Arlington

Arlington Car Insurance

Arlington, Texas, has a population of about 398,860. According to txdot.gov, Arlington experienced over a 15% increase in annual car accidents since 2010. With residents commuting an average of 26.9 minutes daily, the roads are seemingly becoming increasingly congested, and safety needs to be a top priority. Arlington car insurance is not only legally required but a safety necessity for you, your passengers, pedestrians, and other drivers.

What Types of Auto Insurance are There in Arlington?

Most basic car insurance policies consist of 6 different coverage types; however, except for state requirements, you can opt in or out of the coverages to create a policy that best suits your needs. In Texas, the state requires that you have $30,000 in bodily injury liability coverage for each person in an accident, $60,000 in bodily injury liability coverage for each accident, and $25,000 for property damage per accident; this is often referred to as 30/60/25. The other main coverages on most standard auto policies include:

| Type of Coverage | Description |

|---|---|

| Property Damage Liability | Pays for the damage you may cause to someone else’s property. |

| Bodily Injury Liability | Helps you cover the cost of injuries of others involved in an accident you caused. |

| Collision | Pays for the damage to your car from a collision with another car or object. |

| Personal Injury Protection | Pays for treating injuries to you or the passengers of your car. |

| Comprehensive | Reimburses you for loss due to theft or damage caused by something else other than a collision. |

| Uninsured and Underinsured Motorist Coverage | Reimburse you if you are hit by a driver who is either completely uninsured or does not have enough coverage to pay for the damages they caused. |

How Much Does Car Insurance Cost in Arlington?

The average cost of insurance in Arlington is $990.23 per year among TGS Insurance customers. Auto insurance rates can vary significantly due to several particulars, based on your vehicle, location, and the coverage you choose, among many other things. Below is an example of some factors that influence your premium and how they do so.

- Age/Driving Experience: Young drivers will pay the most for car insurance because their lack of experience behind the wheel equates to a higher risk. Typically, rates will decline with experience after the age of 25 and then start increasing again after 60.

- Driving history: Car insurance providers look at your driving history to accurately predict your driving future. If you have a history riddled with speeding tickets, you will be paying for it.

- Credit Score: Drivers with excellent credit may see considerably better rates than those with poor credit.

- Vehicle: Insurance for a brand-new car will be more expensive because it will be more expensive to fix and/or replace than an older car. The value of your car itself also plays into your premium for the same reasons.

- Annual Mileage: Statistically, the more time a driver spends on the road, the more likely they will have an accident so higher annual mileage can mean higher premiums.

- Location: Insurance providers consider many things regarding your location, such as vandalism, theft and accident rates in the area, and where you park your car (in a garage versus in a street or outside exposed to the elements). Urban drivers who park on the street often see higher rates than those who live in a more rural area and park in the garage.

How Does Location in Arlington Affect My Car Insurance Rates?

