Beaumont

Beaumont Auto Insurance

Beaumont, Texas, has a population of about 116,822. According to txdot.gov, Beaumont experienced over 2,600 car accidents in 2020. With residents commuting an average of 20 minutes daily, the roads are seemingly becoming increasingly congested, and safety needs to be a top priority. Beaumont auto insurance is not only legally required but a safety necessity for you, your passengers, pedestrians, and other drivers.

What Does Beaumont Car Insurance Cover?

You love your car. It goes with you most places, and you take good care of it. You want it covered if something happens to it. Texas has a required minimum auto insurance limit that is called 30/60/25. After minimum requirements are met, you should look at your other needs. Minimum liability coverage does NOT cover your car or injuries, just the other party in the accident and their property. Your passengers are also not protected. This is why many people opt into full coverage auto insurance, including the minimum state requirements and comprehensive and collision coverage. This coverage combination offers protection against damage to your car from an accident, theft, or another object hitting your car. You can add extra coverage to your policy if you want more protection, like against uninsured motorists. Here is a breakdown of different coverage options you can add to your car insurance policy:

| Type of Coverage | Description |

|---|---|

| Property Damage Liability | Pays for the damage you may cause to someone else’s property. |

| Bodily Injury Liability | Helps you cover the cost of injuries of others involved in an accident you caused. |

| Collision | Pays for the damage to your car from a collision with another car or object. |

| Personal Injury Protection | Pays for treating injuries to you or the passengers of your car. |

| Comprehensive | Reimburses you for loss due to theft or damage caused by something else other than a collision. |

| Uninsured and Underinsured Motorist Coverage | Reimburse you if you are hit by a driver who is either completely uninsured or does not have enough coverage to pay for the damages they caused. |

How Much Does Car Insurance Cost in Beaumont?

The average cost of insurance in Beaumont is $1,012.31 per year among TGS Insurance customers. Auto insurance rates can vary significantly due to several particulars, based on your vehicle, location, and the coverage you choose, among many other things. Below is an example of some factors that influence your premium and how they do so.

- Age/Driving Experience: Young drivers will pay the most for car insurance because their lack of experience behind the wheel equates to a higher risk. Typically, rates will decline with experience after the age of 25 and then start increasing again after 60.

- Driving history: Car insurance providers look at your driving history to accurately predict your driving future. If you have a history riddled with speeding tickets, you will be paying for it.

- Credit Score: Drivers with excellent credit may see considerably better rates than those with poor credit.

- Vehicle: Insurance for a brand-new car will be more expensive because it will be more expensive to fix and/or replace than an older car. The value of your car itself also plays into your premium for the same reasons.

- Annual Mileage: Statistically, the more time a driver spends on the road, the more likely they will have an accident so higher annual mileage can mean higher premiums.

- Location: Insurance providers consider many things regarding your location,, such as vandalism, theft, and accident rates in the area, and where you park your car (in a garage versus in a street or outside exposed to the elements). Urban drivers who park on the street often see higher rates than those who live in a more rural area and park in the garage.

