Instant Home Insurance Quote

All We Need Is Your Address, NO BS!

Florida Homeowners Insurance

Living in Florida comes with its unique set of advantages and challenges. From beautiful beaches and warm weather to the ever-present risk of hurricanes and tropical storms, Florida homeowners need reliable home insurance to protect their most significant investment. At TGS Insurance Agency, we understand the specific needs of Florida residents and offer comprehensive home insurance policies tailored to your needs.

What Does Florida Home Insurance Cover?

A standard Florida home insurance policy typically includes:

- Dwelling Coverage: Protects the structure of your home from damage caused by covered perils such as hurricanes, fire, lightning, and more.

- Personal Property Coverage: Covers your belongings, including furniture, electronics, and clothing, if they are damaged or stolen.

- Liability Protection: Provides coverage if someone is injured on your property or if you are responsible for damage to someone else’s property.

- Medical Expenses Coverage: Pays for medical bills if someone is injured on your property, regardless of who is at fault.

- Additional Living Expenses (ALE): Covers the cost of living elsewhere if your home is uninhabitable due to a covered loss.

It’s important to note that home insurance policies often have limits to coverage amounts and certain exclusions. Be sure to carefully review your policy to understand what is covered and what is not.

In Florida, coverage from windstorm and hail damage is included in homeowner insurance policies but often comes with its own deductible.

Supplemental Coverage Options for Your Florida Home Insurance Policy

Florida’s unique climate and geography mean that homeowners might need additional coverage options, such as:

- Flood Insurance: Standard home insurance policies do not cover flood damage. Given Florida’s susceptibility to flooding, this is a crucial addition.

- Sinkhole Coverage: Florida is prone to sinkholes, and adding this coverage ensures you’re protected from these natural occurrences.

- Water Backup Coverage: Protects against damage caused by water backing up into your home through sewers or drains.

We strive to protect you comprehensively. Our agents can help you explore all additional coverage options and choose which extra coverage options work best for you.

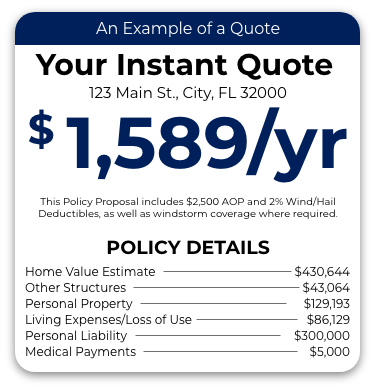

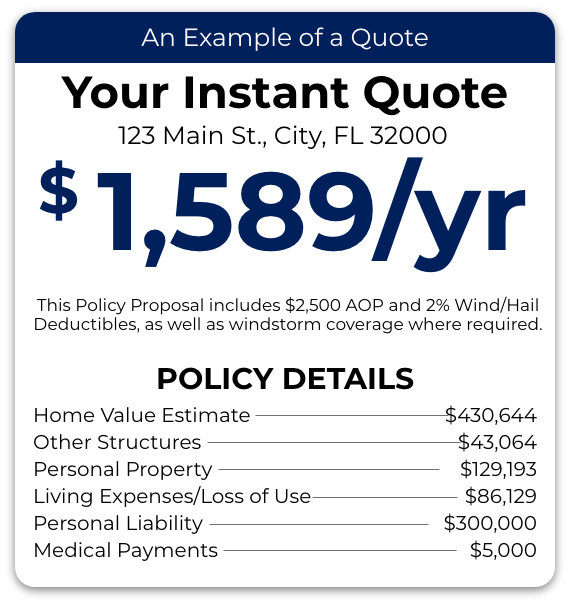

Average Cost of Florida Homeowners Insurance

The cost of home insurance in Florida can vary widely based on several factors, including the location of your home, its age and condition, and the level of coverage you choose. On average, Florida homeowners can expect to pay between $1,500 and $3,000 annually for their home insurance. However, homes in high-risk areas, such as those prone to hurricanes or flooding, may see higher premiums.

At TGS Insurance Agency, we work with multiple insurance providers to find the best rates for your specific situation. We understand the importance of balancing cost with comprehensive coverage and strive to offer affordable options that meet your needs.

Why Choose TGS Insurance Agency

At TGS Insurance Agency, we prioritize your peace of mind by offering:

- Personalized Service: We understand that every homeowner’s needs are unique. Our team works with you to find the right coverage for your home.

- Competitive Rates: We compare rates from multiple insurance providers to ensure you get the best coverage at the best price.

- Expert Advice: Our knowledgeable agents are here to answer all your questions and guide you through the insurance process.

Get Started With Your Florida Homeowners Insurance Quote Today!

Ensuring your home is fully covered by the right homeowners insurance policy is crucial to safeguarding your investment. TGS Insurance Agency provides a hassle-free solution to compare rates with our free online instant quote tool, allowing you to effortlessly shop and compare over 55+ companies with just your address. Our experienced team of independent agents will collaborate with you until your coverage meets your requirements and budget, delivering unbeatable rates.

Florida Home Insurance FAQs

Several factors can influence your home insurance premium, including the age and condition of your home, its location, the materials used in construction, and the coverage options you choose.

Yes, standard home insurance policies do not cover flood damage. Given Florida’s risk of flooding, it’s advisable to have separate flood insurance.

Installing safety features like storm shutters, reinforcing your roof, and choosing a higher deductible can help lower your premium. Our agents can provide more tips specific to your situation.

Learn More About Home Insurance on Our Blog:

Actual Cash Value vs Replacement Cost

10 Factors That Affect Homeowners Insurance Premiums in Florida

Comparing HO3 and HO5 Policies

Comparing HO2 and HO5 Policies

More Articles on Home Insurance

Looking for More Information on Your Area?

Jacksonville Homeowners Insurance

Saint Petersburg Homeowners Insurance

Port Saint Lucie Homeowners Insurance

Cape Coral Homeowners Insurance

Tallahassee Homeowners Insurance