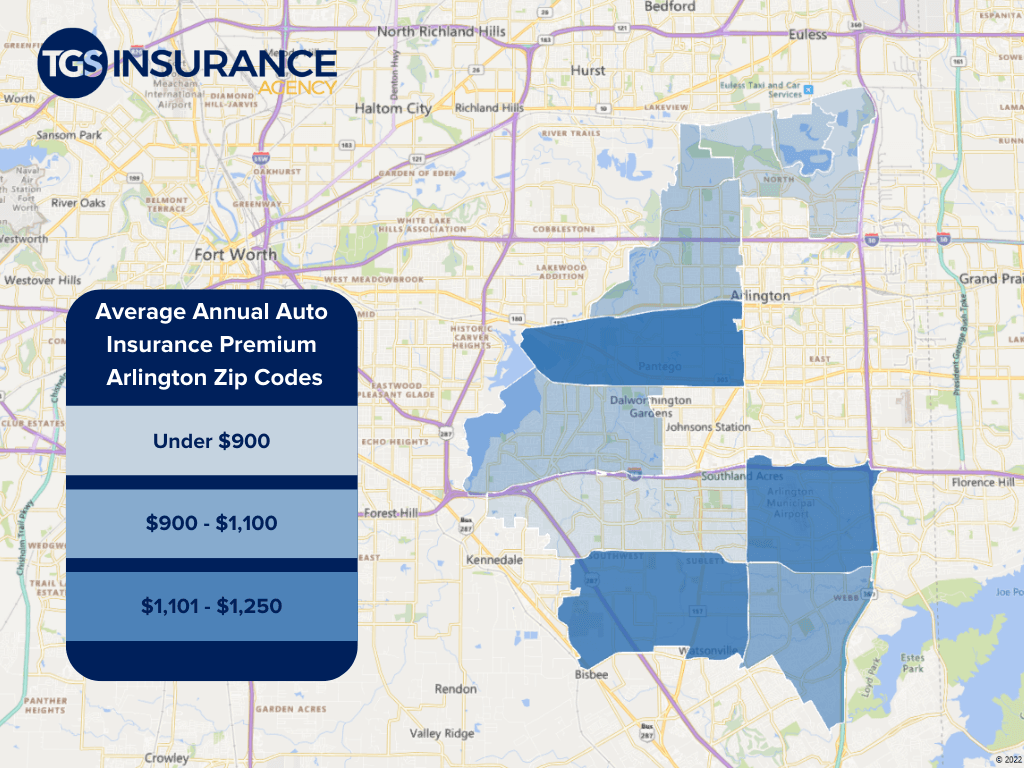

Location is a significant facet of calculating your auto insurance rates in Arlington. For example, if you live in an area with a higher population density, insurers see you as having a higher risk of getting in an accident since there are more cars on the road; consequently, you will see a higher premium than someone living in a less populated area. Insurance companies will also look at the number of uninsured motorists in your area- the higher that number is, the higher your premium will be. If you are looking for ways to reduce your premium, park your car in a garage or covered area versus the street. These are just a few examples of how your location plays into your car insurance premium. Below are the average annual premiums for zip codes in the Arlington area for reference:

Best Arlington Auto Insurance Companies

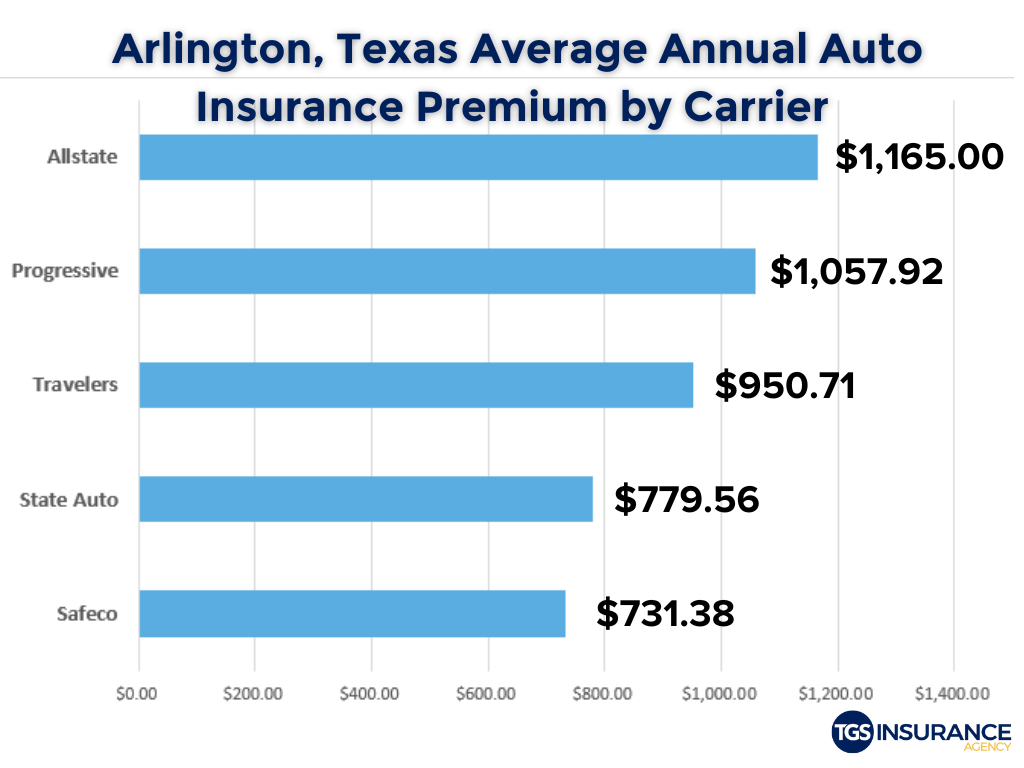

Knowing who will give you a good rate in your area is a big part of choosing your car insurance. Among TGS customers, the most popular carrier in Arlington is Progressive. The average premium with Progressive is $1,057.92. Other popular carriers are Safeco and Travelers. Choosing a carrier is more than just the price; here at TGS, we know that is a factor. Check out the table below to see the average price for Arlington based on insurance provider.

Finding Affordable Arlington Auto Insurance Is Easier Than You Think.

Looking for car insurance can be tedious, boring, and overwhelming… you name it, we’ve heard it. And we agree! That’s why TGS Insurance Agency is dedicated to doing the heavy lifting for you, instantly comparing quotes from 35+ A-rated (or better) carriers to find you the best possible price in your area without compromising coverage. We can provide you with your initial quote within 15 seconds with just your name and address. From there, if you would like to customize your policy, any of our dedicated independent agents are ready to work for you to create a policy that covers everything you need. We shop. You Save. Yes, it really is that easy.

Disclaimer

Every driver is unique. Insurance premium costs are impacted by several factors; therefore, we recommend obtaining an individualized quote to find your rates. Our data is representative of quality, publicly sourced, and internal data, but should not be deciphered as bindable.

Looking for Another City?

Arlington Auto InsuranceDallas Auto Insurance

Flower Mound Auto Insurance

Fort Worth Auto Insurance

Grand Prairie Auto Insurance

McKinney Auto Insurance

Frisco Auto Insurance

Plano Auto Insurance

Irving Auto Insurance

More Cities