Instant Landlord Insurance Quote

Texas Landlord Insurance

Texas is considered a landlord-friendly state thanks to its lack of rent control, streamlined eviction process, and absence of standard limits for security deposits. While laws make Texas a great place to invest in property, landlords also need to consider natural disasters and risks, such as crime rates or the increasing number of hurricanes, when purchasing their rental property. Some risks can be prepared for, but others are less predictable, so having the right insurance on your investment property is crucial to protect yourself financially. If you own a rental property, understanding your need for landlord insurance and its coverage options is important.

The idea of landlord insurance can be overwhelming, especially for a first-time investor or someone new to the state’s real-estate scene. TGS Insurance Agency is here to simplify the process for you. This page will help you understand landlord insurance in Texas, from coverage options to factors that could impact your premium. However, always feel free to contact one of our independent agents directly or submit your information for a free landlord insurance quote here.

Key Takeaways

- Landlord insurance is a policy purchased specifically for rental properties.

- Most landlord insurance policies provide coverage for property damage, liability protection, and rental income loss.

- A landlord insurance policy costs about 25% more than a homeowners insurance policy.

Table of Contents:

What Is Landlord Insurance?

Landlord insurance, also called rental property insurance, investment property insurance, or dwelling fire coverage, covers risks associated with renting out your property for long periods of time. Types of property eligible include single- or multi-family homes, apartments, and condominiums that are not your primary residence. Coverage typically includes property damage, liability costs, and protection for landlords’ loss of rental income.

Related Reading: Landlord Insurance versus Homeowners Insurance

What Does Landlord Insurance Cover?

Depending on your policy, your coverage may include some or all of the following types of coverage for your rental property.

Property Damage

Similar to dwelling coverage on your homeowners policy, property damage coverage in your landlord insurance policy covers damage to your home’s structure (and detached structures) due to covered perils. This coverage may also apply to property owned by the landlord to maintain a rental property or items provided for tenant use, like TVs, furniture, a lawn mower, etc.

Liability Coverage

In a landlord policy, liability coverage protects you, as a landlord, legally if someone is injured on your property. It can help cover medical care costs for the injured party in addition to helping with legal and court fees if you are sued by the injured party.

Loss of Rental Income Coverage

If your rental property is damaged by a covered event and becomes uninhabitable, your landlord insurance policy may cover your loss of rental income with this coverage.

What Does Landlord Insurance Not Cover?

Landlord insurance is a reassuring safeguard for owners to rent their property. It is there to cover unpredictable losses, but it doesn’t cover everything. Below is a list of claims that are usually not covered by landlord insurance.

Maintenance and Repairs

If an appliance stops working, like an oven or dishwasher, landlord insurance will not cover the repairs or the money to purchase a new one.

Damage from Tenants

Irresponsible tenants who neglect to properly take care of your rental property aren’t always covered by landlord insurance. Property owners might have to consider extra protection from these claims.

Renter’s Personal Property

Unless the damage is a result of your negligence as a landlord, the personal property of your tenants will not be covered by your landlord policy. We recommend that you require all of your tenants to obtain renters insurance to protect their personal belongings.

Related Reading: Landlord Insurance vs Renters Insurance

Flooding

As with the case of a standard homeowners policy, a separate flood insurance policy needs to be purchased. This is to ensure that flooding is covered by insurance and is highly recommended even if your investment property is not in a flood zone!

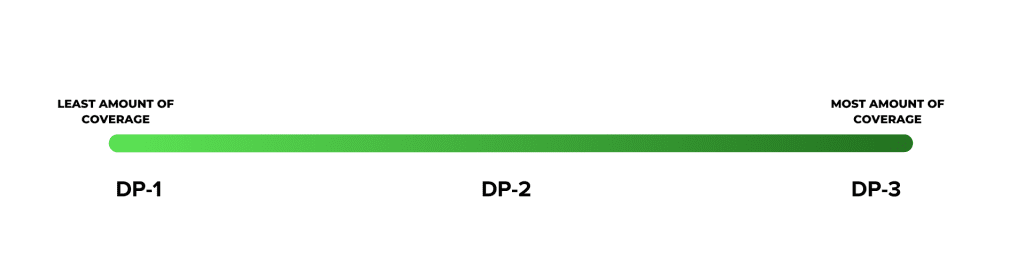

Choosing The Right Landlord Insurance Policy Form

Understanding the policy types and coverage options that differentiate landlord insurance policies will give you peace of mind and make it easier to sleep at night. Insurers might have varying carrier titles to describe their policies, so it is important to understand what each policy covers.

Dwelling Policy 1 (DP1)

A DP-1 policy is the most basic and limited form of landlord insurance for rental properties. The DP1 policy is a named-perils policy, which only protects against the perils specifically named in the policy form; typically, there are only 10 named perils in this policy.

Dwelling Policy 2 (DP2)

A DP-2 policy offers slightly more coverage than a DP-1 policy and is considered moderate coverage for landlords. It covers all of the perils covered by a DP-1 policy plus additional events. The biggest difference over a DP-1 policy is that a DP-2 policy pays out the replacement cost value on property damage instead of the actual cash value.

Related Reading: Actual Cash Value vs. Replacement Cost Value

Dwelling Policy 3 (DP3)

A DP-3 policy is the most common landlord insurance policy and offers the most protection for landlords. This policy is written as an “open peril” policy, which provides coverage from all events not explicitly listed on the policy and offers the broadest protection of the 3 types of landlord insurance. A DP-3 policy pays out the replacement cost on claims.

