurance Premiums by Carrier

The price is often the most influential factor when considering a car insurance policy. Because each carrier sets its rates, sometimes the same coverage can vary in price among different carriers. Two of our most popular carriers in Frisco are Progressive. Auto insurance quotes from TGS Insurance for Progressive average $954.79 annually. When it comes to picking the right insurance carrier, there are many factors involved. You want to make sure the carrier you choose is right for you. Here are some questions to ask yourself when picking a carrier.

- What is the company’s history and reputation?

- Do they offer the coverage I am looking for?

- What is their price for the coverage I want?

- Is it easy and convenient to work with them?

- Are there discounts available?

- Have you heard anything about the company?

Finding Affordable Frisco Auto Insurance Is Easier Than You Think.

Looking for car insurance can be tedious, boring, and overwhelming… you name it, we’ve heard it. And we agree! That’s why TGS Insurance Agency is dedicated to doing the heavy lifting for you, instantly comparing quotes to find you the best possible price in your area without compromising coverage. We can provide you with your initial quote within 15 seconds with just your name and address. From there, if you would like to customize your policy, any of our dedicated independent agents are ready to work for you to create a policy that covers everything you need. We shop. You Save. Yes, it really is that easy.

Disclaimer

Every driver is unique. Insurance premium costs are impacted by several factors; therefore, we recommend obtaining an individualized quote to find your rates. Our data is representative of quality, publicly sourced, and internal data, but should not be deciphered as bindable.

Looking for Another City?

Dallas Auto InsuranceFort Worth Auto Insurance

Mckinney Auto Insurance

Flower Mound Auto Insurance

Arlington Auto Insurance

Houston Auto Insurance

Austin Auto Insurance

Katy Auto Insurance

Missouri City Auto Insurance

More Cities