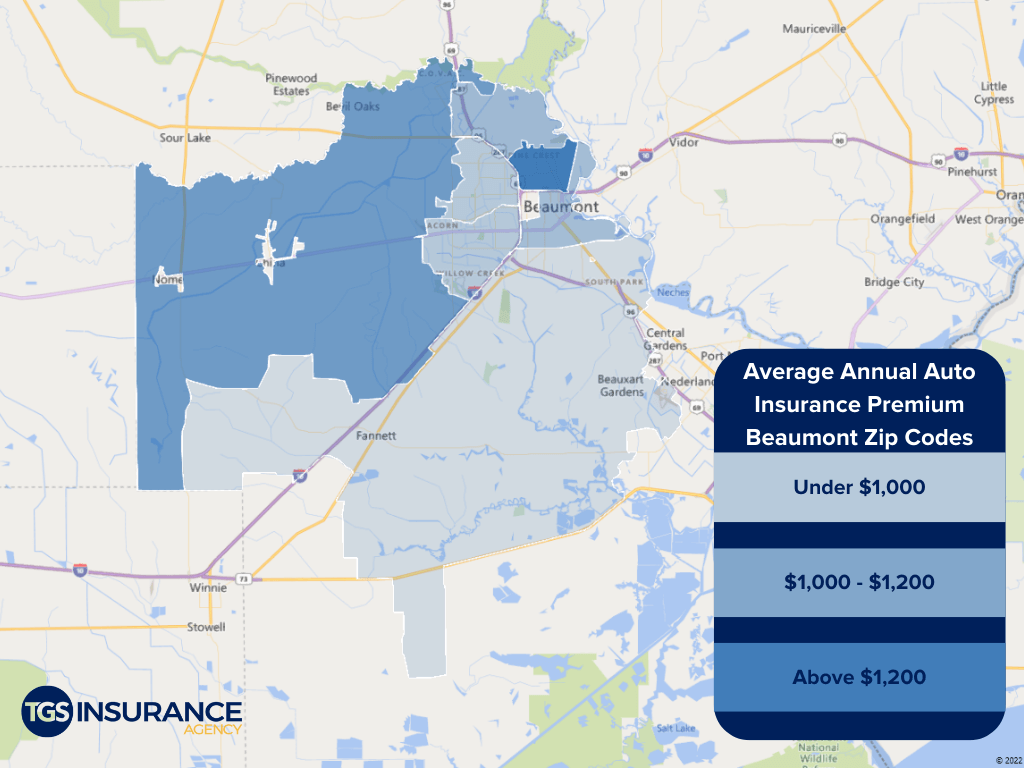

How Does My ZIP Code Affect My Auto Insurance Rate?

While some factors regarding your location, such as the probability of an accident, are calculated at the city or even county level, some factors are analyzed as granular as your zip code or neighborhood. Since theft and vandalism typically happen while your car is parked, the location your vehicle is housed plays a significant role in determining your risk of such incidents. In Beaumont, the ZIP code 77705 is the area with an average premium of $925.42 from TGS customers. The ZIP code with the highest premium is 77703costing TGS customers an average of $1,259.65 a year.

Compare Beaumont Car Insurance Premiums by Carrier

The price is often the most influential factor when considering a car insurance policy. Because each carrier sets their rates, sometimes the same coverage can vary in price among different carriers. Two of our most popular carriers in Beaumont are Progressive and Travelers. Auto insurance quotes from TGS Insurance for Progressive average $947.91 annually. Auto insurance quotes for Travelers run a bit more expensive at $1,274.50 per year. When it comes to picking the right insurance carrier, there are many factors involved. You want to make sure the carrier you choose is right for you. Here are some questions to ask yourself when picking a carrier.

- What is the company’s history and reputation?

- Do they offer the coverage I am looking for?

- What is their price for the coverage I want?

- Is it easy and convenient to work with them?

- Are there discounts available?

- Have you heard anything about the company?

Finding Affordable Beaumont Auto Insurance Is Easier Than You Think.

Looking for car insurance can be tedious, boring, and overwhelming… you name it, we’ve heard it. And we agree! That’s why TGS Insurance Agency is dedicated to doing the heavy lifting for you, instantly comparing quotes from 35+ A-rated (or better) carriers to find you the best possible price in your area without compromising coverage. We can provide you with your initial quote within 15 seconds with just your name and address. From there, if you would like to customize your policy, any of our dedicated independent agents are ready to work for you to create a policy that covers everything you need. We shop. You Save. Yes, it really is that easy.

Disclaimer

Every driver is unique. Insurance premium costs are impacted by several factors; therefore, we recommend obtaining an individualized quote to find your rates. Our data is representative of quality, publicly sourced, and internal data, but should not be deciphered as bindable.

Looking for Another City?

Houston Auto InsuranceBaytown Auto Insurance

Conroe Auto Insurance

Cypress Auto Insurance

Kingwood Auto Insurance

League City Auto Insurance

Missouri City Auto Insurance

Pearland Auto Insurance

Spring Auto Insurance

More Cities