What is SR-22 Insurance?

SR-22 car insurance is a certificate of financial responsibility that proves your auto insurance policy meets the minimum liability standards set by your state. The document is not a stand-alone policy! SR-22 insurance is supplemental to your existing auto insurance policy filed on your behalf by your insurance company.

Who Needs SR-22 Insurance in Texas?

An SR-22 form is most commonly required for drivers with severe infractions on their records. So, you will know if you are required to file an SR-22 form. Either the court or the state will order an SR-22. If you got it through the court, the judge would let you know during your hearing. If the state requires it, you will receive a letter in the mail from your state’s Department (or Bureau) of Motor Vehicles.

One common offense requiring you to file an SR-22 is if you are driving without insurance or a valid driver’s license and get caught. Other reasons might include the following:

- DUI or DWI conviction

- Driving without enough insurance

- Too many at-fault accidents/ violations

- Repeat offenses

- 3+ speeding tickets in 6 months

- Not paying child support

- Hardship license

How Much is SR-22 Auto insurance?

There are two costs associated with being required to have SR-22 insurance in Texas. The first cost is a one-time, flat-rate filing fee which typically costs about $25. While this fee seems minimal, the financial impact of an SR-22 is actually much more. Drivers who are required to file an SR-22 are doing so because of serious infractions. These infractions make you a high-risk driver, resulting in higher auto insurance premiums.

How Do You Get SR-22 Insurance in Texas?

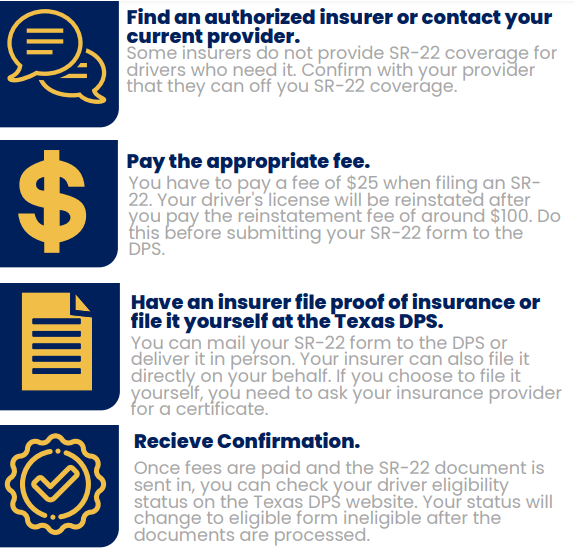

To file an SR-22 form in Texas, follow these key steps:

In addition to the filing steps, you may need to show proof that you have completed repeat offender programs if you were appointed to complete those. Also, ensure your current mailing address is on file because the Texas DPS will mail you your changes in your driver status.

Non-Owner SR-22 Car Insurance

If you are required to get SR-22 insurance but do not own a vehicle, you will have to get non-owner SR-22 car insurance. Even if you do not have a car, you are still required to have the minimum amount of bodily injury and property damage liability for your state. This requirement is not changed by vehicle ownership status. Let your insurer know you need an SR-22 for non-ownership car insurance.

Remember, if you fail to maintain your minimum coverage limits, you must re-file with the state, and your sentenced time restarts. Typically, non-owner insurance is less expensive than standard auto insurance policies. Having an SR-22 on your account could increase your rates, but when you are no longer required to have it, your rates may decrease again.

Get the Right Auto Insurance With TGS Insurance Agency!

Shopping for auto insurance can be frustrating, time-consuming, complicated, and an inconvenience in general. At TGS Insurance, we simplify the process by instantly searching across our top-rated insurance carriers for the right coverage options for your needs. We can even bundle your auto insurance with other policies to help save you even more. So, whether you’re looking just to stay legal, fill in the gaps, or save money, our team is here to keep you rolling for less at TGS Insurance. Get started with your free auto insurance quote by providing your address above!