DP-1 vs DP-2 vs DP-3

| Type of Coverage | Method of Payout | |

| DP-1 | Named Perils | Actual Cost Value (ACV) |

| DP-2 | Named Perils | Replacement Cost Value (RCV) |

| DP-3 | Open Perils | Replacement Cost Value (RCV) |

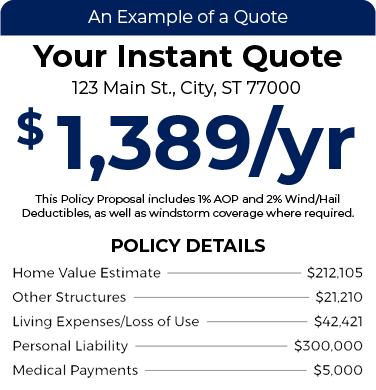

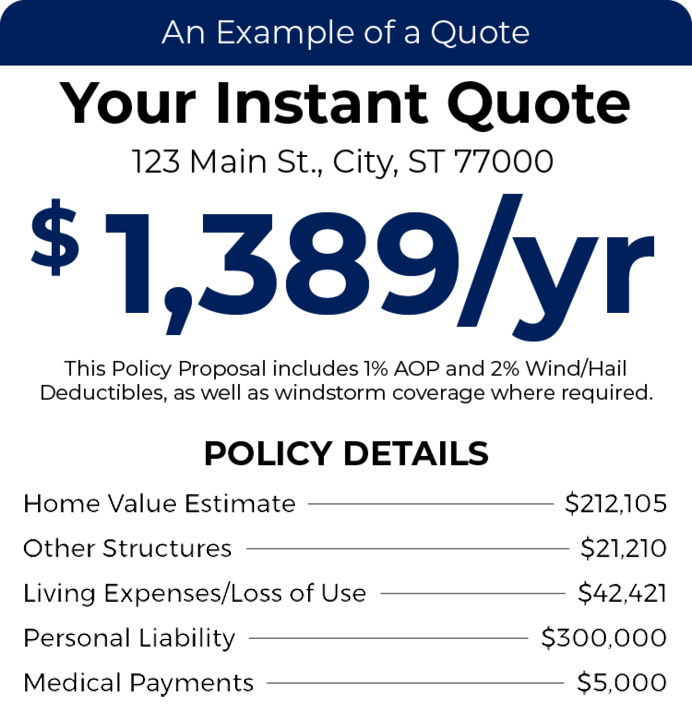

What Does Landlord Insurance Cost?

Typically, landlord insurance costs about 25% more than your average homeowners policy because rental properties have a higher statistical occurrence of claims than primary properties.

The average cost for landlord insurance in Texas is $1,320 per year among TGS Insurance Agency customers. This average premium can vary significantly for landlords depending on several factors, including, but not limited to:

Location: properties in higher-risk areas will have higher premiums. Higher-risk areas may include locations more susceptible to natural disasters or high crime rates.

Property Type and Size: premiums for a stand-alone single-family home are typically lower than those for a multifamily building.

Policy Type: a more basic policy, such as the DP-1, offers less coverage and costs less than the more comprehensive DP-2 or DP-3.

Condition of the Property: newer and well-maintained properties will see lower premiums than older and poorly maintained properties because the likelihood of a claim is less.

Rental Prices: if you have comprehensive coverage that includes loss of use, the higher the rental rates, the higher the premiums.

Deductible Selected: a higher deductible leads to a lower premium and vice versa. While the lower premium is tempting, it is important to assess your financial situation to ensure you can cover more damages out of pocket than if you selected a lower deductible.

Cheapest Landlord Insurance Carriers in Texas

When shopping for affordable landlord insurance in Texas, it is important to compare several companies to ensure you get the best rate for the coverage that best suits your needs. While rates will vary from location to location, ten of the cheapest carriers for landlord insurance are:

| Carrier | Average Annual Premium |

| ASI | $1,208 |

| Travelers | $1,278 |

| Safeco | $1,283 |

| Allied Trust | $1,300 |

| Wellington | $1,304 |

| State Auto | $1,318 |

| UPC | $1,325 |

| Homeowners of America | $1,331 |

| SageSure | $1,342 |

| Nationwide | $1,503 |

Landlord Insurance FAQS:

No, landlord and building insurance are different in a few ways. Landlord insurance protects owners from events that cause a loss of rental income, harm, or burglary inside the property. For example, tenants leaving without notice or if your property becomes unlivable due to mold or fire damages. In contrast, building insurance covers property owners against loss to the property’s structure. This goes beyond the actual property itself and covers the garage, shed, or pools. Some examples of what building insurance covers are: fire, storm damage, lightning strikes, or water damage

The only tenant damage that a standard landlord insurance policy will cover is accidental damage. Any intentional damage or damage from typical wear and tear is not covered by your policy in most situations.

Appliances are typically not covered by your landlord insurance policy.

Recent Landlord Insurance Posts:

Instant Landlord Insurance Quote

Explore Landlord Insurance Policies:

Learn More About Landlord Insurance:

Landlord Insurance vs Homeowners Insurance

Landlord Insurance vs Renters Insurance