League City

League City Car Insurance

League City, Texas, is home to 106,730 Texans as of 2020, according to the US Census. This is a 53.09% increase from 2010. With the growing population leading to increasingly congested roads and almost a 30-minute daily commute time, keeping safe on the roads is essential! Texas requires League City car insurance, but understanding your policy and ensuring you have adequate coverage is a personal responsibility that protects you and your assets.

League City Auto Insurance: The Basics

With so much reliance on personal vehicles in the city, it’s crucial to ensure you have proper car coverage so that you are covered in the event of an accident. In Texas, you are required to carry liability auto insurance with 30/60/25 minimum coverage limits. Liability insurance only provides financial assistance to pay for damages or injuries to other vehicles or drivers in an accident that you cause. If you carry only liability insurance, any repairs to your vehicle will come out of pocket for you. Carrying only liability insurance, especially at the minimum coverage limits, is a considerable financial risk; because of this risk, less than 0.20% of auto policies that we write in Texas are for minimum liability only. For drivers seeking coverage that provides financial protection should anything happen to their own vehicle, regardless of fault, collision and comprehensive coverages can be added. Other popular optional coverages include:

- Uninsured and underinsured motorist coverage

- Medical payments coverage

- Personal injury protection (PIP)

- Rental reimbursement coverage

- New car replacement coverage

How Much Does League City Car Insurance Cost?

The average cost for full coverage auto insurance in League City is $1,014.56 among TGS Insurance Agency customers. Car insurance rates differ considerably due to several constituents, based on you, your vehicle, and your location, among many other things. These factors include, but are not limited to:

- Age

- Car make and model

- High-risk violations

- Yearly mileage

- Credit history

- Driving record

- Zip code

- Marital status

- Gender

How Does Location Affect Car Insurance Rates in League City?

Similar to homeowners insurance, location is important in determining your auto insurance rates in League City. If your neighborhood has a higher rate of theft than the neighborhood a few blocks down, your rates will be higher. If there is a higher than the average number of uninsured motorists in your area, your rates will be higher. If auto insurance companies identify anything in your area that might make your vehicle riskier to insure, you will see that reflected in your premium. Likewise, there are things you can do, like parking your car in a garage or covered area versus the street, that can help reduce your premium. Because carriers get so granular with risk evaluations, rates can vary greatly- even within the same city.

Best League City Auto Insurance Companies

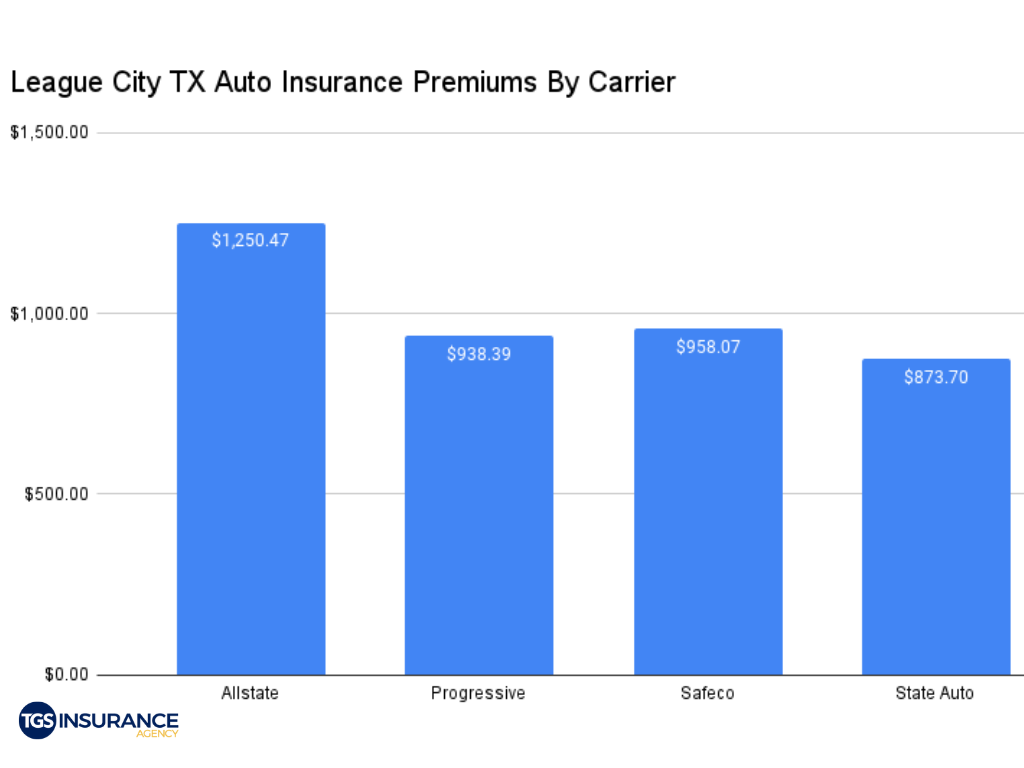

Knowing who will give you a good rate in your area is a big part of choosing your car insurance. Among TGS customers, the most popular carrier in League City is Progressive. The average premium with Progressive is $956.91. Other popular carriers are Safeco and Allstate. Choosing a carrier is more than just the price; here at TGS, we know that is a factor. Check out the table below to see the average price for League City based on insurance provider.

Comparison Shop Car Insurance in League City from Multiple Carriers in Minutes!

Shopping for car insurance can be exhausting, dull, and downright stressful. TGS Insurance Agency is here to change that. At TGS Insurance, we do all the nitty-gritty work for you, so you don’t have to! Our agents will shop your car insurance policy across our bank of 35+ carriers to find you the best policy at the best price, so you never have to compromise on coverage to save money. How do you get started? Easy! All we need is your name and address; you’ll get an accurate quote in 30 seconds or less. After that, our agents will further customize your policy, so it’s tailored to your specific insurance needs. Shopping for car insurance has never been so simple!

Disclaimer

Every driver is unique. Insurance premium costs are impacted by several factors; therefore, we recommend obtaining an individualized quote to find your rates. Our data is representative of quality, publicly sourced, and internal data, but should not be deciphered as bindable.

Looking for Another City?

Houston Auto InsuranceBaytown Auto Insurance

Conroe Auto Insurance

Cypress Auto Insurance

Kingwood Auto Insurance

League City Auto Insurance

Missouri City Auto Insurance

Pearland Auto Insurance

Spring Auto Insurance

More Cities